Some investors may feel conservative about investing in a stock that is hitting an all-time high. Rather than viewing the price level as concerning, history has shown us that a stock hitting new highs is a telling sign of strength. Only the strongest stocks that are in the most powerful uptrends eclipse their former highs, and many homebuilders are displaying that exact behavior at this very moment.

History has also illustrated countless times that stock trends tend to last longer than most investors realize – particularly strong uptrends breaking out to new highs. The SPDR S&P Homebuilders ETF XHB has not only outperformed over the course of the year (climbing nearly 50%), it is also showing relative strength over the past three months. As we can see below, XHB is leading the way up and is making a series of 52-week highs as we head into the final trading days of the year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

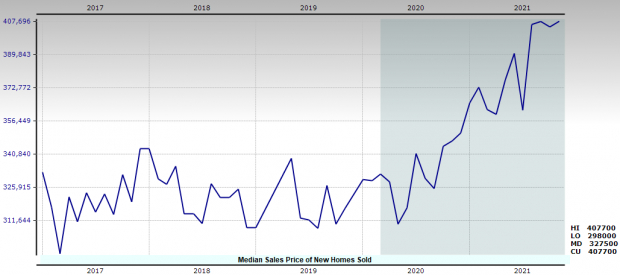

The old market adage comes to mind – follow the trend until the end when it bends. There’s no sign that the uptrend in the SPDR S&P Homebuilders ETF is bending. Although lumber prices are back on the ascent again with a nearly 100% increase over the last four months, most homebuilders have been able to pass on the increased cost to new homebuyers. XHB is benefitting from pricing for new homes which are hitting record highs. In early December of 2020, the median new home price was $350,800. That number is now $407,700 – a 16.2% increase in just the past year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Building Products – Homebuilders industry group has outpaced the market this year with a 36.7% return and is currently ranked in the top 34% of all 254 industries. This group also contains all three companies we will discuss below. Let’s take a more in-depth look at three homebuilders that are set to continue their run into 2022.

Tri Pointe Homes (TPH)

Tri Pointe Homes is engaged in the design, construction and sale of single-family homes. Headquartered in Irvine, CA, TPH has operations in ten different states as well as the District of Columbia. The company has assisted more than 28,000 homeowners, establishing over 330 neighborhoods and 15 masterplan communities.

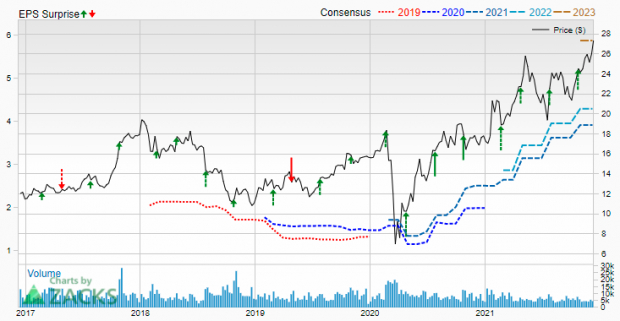

TPH is a Zacks #1 Strong Buy and has strung together a solid track record of earnings surprises, surpassing estimates in each of the last ten quarters. The homebuilder most recently reported EPS of $1.17 back in September for the prior quarter, a +31.46% surprise over consensus. TPH has a trailing four-quarter average earnings surprise of +31.73%, supporting the stock’s 60% run this year.

Tri Pointe Homes (TPH) Price, Consensus and EPS Surprise

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

TPH is trading at a very reasonable 6.99 P/E and has recently witnessed positive earnings revisions from analysts covering the firm. 2021 EPS estimates are presently $3.91, an increase of 8.01% from 60 days ago. This translates to a greater than 80% increase in EPS over 2020. Tri Pointe Homes is slated for its next earnings announcement on February 17th, 2022.

