The second-quarter 2021 earnings season obtained off to a flying begin with better-than-expected outcomes. Market contributors have excessive expectations as company earnings are anticipated to have soared within the final quarter.

As of Jul 23, 120 corporations of the S&P 500 Index reported outcomes. Whole earnings of those corporations had been up 118.9% 12 months over 12 months on 18.4% greater revenues. Furthermore, 89.2% of those corporations beat their earnings per share (EPS) estimates and 85% surpassed income estimates.

For the second quarter as a complete, whole earnings of the S&P 500 Index are anticipated to be up 74.3% 12 months over 12 months on 20% greater revenues. This means an enchancment over the preliminary projection of EPS growing 62.2% from the identical interval final 12 months on 18.2% greater revenues.

In the meantime, six Zacks Prime-Ranked shares are set to beat on earnings outcomes inside the subsequent seven buying and selling days. Funding in these shares could also be prudent within the close to time period.

S&P 500 in Q2 At a Look

Yr so far, the S&P 500 Index is the most effective Wall Avenue performer compared to the 2 different main indexes. The market’s benchmark index has rallied 17.7% to date this 12 months, whereas the Blue-chip Dow and the tech-laden Nasdaq Composite have gained 14.8% and 15.2%, respectively.

Nevertheless, within the second quarter, the S&P 500 lagged its peer. The broad-market index surged 4.6%, whereas the Dow and the Nasdaq Composite climbed 8.2% and 9.5%, respectively. This was primarily on account of mounting inflationary pressures which have resulted in market volatility.

However, fast vaccination coupled with authorities stimulus supported the economic system in its path to restoration from the COVID-19 pandemic in second-quarter 2021. Buyers centered on vitality, financials and industrials shares that benefitted within the early stage of the financial cycle. Consequently, the S&P 500 additionally moved northward.

Our Prime Picks

We’ve got narrowed down our search to 6 S&P 500 shares which can be slated to launch second-quarter earnings outcomes inside the subsequent seven buying and selling days. Every of those shares carries a Zacks Rank #1 (Sturdy Purchase) and has a constructive Earnings ESP. You may see the whole record of at the moment’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Our analysis exhibits that for shares with the mix of a constructive Earnings ESP and a Zacks Rank #3 (Maintain) or higher, the prospect of an earnings beat is as excessive as 70%. These shares are anticipated to understand after earnings releases. You may uncover the most effective shares to purchase or promote earlier than they’re reported with our Earnings ESP Filter.

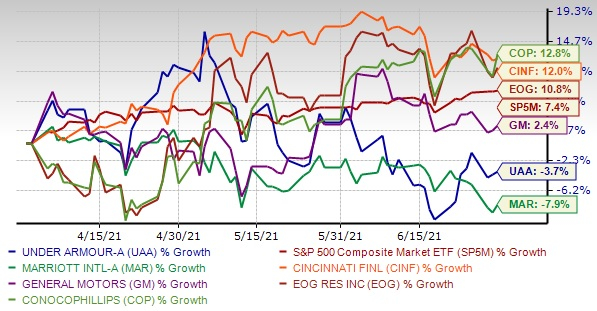

The chart under exhibits the value efficiency of our six picks within the final quarter.

Picture Supply: Zacks Funding Analysis

Cincinnati Monetary Corp. CINF: The Business Strains Insurance coverage phase of this firm has been persistently rising over the previous a number of quarters, led by development initiatives and worth will increase. Additionally, its premiums proceed to develop via a disciplined enlargement of Cincinnati Re whereas the division makes a pleasant contribution to the corporate’s total earnings.

The corporate has an Earnings ESP of +10.98%. It has an anticipated earnings development fee of 38.1% for the present 12 months. The Zacks Consensus Estimate for the present 12 months has improved 7.1% during the last 30 days. It recorded earnings surprises in three out of the final 4 reported quarters, with a median beat of 17.6%. The corporate is about to launch earnings outcomes on Jul 28, after the closing bell.

