BoC assembly: With somewhat nervousness from the US – Foreign exchange Information Preview Posted on July

BoC assembly: With somewhat nervousness from the US – Foreign exchange Information Preview

Posted on July 14, 2020 at 9:49 am GMTMarios Hadjikyriacos, XM Funding Analysis Desk

The Financial institution of Canada (BoC) will wrap up its coverage assembly at 14:00 GMT Wednesday, and whereas no motion is anticipated, the accompanying assertion might nonetheless be essential. Despite the fact that the Canadian economic system is therapeutic, the resurgence of infections within the US is frightening given Canada’s publicity to America, and may lead policymakers to strengthen their easing bias. If that’s the case, that will argue for a unfavourable response within the loonie. Long run although, the stage appears set for a strong rally.

Tied collectively

The Canadian economic system has continued to get well because the BoC’s newest assembly in June. Incoming information verify that each the roles market and the broader economic system are slowly therapeutic their wounds, helped by the gargantuan stimulus measures from each the federal government and central financial institution.

That is exactly what the BoC envisioned at its June assembly. Again then, policymakers famous that the worst level of the disaster was seemingly behind Canada, however in addition they warned of ‘excessive uncertainty’ about how the restoration would play out. These encouraging indicators recommend the Financial institution will most likely keep on the sidelines at this assembly. However this isn’t the time to sound optimistic both.

Issues is perhaps going in keeping with plan in Canada, however that’s not the case throughout the border, within the US. Infections are hovering in America, threatening to disrupt the financial restoration as well being issues may maintain consumption down, or worse but, pressure some states again into lockdowns.

Issues is perhaps going in keeping with plan in Canada, however that’s not the case throughout the border, within the US. Infections are hovering in America, threatening to disrupt the financial restoration as well being issues may maintain consumption down, or worse but, pressure some states again into lockdowns.

Round three-quarters of all Canadian exports are destined for the US market, so the fortunes of the Canadian economic system are tied along with these of the American one.

Proactive method?

