Wednesday introduced launch of the weekly EIA crude oil inventories report. The determine got here in at -7.195 million barrels, effectively under

Wednesday introduced launch of the weekly EIA crude oil inventories report. The determine got here in at -7.195 million barrels, effectively under expectations of -0.710 million. Subsequent week is prone to deliver one other drop in provides resulting from this weekend’s vacation journey demand. September WTI crude has reacted positively to the information, buying and selling above $40.00. Subsequently, the USD/CAD is positioned to shut the session beneath 1.3600.

On the political entrance, President Trump spoke this morning on the “Spirit of America” celebration. On the occasion, Trump lauded the speedy restoration in U.S. employment and warned of a “1929 market crash” if he isn’t re-elected in November.

$40.00 crude, shrinking oil provides, and a rebound in employment figures are all excellent news for President Trump. Nevertheless, polling information and betting odds now have Democratic contender Joe Biden put in as a stable favourite to win the Presidency. Over at predictit.org, Biden is being given a 61% probability of victory (39% for Trump). The polls at Actual Clear Politics have Biden with a 12-point lead ― a 180-degree shift from February.

Let’s dig into the USD/CAD weekly technicals and see if we are able to spot a commerce or two.

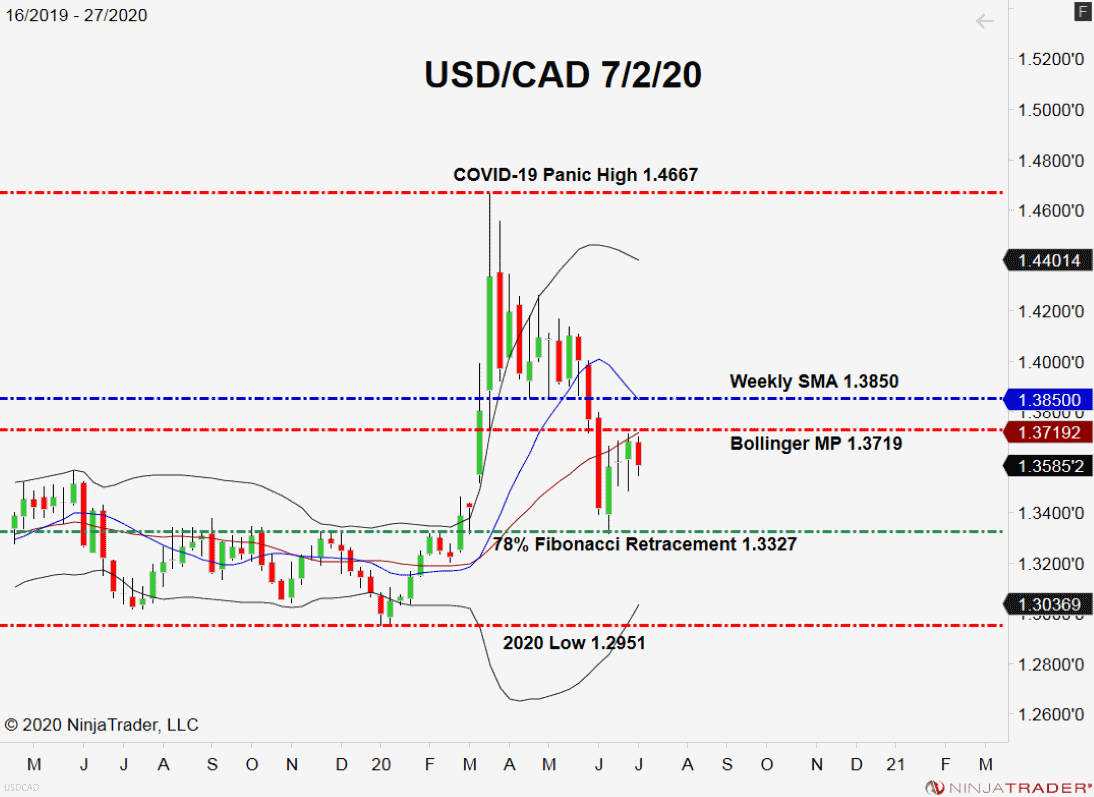

USD/CAD: Weekly Technicals

The chart under offers us a transparent have a look at the “L” formation that has developed for the USD/CAD on the weekly timeframe. This sample is an indication of compression and a noncommittal market.

+2020_27+(11_52_03+AM).png)

Backside Line: So, which method is the USD/CAD going to maneuver? At this level, it’s anybody’s guess. However, on condition that crude oil is prone to rise over the approaching summer time months, a bearish breakout is unquestionably a risk.

Till elected, I’ll have purchase orders queued up from 1.3335. With an preliminary cease at 1.3274, this commerce produces 61 ticks on a normal 1:1 threat vs reward ratio.