Crude oil costs have been closed at $65.12 after putting a excessive of $66.75 and a low of $64.92. Crude oil rose to its highest degree since Marc

Crude oil costs have been closed at $65.12 after putting a excessive of $66.75 and a low of $64.92. Crude oil rose to its highest degree since March Eight on Wednesday within the first half of the day; nonetheless, it began posting losses and ended its day on a bearish notice. After rising for 3 consecutive classes, WTI oil dropped on Wednesday as risk-off market sentiment emerged and raised fears of diminished oil demand. In the course of the first half of the day, oil costs moved greater after the Power Data Administration introduced a crude inventories’ draw of Eight million barrels for the week to April 30.

The American Petroleum Institute estimated a weekly draw of seven.68 million barrels a day earlier, and the EIA reported a reasonable construct of 100,000 barrels for the earlier week. This week, the EIA had forecast 1.9M barrel drop in crude oil inventories, however they got here in as -8.0M barrels. The crude oil stock draw of Eight million added power in oil costs on Wednesday.

On the information entrance, at 17:15 GMT, the ADP Non-Farm Employment Change in April diminished to 742Okay in opposition to the projected 872Okay and weighed on the united statesdollar that capped additional losses in crude oil. At 18:45 GMT, the Remaining Companies PMI in April elevated to 64.7 in opposition to the anticipated 63.1 and confirmed an enlargement within the service business that pushed the greenback greater and added losses in crude oil. At 19:00 GMT, the ISM Companies PMI fell to 62.7 in opposition to the anticipated 64.2 and weighed on the U.S. greenback, limiting the losses in crude oil.

Within the second half of Wednesday, crude oil costs confronted heavy stress after the worldwide depend of coronavirus infections reached above 154 million attributable to rising an infection circumstances in India. The entire tally of COVID-19 circumstances in India reached 20.6 million. On Wednesday, World Well being Group additionally reported that India accounted for about 46% of world COVID-19 circumstances final week.

India is the second-largest importer of crude oil, and the rising variety of coronavirus infections within the nation has raised fears for diminished demand for crude oil. The information that India accounted for 46% of world circumstances and 25% of world deaths reported elevated WTI crude oil costs final week. The each day infections in India rose by 382,315 on Wednesday for a 14thstraight day of infections over 300,000 as per well being ministry knowledge. The rising variety of an infection circumstances in India and throughout the globe as a result of third wave of coronavirus raised risk-off market sentiment. It supported the safe-haven forex U.S. greenback that additionally added within the declining costs of WTI crude oil on Wednesday.

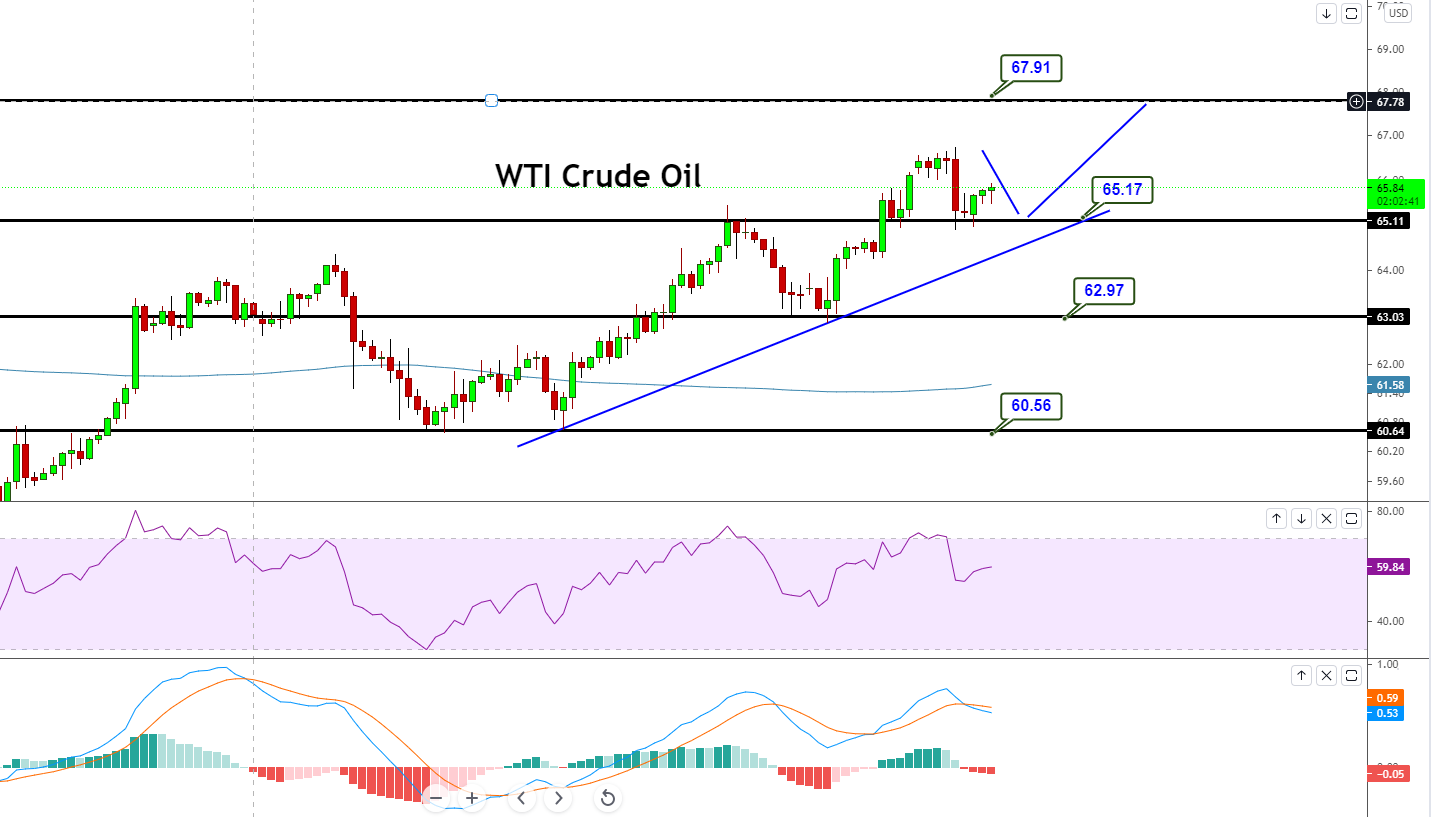

Each day Technical Ranges

Assist Resistance

64.45 66.28

63.77 67.43

62.62 68.11

Pivot Level: 65.60

The technical aspect of the WTI hasn’t modified loads as crude oil is buying and selling barely bullish, holding a good buying and selling vary of 66.55 – 63.08 degree. The technical indicators counsel a robust bullish bias, because the MACD and RSI are tossing above mid-levels, indicating a bullish bias amongst traders. On the upper aspect, a bullish breakout of 66.55 ranges can drive shopping for tendencies till 67 ranges. On the identical time, the violation of 63 assist can lead the WTI value decrease in direction of 62 and even 60. Let’s keep watch over 64 ranges as we speak, as promoting might be seen under this and shopping for above the identical degree. Good luck!