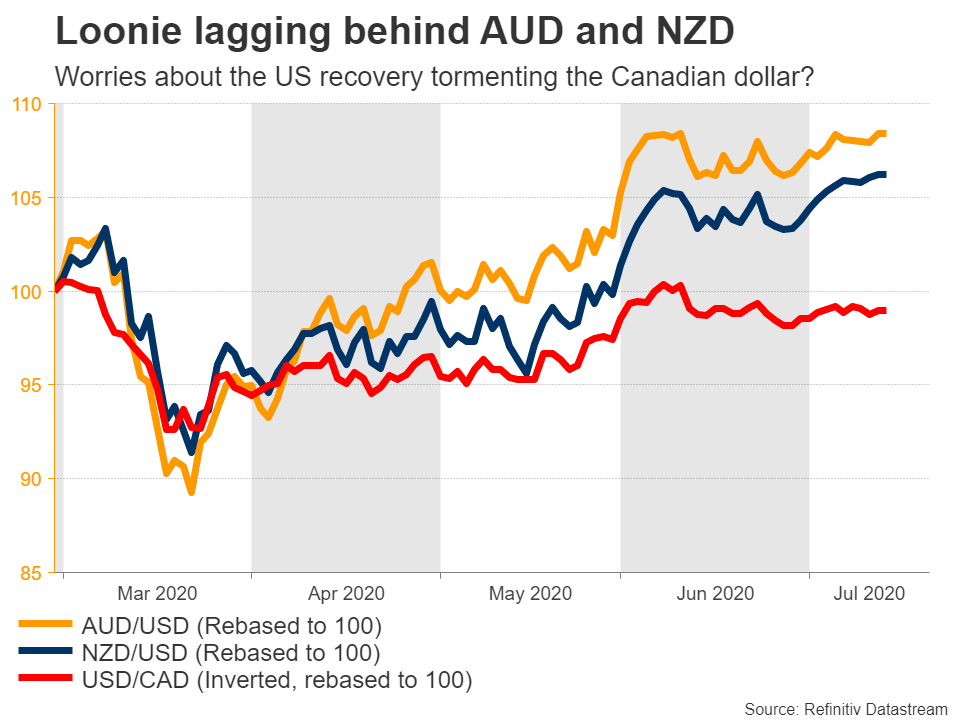

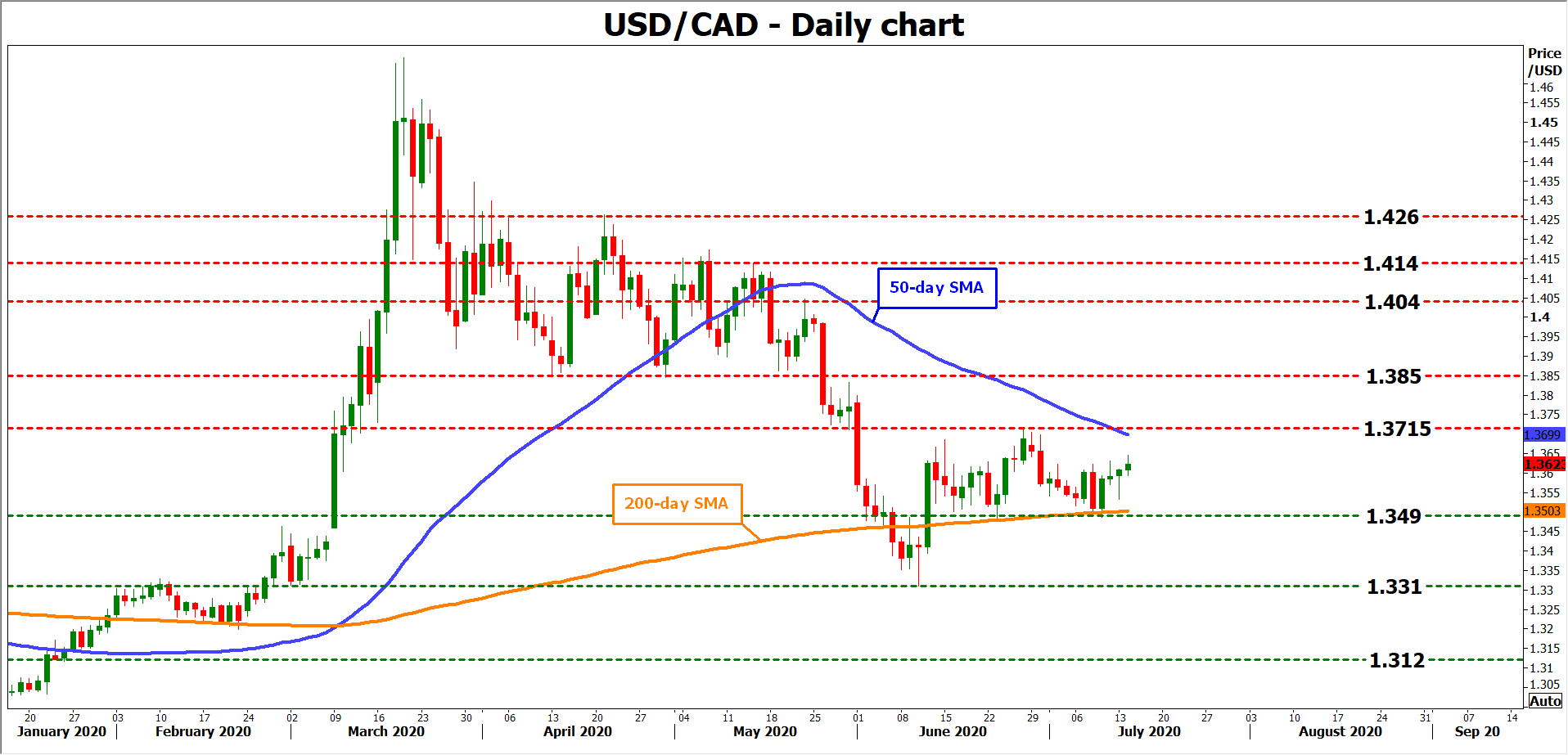

Certainly, issues about America seemingly clarify a lot of the loonie’s weak efficiency all through this restoration. The Canadian forex has strengthened because the March meltdown to make certain, but it surely has gained a lot lower than the Australian or New Zealand {dollars}, regardless of the highly effective rebound in oil costs. The White Home threatening new tariffs on Canadian aluminum exports these days didn’t assist both.

