Earnings season is upon us and preliminary estimates present that this shall be one other robust quarter for corporations. However with most corporations more likely to profit from simpler comps, selecting the true winners may be difficult.

A fundamental technique of sticking to Purchase or Maintain ranked shares with constructive earnings Anticipated Shock Prediction (ESP) might enable you determine these which might be most certainly to beat estimates. And normally, corporations that beat estimates additionally see their costs recognize over the following few months. So this offers you an opportunity to select up some fast beneficial properties.

Nonetheless, there’s additionally one other strategy to profit from earnings season. And that includes taking inventory of the businesses which have already reported. The businesses that may have already reported right now are those which have their quarters ending in April or Might.

The shares you’d need to choose are ones with robust upward revisions in estimates. Simply guarantee that in addition they have Zacks #1 (Robust Purchase) or #2 (Purchase) ranks, that they function in engaging industries and have a VGM Rating of A or B to extend your probabilities of success.

When such shares are nonetheless undervalued, you possibly can make sure that they’re headed up. Listed here are a number of examples-

Business Metals Firm CMC

Business Metals Firm manufactures, recycles and markets metal, steel merchandise and associated supplies and in addition gives associated providers.

The Zacks Rank #1 inventory with a VGM Rating of B operates within the engaging Metal – Producers trade, which is within the prime 5% of Zacks categorised industries.

After reporting robust leads to the Might quarter when reported earnings topped estimates by 28.4%, the Zacks Consensus Estimate for 2021 (ending August) jumped 20.6% whereas that for 2022 jumped 15.2%. The four-quarter common shock can be engaging, at 17.5%. So this isn’t a one-off factor.

Nonetheless, the shares are nonetheless buying and selling at a 10.9X P/E a number of, which is properly beneath the S&P common of 22.2X and in addition its personal median worth of 11.5X over the previous 12 months. So additional upside appears seemingly.

GMS Inc. GMS

Zacks #1 ranked GMS sells wallboard, suspended ceilings methods and complementary inside building merchandise utilized in industrial and residential buildings.

Since it is usually a member of the Constructing Merchandise – Retail trade, which is on the prime 7% of Zacks-classified industries, there’s a powerful probability of near-term share worth appreciation.

Its VGM Rating of A signifies that the inventory fits worth, development and momentum funding types.

The Zacks Rank is after all associated to the corporate’s latest robust efficiency whereby it topped the Zacks Consensus Estimate by 25.9%, in addition to the robust estimate revision motion (the Zacks Consensus for fiscal 2022 ending in April is up 19.3% whereas that for 2023 is up 25.9%).

The truth that the final 4-quarter common shock is 15.7% signifies that that is the continuation of an ongoing pattern.

What’s extra, the shares nonetheless look low cost at a ahead P/E of simply 9.7X (median 10.2X over the previous 12 months). For comparability, the S&P 500 is buying and selling at 22.2X whereas the involved trade is buying and selling at 20.0X.

Earthstone Power, Inc. ESTE

Earthstone develops and operates oil and gasoline properties with major belongings within the Midland Basin of west Texas and the Eagle Ford pattern of south Texas. Given latest pricing developments, the associated trade (Oil and Gasoline – Exploration and Manufacturing – United States) is at present on the prime 9% of Zacks-classified industries. The Zacks Rank #1 inventory additionally has a VGM Rating of B.

These components together are a ok indication of upside potential. But it surely’s additionally encouraging to notice that the corporate topped The Zacks Consensus Estimate by 240% within the final quarter and that its four-quarter common shock stands at 103.8%. Not solely that – for the reason that announcement of those robust outcomes, its 2021 (ending December) estimate is up 22.4% whereas the 2022 estimate is up a whopping 56.0%.

Valuation additionally appears engaging with a ahead P/E of 10.1X that is still properly beneath its median worth of 19.2X over the previous 12 months.

