Bullish USD/ZAR, EUR/ZAR– Rand Energy Could Quickly Dissipate Since mid-2020 the South African Rand has ridden the wave of “risk-

Bullish USD/ZAR, EUR/ZAR– Rand Energy Could Quickly Dissipate

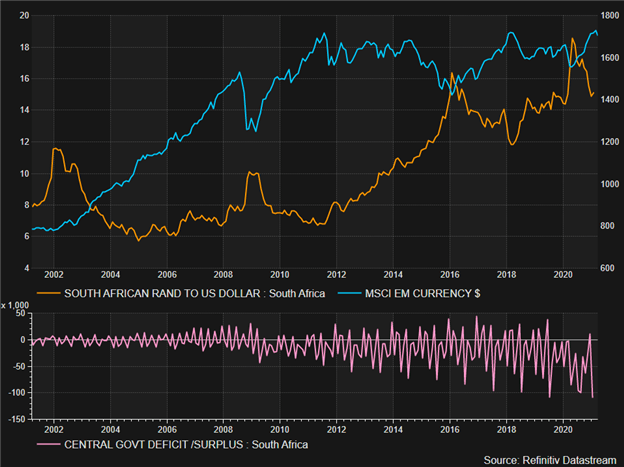

Since mid-2020 the South African Rand has ridden the wave of “risk-on” sentiment much like many Rising Market (EM) currencies (see chart beneath). The nation’s long-term structural challenges proceed to occupy information headlines, however the Rand’s standing as an EM foreign money has managed to protect it in opposition to a few of this negativity.

ZAR Appreciation In Line With EMs Regardless of Ballooning Deficit

Chart ready by Warren Venketas, Supply: Refinitiv

With Europe and america driving massive money injections into their economies, the Rand has diverged from the weakening Euro and U.S. Greenback. After clawing again losses from the preliminary lockdown part, the Rand seems to be considerably over-extended in opposition to each currencies. With markets beginning to digest the U.S. stimulus bundle in addition to Europe’s PEPP program, it might be time for these two main currencies to start to recuperate in opposition to the ZAR.

Moreover, the swelling price range deficit (see chart above) will quickly be uncovered by way of the native foreign money which is almost certainly going to be to its detriment. With rates of interest remaining flat in the interim and inflation falling wanting the South African Reserve Banks (SARB) goal of three% – 6%, this may increasingly open up an extra risk of Rand weak point for the quarter forward.

USD/ZAR Weekly Chart

Chart ready by Warren Venketas, IG Charts

The USD/ZAR weekly chart has been consolidating since late December, forming a rectangle sample proven in yellow above. This has the potential for a breakout ought to a weekly candle shut exterior of the rectangle’s barrier. The Relative Energy Index (RSI) remains to be beneath the midpoint degree, however this draw back momentum has been slowing and can doubtless surpass the midpoint whereas costs push in direction of topside resistance across the 15.4285 degree. This outlook helps the elemental backdrop of general Rand weak point for Q2.

EUR/ZAR Weekly Chart

Chart ready by Warren Venketas, IG Charts

Technical evaluation of the weekly EUR/ZAR chart paints the same image as USD/ZAR. After a powerful 2021 for the Rand, the downward transfer has long-established a falling wedge formation which typically follows on from an uptrend, and is usually approached with the intention of bullish reversals.

The RSI acts as a substantiating issue within the bullish viewpoint as declining costs in EUR/ZAR are coupled by a rise within the Relative Energy Index (black). So whereas worth was making lower-lows, RSI was making higher-lows. That is generally known as divergence however extra particularly ‘bullish’ divergence. Ought to this technical reversal sign unfold and break above topside resistance, the 38.2% Fibonacci retracement degree will function the preliminary resistance goal at 18.8788 adopted by the 19.0000 psychological degree.

Advisable by Warren Venketas

Get Your Free High Buying and selling Alternatives Forecast

aspect contained in the

aspect. That is in all probability not what you meant to do!nn Load your software’s JavaScript bundle contained in the aspect as an alternative.www.dailyfx.com