What does all this suggest for the BoC? In a nutshell, the central financial institution will most likely acknowledge the encouraging indicators in Canada, however maintain a cautious tone general, because the worsening US outlook threatens to spill over and put the brakes on the Canadian restoration too. As such, from a risk-management perspective it makes extra sense for the BoC to strengthen its dedication to supporting the restoration, for instance by stressing that it stands able to act once more if wanted.

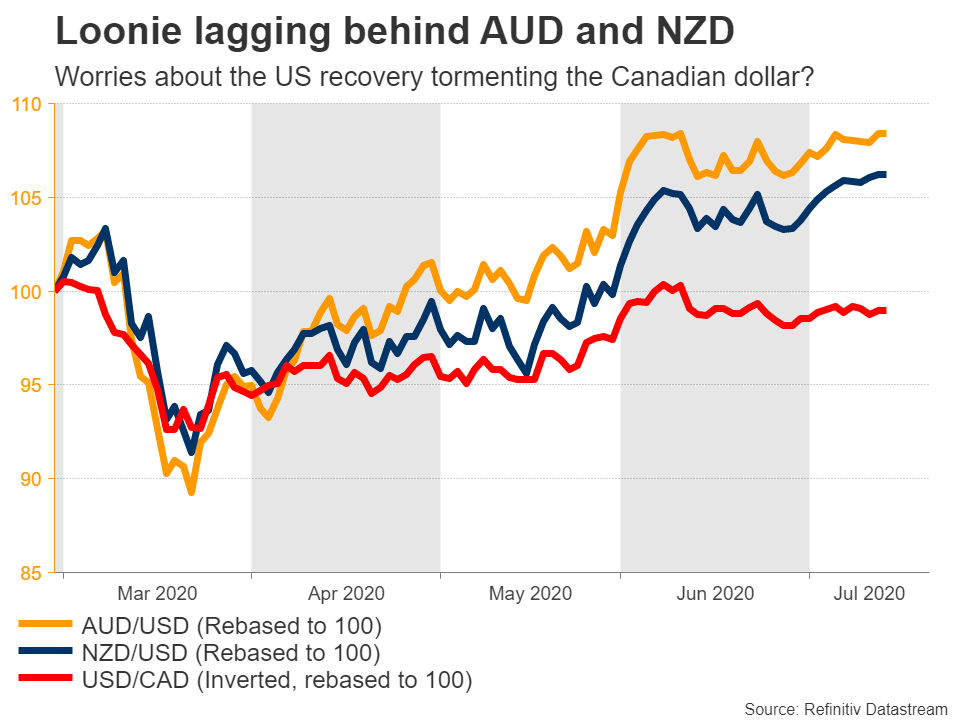

If that’s the case, that will argue for a unfavourable response within the loonie. Taking a technical take a look at greenback/loonie, the pair might spike increased and head for a check of the 1.3715 zone initially.

If that’s the case, that will argue for a unfavourable response within the loonie. Taking a technical take a look at greenback/loonie, the pair might spike increased and head for a check of the 1.3715 zone initially.

Rocky path forward, however long-term outlook brilliant

Past the BoC assembly, a lot of the loonie’s near-term route will rely on international danger sentiment and the way shortly US infections rise. Admittedly although, the subsequent few weeks look troublesome, as incoming US information for July that can seize the consequences of enterprise re-closures in a number of states might dampen danger sentiment, alongside a doubtlessly disastrous earnings season.

