The development sector is wanting good in the mean time, primarily due to the continued power in residential housing.

And residential housing is made from two components, current houses and new houses. Present houses is by far the bigger of the 2 segments, so the numbers ought to ideally be learn collectively, a minimum of as a gauge of demand.

So we see that within the month of Could, current dwelling gross sales (estimated by Nationwide Affiliation of Realtors) totaled 5.80 million, whereas new dwelling gross sales (estimated by the Census Bureau) totaled simply 769Okay. In fact, new houses value extra (median gross sales worth of $374,400 in Could) than current houses (median gross sales worth of $350,300), which is the doubtless an essential motive for the disparity.

Costs have run up over the previous 12 months due to rising enter prices and low inventories, when in flip is a results of favorable demographics and pandemic-induced shopping for. However the final couple of weeks has seen some easing in wooden costs as extra stock turns into out there, which must be a optimistic for each the development (new dwelling) and restore/renovation (current dwelling) markets.

So at present, we’re within the place of the cycle the place rising costs are pushing some entry-level patrons out of the market. If inventories of each new and current houses don’t improve, costs will proceed to rise and extra folks will postpone their dwelling possession plans. And that’s regardless of the reprieve they’re getting from low mortgage charges.

In accordance with the NAR, something under six months of provide results in worth appreciation at an accelerated charge. It’s solely at six months of provide that worth appreciation moderates. So the truth that new dwelling stock at Could-end represents 5.1 months of provide on the present degree of gross sales signifies that costs will recognize extra earlier than they reasonable.

So for a house development firm, that is the interval throughout which demand may be very sturdy, costs are rising and a few prices are declining, which after all implies that margins (and earnings) also needs to be rising. And for suppliers to those development corporations, it is a nice time for enterprise.

With this in thoughts, I’ve picked 5 buy-ranked shares which are both dwelling builders themselves or suppliers into this red-hot market. It does appear to be they may generate outsized returns for buyers over the following 12 months or so. So right here they are-

Lennar Corp. LEN

Lennar is engaged within the development and sale of single-family hooked up and indifferent houses in addition to the acquisition, improvement and sale of residential land immediately and thru unconsolidated entities in america.

Zacks #1 (Robust Purchase) ranked Lennar belongs to the Constructing Merchandise – House Builders trade, which is ranked 21 out of 250+ industries, or the highest 8%. Naturally, the trade rank represents the stable prospects mentioned above that corporations on this trade are benefiting from.

The corporate is predicted to develop earnings 73.3% this 12 months. Over the previous month, the Zacks Consensus Estimates for the present and following years’ earnings are up 16.1% and 26.6%, respectively.

Louisiana-Pacific Corp. LPX

Louisiana-Pacific is a number one producer of sustainable, high quality engineered wooden constructing supplies, structural framing merchandise and exterior siding to be used in new dwelling development, restore/ transforming and outside buildings. It caters to the residential, industrial and lightweight business development markets.

Zacks #1 ranked LPX is a part of the Constructing Merchandise – Wooden industries, which is on the high 3% of Zacks-ranked industries. Wooden costs had been escalating over the previous couple of months due to depleting inventories, as recent provides had been up towards provide constraints. However the scenario is normalizing now with costs additionally declining because of this. That is optimistic for sustained income development.

The Zacks Consensus Estimate for the corporate’s present 12 months earnings represents development of 194.7%. The estimates for the present and following years have risen a respective 22.8% and 18.5% prior to now 4 weeks.

Quanex Constructing Merchandise Corp. NX

Quanex designs and produces fenestration parts like energy-efficient versatile insulating glass spacers, extruded vinyl profiles, window and door screens, and precision-formed metallic and wooden merchandise, in addition to kitchen and toilet cupboard parts. It additionally provides non-fenestration constructing development parts and merchandise like photo voltaic panel sealants, wooden flooring, trim moldings, vinyl decking, fencing, water retention limitations, and conservatory roof parts.

The Zacks Rank #2 (Purchase) inventory is a part of the Constructing Merchandise – Miscellaneous trade, which is within the high 33% of Zacks-classified industries.