Toll Brothers, Inc. (TOL)

Toll Brothers is based in Fort Washington, PA and builds single-family detached and attached home communities. TOL operates its own engineering, architectural, mortgage, title, home security, and landscape subsidiaries. The company is also known for its urban low, mid and high-rise communities on land it develops and improves.

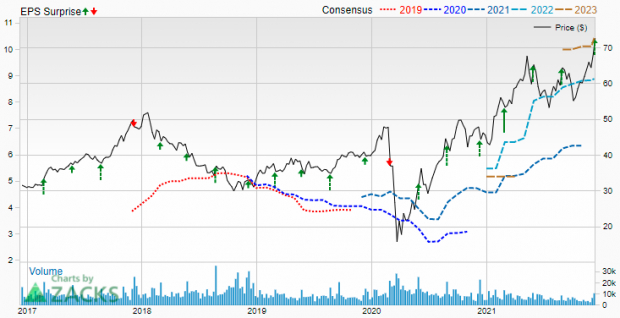

Trading at a relatively undervalued 8.18 P/E, TOL has consistently exceeded EPS estimates with a 31.54% average surprise over the last four quarters. TOL sports a Zacks #2 (Buy) ranking and most recently reported earnings earlier this month of $3.02, a 21.77% surprise over consensus. The stock has risen over 67% YTD.

Toll Brothers (TOL) Price, Consensus and EPS Surprise

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Given the favorable housing market backdrop, TOL has begun building housing for rental apartment communities in lucrative locations such as metro-Boston and Atlanta. Toll Brothers plans to continue driving shareholder value through regular share repurchases and dividend payments.

The current Zacks Consensus Estimate for full-year earnings stands at $8.89, a 34.09% increase over last year. TOL’s next quarterly earnings report is due out on February 22nd, 2022.

Meritage Homes Corp. (MTH)

Based in Scottsdale, AZ, Meritage Homes is the eighth-largest public homebuilder in the United States. MTH specializes in single-family homes for first-time, move-up, luxury and active adult buyers in historically high-growth regions across the country. The company is an industry leader in energy-efficient homebuilding and has consistently received awards for its industry leadership.

Meritage Homes also operates Carefree Title Agency, a wholly-owned title company that includes title insurance and settlement services. As of September 2021, MTH actively sold homes in 236 communities.

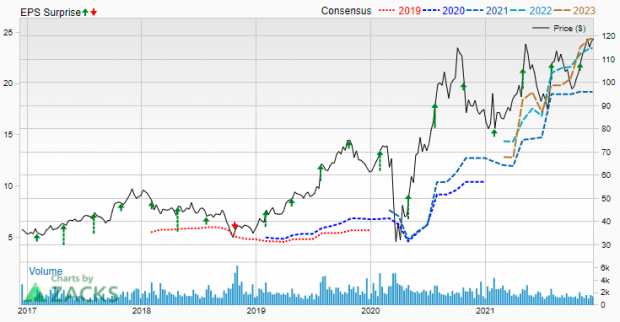

A Zacks #2 (Buy) stock, MTH trades at a relatively attractive P/E of 6.2. MTH has beaten earnings estimates for the past three years running, most recently reporting EPS of $5.25 in October – a +13.64% surprise over consensus.

Meritage Homes (MTH) Price, Consensus and EPS Surprise

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

MTH has posted an average positive earnings surprise of 24.36% over the last four quarters, helping the stock advance over 43% on the year. Analysts covering the firm are in agreement in terms of earnings revisions, climbing by 1.16% over the past 60 days. The Zacks Consensus Estimate for 2021 EPS is presently $19.18, which would represent growth of 74.36% year-over-year. MTH is set to report earnings on January 26th, 2022.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Click to get this free report

Toll Brothers Inc. (TOL): Free Stock Analysis Report

Meritage Homes Corporation (MTH): Free Stock Analysis Report

Tri Pointe Homes Inc. (TPH): Free Stock Analysis Report

SPDR S&P Homebuilders ETF (XHB): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com