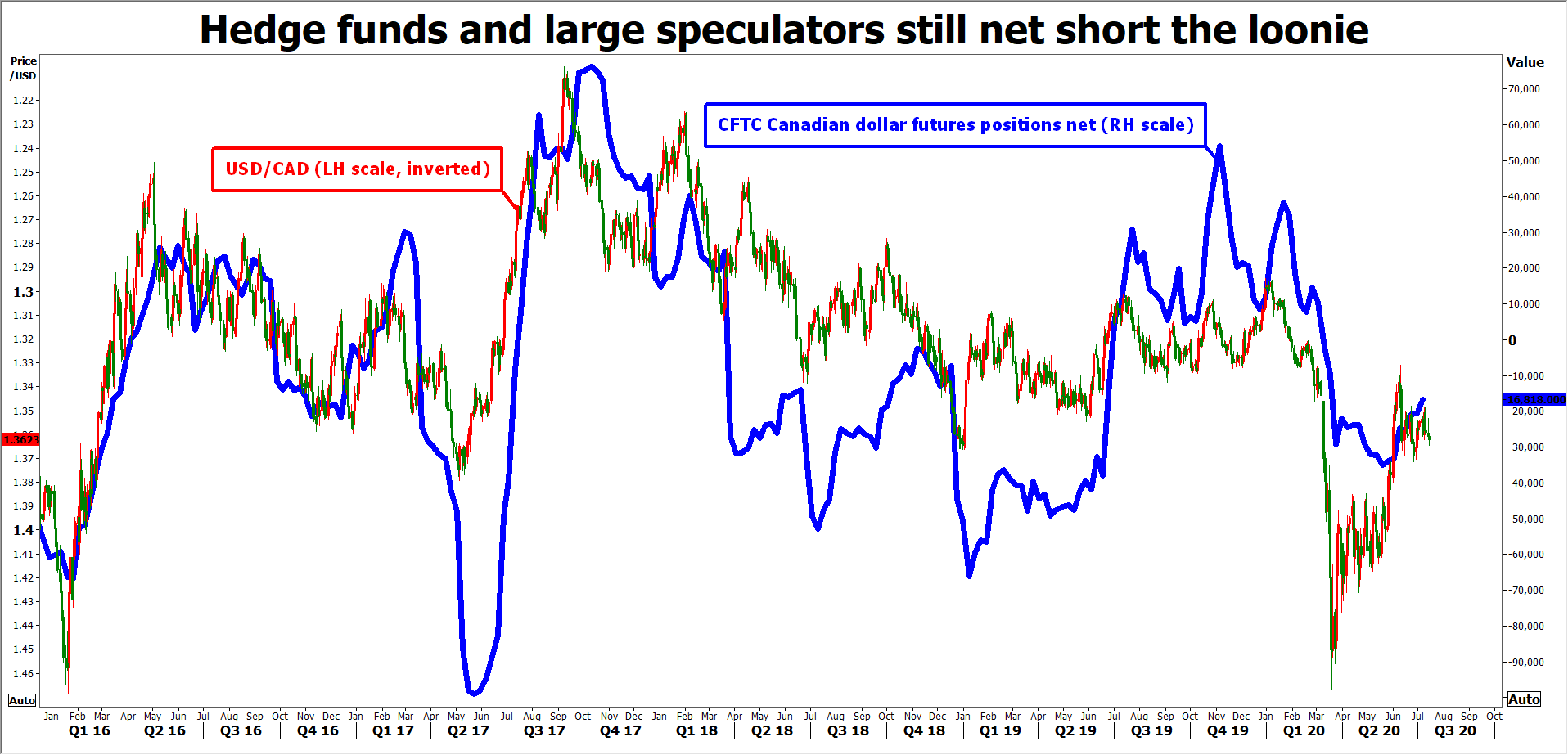

Long run although, as soon as the US outbreak is introduced beneath management, the stage appears set for a strong rally within the loonie. The forex’s underperformance up to now implies that it has larger scope to strengthen going ahead, one thing additionally supported by CFTC positioning information, which present that enormous speculators stay web brief.

Subsequently, if sentiment improves, there’s potential for a ‘brief squeeze’ that catapults the loonie a lot increased as a number of brief bets are closed or lined.

Subsequently, if sentiment improves, there’s potential for a ‘brief squeeze’ that catapults the loonie a lot increased as a number of brief bets are closed or lined.

On this state of affairs, greenback/loonie might break beneath the intersection of the 1.3490 stage and the 200-day easy shifting common (SMA), to problem the June low of 1.3310 initially.

Financial institution of Canadaforeign exchangeUSDCAD