Its current-year (ending October) earnings are anticipated to develop 39.5%. Over the previous month, the estimate for the present 12 months earnings elevated 18.5% whereas the estimate for subsequent 12 months elevated 18.9%.

Potlach Corp. PCH

#1 ranked Potlach is one other member of the Constructing Merchandise – Wooden trade. The Actual Property Funding Belief (REIT) owns acres of timberland in Alabama, Arkansas, Idaho, Minnesota and Mississippi, and operates wooden product manufacturing amenities. It additionally has a land improvement and gross sales enterprise.

Its earnings are anticipated to develop 169.8% this 12 months. Estimates for 2021 and 2022 are up 30.8% and 96.3%, respectively.

Weyerhaeuser Co. WY

#1 ranked Weyerhaeuser additionally belongs to the Constructing Merchandise – Wooden trade.

It is without doubt one of the main U.S. forest product corporations with operations primarily concentrated in Southern California, Nevada, Washington, Texas, Maryland and Virginia though it caters to a various clientele throughout america, Canada, Japan, Europe and different areas.

The corporate grows and harvests timber, builds houses and manufactures forest merchandise worldwide, primarily for use as lumber, pulp and paper, and different wooden and constructing merchandise. It provides logs, hardwood lumber, timber, poles and plywood, in addition to minerals, oil, fuel, seeds and seedlings.

The corporate is predicted to develop 186.8% this 12 months. The present 12 months earnings estimate is up 26.8%. The 2022 estimate is up 33.5%.

Conclusion

There could also be some concern about the truth that new dwelling gross sales in Could declined 5.9% from April whereas current dwelling gross sales declined 0.9%. Importantly, this shouldn’t be learn as softness in demand. On the most, it might imply that among the dwelling builders received’t meet income expectations within the present quarter. However they need to nonetheless beat earnings estimates by a mile for the explanations outlined above.

It’s additionally essential to bear in mind the year-over-year development charge, which was 9% for brand spanking new houses and 45% for current houses. So we’re speaking a few a lot greater degree of gross sales this 12 months.

The primary factor to regulate is new dwelling stock. As a result of when stock normalizes, costs will come down, additionally knocking down costs of current houses. That’s after we’ll see one other surge in demand. And if it occurs whereas mortgage charges proceed to hug backside, development charges will speed up all of the extra.

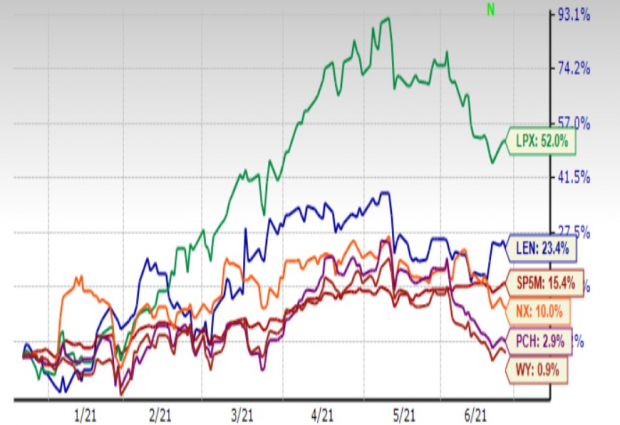

12 months-to-Date Value Motion

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Infrastructure Inventory Increase to Sweep America

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions can be spent. Fortunes can be made.

The one query is “Will you get into the appropriate shares early when their development potential is best?”

Zacks has launched a Particular Report that will help you do exactly that, and immediately it’s free. Uncover 7 particular corporations that look to realize probably the most from development and restore to roads, bridges, and buildings, plus cargo hauling and power transformation on an nearly unimaginable scale.

Obtain FREE: Learn how to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

Weyerhaeuser Firm (WY): Free Inventory Evaluation Report

LouisianaPacific Company (LPX): Free Inventory Evaluation Report

Lennar Company (LEN): Free Inventory Evaluation Report

Potlatch Company (PCH): Free Inventory Evaluation Report

Quanex Constructing Merchandise Company (NX): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.