Meme shares could also be on high of buyers’ minds for the time being, however there most likely isn’t motive to assume that they’ll have an enduring influence. True, buying and selling at this time isn’t what it was up to now with social media offering the platform for retail investor gatherings.

Reality be advised, although, that is all a big gamble. You might change into wealthy, however there’s an equal probability that you simply’ll lose no matter you’ve. The volatility, and due to this fact danger in these trades is critical as a result of costs aren’t pushed by fundamentals.

So must you maybe earmark a small share of your funds to those shares? Do you have to ignore them? Or must you consider this as a studying expertise?

A studying expertise is the best way I view it, irrespective of how a lot who produced from it. Particularly for those who aren’t younger anymore and so, have much less to spare. And it’s most likely value maintaining in thoughts that the straightforward/low cost cash the federal government’s been doling out will quickly be gone.

Can this buying and selling fashion be replicated sooner or later when that occurs? And what sort of position will inflation play for that matter? We don’t have solutions to those questions after all, nevertheless it appears doubtless that we gained’t see a ton of this stuff going ahead.

And so, that is most likely the time once we needs to be specializing in fundamentals. If we’re patrons on this market, we don’t wish to overpay for shares. Which might simply occur given the place valuations are sitting at proper now.

One encouraging development is the consistently bettering earnings image. The second quarter was at all times anticipated to be stronger than the primary as a result of the lockdown final yr makes for simpler comparisons. However these expectations have continued to rise, which additionally factors to some actual progress. So it shouldn’t be too tough to seek out shares with an excellent progress runway.

The picks at this time are primarily based on the concept that firms which have generated stable earnings progress up to now, on which analysts are incrementally optimistic concerning the future and that are anticipated to see progress within the subsequent couple of years must be good selections. Particularly when the valuations aren’t too wealthy and the Zacks Rank and Worth-Development-Momentum (VGM) Scores are supportive-

Harvard Bioscience, Inc. HBIO

Harvard Bioscience develops, manufactures and markets instruments utilized in drug discovery analysis at pharmaceutical and biotechnology firms, universities and authorities laboratories.

The shares carry a Zacks Rank #2 (Purchase) and VGM Rating A.

The corporate has generated 24.2% EPS progress within the final 5 years. Analysts at the moment count on it to generate EPS progress of 75.0% this yr and 42.9% within the subsequent. And so they’ve raised their estimates for 2021 and 2022 by 21.7% and 14.3%, respectively.

The shares additionally look fairly valued at these ranges: the present P/E of 21.63X is under the median worth of 28.98X over the previous yr.

Textainer Group Holdings Ltd. TGH

Textainer Group is the world’s largest lessor of intermodal containers with a complete fleet of greater than 1.Three million items, representing over 2,000,000 TEU that it leases to 400+ delivery traces and different lessees, together with every of the world’s high 20 container traces and the U.S. Navy. Additionally it is one of many largest purchasers of latest containers and the biggest sellers of used containers.

The shares carry a Zacks Rank #1 (Sturdy Purchase) and VGM Rating B.

Textainer has grown earnings at 24.2% over the previous 5 years and is anticipated to develop one other 196.9% this yr and one other 6.4% subsequent yr. Estimates for the 2 years have climbed 27.7% and 35.5%, respectively over the past 4 weeks.

At 7.03X earnings, the shares are additionally buying and selling under their median worth of seven.49 because it started buying and selling.

Alpha and Omega Semiconductor Ltd. AOSL

Alpha and Omega Semiconductor is an ODM (though many of the packaging and check is completed in-house) that designs, develops and sells a broad vary of energy semiconductors globally, together with a portfolio of Energy MOSFET and Energy IC merchandise.

It differentiates itself by integrating system physics, course of expertise, design and superior packaging to optimize product efficiency and value. It targets high-volume end-market purposes like notebooks, netbooks, flat panel shows, cell phone battery packs, set-top packing containers, moveable media gamers and energy provides.

The shares carry a Zacks Rank #1 and VGM Rating B.

The corporate’s earnings have grown 28.5% within the final 5 years with additional progress of 209.1% and 5.15% anticipated in fiscal 2021 and 2022 (ending June). Previously 4 weeks, analysts raised their estimates for the 2 years by 15.8% and 21.5%, respectively.

The shares are buying and selling at their one-year low of 11.40X P/E.

ArcBest Corp. ARCB

Headquartered in Fort Smith, Arkansas, ArcBest presents transportation of common commodities, motor provider freight transportation, business-to-business air transportation and ocean transport, in addition to international customizable provide chain options and built-in warehousing providers. It additionally presents expedited freight transportation providers to industrial and authorities clients and premium logistics providers.

The shares carry a Zacks Rank #2 and VGM Rating A.

The final 5 years have seen its earnings develop 37.5%. Analysts at the moment count on progress of 51.4% this yr and seven.3% within the subsequent, taking their estimates up 19.1% and 12.9%, respectively up to now 4 weeks.

The shares are buying and selling at a P/E of 15.53X, which is near the median worth of 14.64X over the previous yr.

LGI Houses, Inc. LGIH

Headquartered in The Woodlands, Texas LGI Houses designs and constructs entry-level/reasonably priced houses in Texas, Arizona, Florida and Georgia.

The shares carry a Zacks Rank #2 and VGM Rating A.

Earnings progress within the final 5 years has averaged at 31.8%. The estimated earnings progress for 2021 is 29.7%, stabilizing within the following yr at 0.9%. However these estimates might show conservative given the sturdy demand surroundings, and if the development over the previous month is any indication: the 2021 estimate jumped 25.0% throughout this time with the 2022 estimate leaping 14.2%.

The valuation has began climbing however the present P/E of 12.01X continues to be fairly near the median worth of 11.26X over the previous yr.

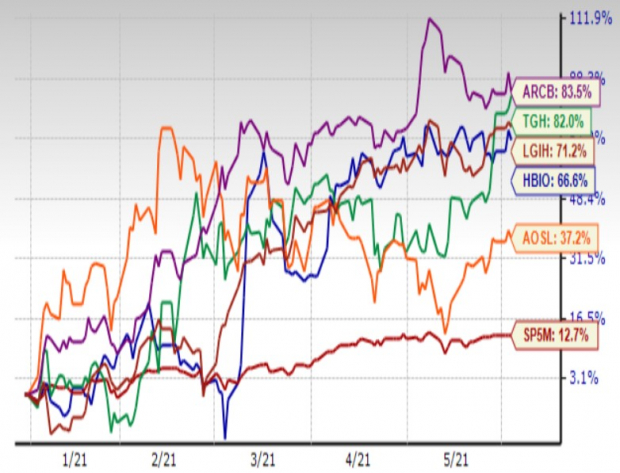

12 months-to-Date Worth Motion

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Infrastructure Inventory Growth to Sweep America

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions might be spent. Fortunes might be made.

The one query is “Will you get into the fitting shares early when their progress potential is best?”

Zacks has launched a Particular Report that can assist you just do that, and at this time it’s free. Uncover 7 particular firms that look to achieve essentially the most from development and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an nearly unimaginable scale.

Obtain FREE: The best way to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

ArcBest Company (ARCB): Free Inventory Evaluation Report

Harvard Bioscience, Inc. (HBIO): Free Inventory Evaluation Report

LGI Houses, Inc. (LGIH): Free Inventory Evaluation Report

Alpha and Omega Semiconductor Restricted (AOSL): Free Inventory Evaluation Report

Textainer Group Holdings Restricted (TGH): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.