Sensible International Holdings, Inc. SGH

Sensible International is a designer, producer and provider of digital subsystems to OEMs within the pc, industrial, networking, telecommunications, aerospace and protection markets.

The Zacks Rank #1 inventory, which belongs to the Electronics – Semiconductors trade (prime 41%) has a VGM Rating A.

The corporate reported robust leads to the final quarter, beating estimates by 26.4%. This shock was stronger than the four-quarter common of 12.2%, indicative of the momentum in its enterprise. Analysts are additionally optimistic concerning the inventory, elevating the 2021 (ending August) estimate by 17.1% and the 2022 estimate by 13.5%.

Valuation stays engaging at 9.8X ahead P/E, which is why the inventory could possibly be price shopping for proper now. Each the S&P 500 and the involved trade look far more costly.

Smith & Wesson Manufacturers, Inc. SWBI

This well-known supplier of pistols, revolvers, rifles, handcuffs and different associated merchandise and equipment is ranked #1 by Zacks. The corporate belongs to the engaging Leisure and Recreation Merchandise trade (prime 9%), so the shares look set for appreciation. Additionally they have a VGM Rating of A, which typically signifies that traders would discover them helpful, no matter whether or not they’re inclined towards worth or development investing or just, momentum buying and selling.

After the corporate topped April-quarter estimates by 59.8%, estimates had been raised for 2022 and 2023 (ending April) by a respective 100.0% and 66.0%. The mixed earnings shock for the 4 previous quarters is 58.9%, so demand doesn’t seem like slowing down. Given the robust demand the corporate is seeing, additional upward revisions definitely appear to be within the playing cards.

So far as valuation is worried, the ahead P/E of 6.5X makes the shares actually low cost, each with respect to the S&P 500, which is buying and selling at 22.2X and the trade, which is buying and selling at 29.3X. They’re additionally buying and selling beneath their median stage over the previous 12 months.

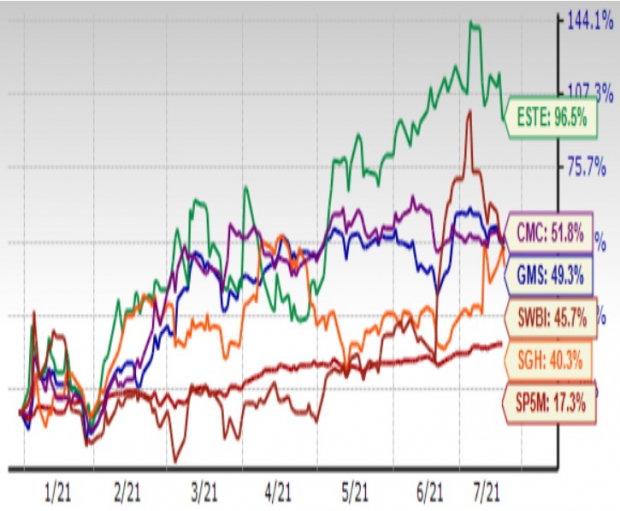

Yr-to-Date Value Efficiency

Picture Supply: Zacks Funding Analysis

Bitcoin, Just like the Web Itself, May Change All the pieces

Blockchain and cryptocurrency has sparked one of the thrilling dialogue subjects of a era. Some name it the “Web of Cash” and predict it might change the best way cash works without end. If true, it might do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early levels of this know-how, and because it grows, it can create a number of investing alternatives.

Zacks’ has simply revealed Three corporations that may assist traders capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them instantly.

See Three crypto-related shares now >>

Click on to get this free report

Business Metals Firm (CMC): Free Inventory Evaluation Report

Earthstone Power, Inc. (ESTE): Free Inventory Evaluation Report

GMS Inc. (GMS): Free Inventory Evaluation Report

SMART International Holdings, Inc. (SGH): Free Inventory Evaluation Report

Smith & Wesson Manufacturers, Inc. (SWBI): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.