Beneath Armour Inc. UAA: The corporate has been benefiting from its strong direct-to-consumer enterprise. Previously few years it has been making an attempt to spice up its direct-to-consumer enterprise via retailer enlargement initiatives and enhancement of the e-commerce platform. The corporate is concentrated on strengthening its model via improved buyer connections and efficient improvements.

The corporate has an Earnings ESP of +47.69%. It has an anticipated earnings development fee of greater than 100% for the present 12 months. The Zacks Consensus Estimate for the present 12 months has improved 3.1% during the last 30 days. It recorded earnings surprises within the final 4 reported quarters, with a median beat of 286%. The corporate is about to launch earnings outcomes on Aug 3, earlier than the opening bell.

Marriott Worldwide Inc. MAR: The corporate has been benefitting from its steady deal with enlargement initiatives, digital innovation and loyalty program. Marriott is persistently making an attempt to broaden its presence worldwide and capitalize on the demand for accommodations in worldwide markets. The corporate plans to considerably broaden its world portfolio of luxurious and life-style manufacturers.

Marriott has an Earnings ESP of +32.52%. It has an anticipated earnings development fee of greater than 100% for the present 12 months. The Zacks Consensus Estimate for the present 12 months has improved 0.9% during the last 7 days. It recorded earnings surprises in three out of the final 4 reported quarters, with a median beat of 98.4%. The corporate is about to launch earnings outcomes on Aug 3, earlier than the opening bell.

ConocoPhillips COP: It holds a bulk of acres within the three massive unconventional performs, specifically Eagle Ford shale, Delaware basin and Bakken shale, that are wealthy in oil. The corporate has long-term plans to spend virtually $Four billion every year on the shale performs and function round 20 rigs throughout 4 main fields. The upstream vitality participant additionally has a foothold in Canada’s oil sand assets and has publicity to developments associated to liquefied pure gasoline.

The corporate has an Earnings ESP of +8.25%. It has an anticipated earnings development fee of greater than 100% for the present 12 months. The Zacks Consensus Estimate for the present 12 months has improved 4.7% during the last 7 days. The corporate is about to launch earnings outcomes on Aug 3, earlier than the opening bell.

Common Motors Co. GM is seeing sturdy demand for worthwhile vans and SUVs that’s driving its revenues. The corporate revamped the crossover lineup and is launching all-new, full-size pickups, adopted by full-size SUVs. Its hot-selling manufacturers in the USA like Chevrolet Silverado, Equinox and GMC Sierra are driving the highest line. The demand for these manufacturers is anticipated to develop additional.

The corporate has an Earnings ESP of +19.83%. It has an anticipated earnings development fee of 38.6% for the present 12 months. The Zacks Consensus Estimate for the present 12 months has improved 2.6% during the last 7 days. It recorded earnings surprises within the final 4 reported quarters, with a median beat of 75.8%. The corporate is about to launch earnings outcomes on Aug 4, earlier than the opening bell.

EOG Sources Inc. EOG has a sexy development profile, an enormous stock of drilling alternatives, higher quartile returns and a disciplined administration group. It has vital acreages in oil shale performs like Permian, Bakken and Eagle Ford.

The corporate has an Earnings ESP of +3.54%. It has an anticipated earnings development fee of greater than 100% for the present 12 months. The Zacks Consensus Estimate for the present 12 months has improved 7% during the last 7 days. It recorded earnings surprises in three out of the final 4 reported quarters, with a median beat of 51%. The corporate is about to launch earnings outcomes on Aug 4, after the closing bell.

+1,500% Progress: One in every of 2021’s Most Thrilling Funding Alternatives

Along with the shares you examine above, would you wish to see Zacks’ prime picks to capitalize on the Web of Issues (IoT)? It is without doubt one of the fastest-growing applied sciences in historical past, with an estimated 77 billion gadgets to be linked by 2025. That works out to 127 new gadgets per second.

Zacks has launched a particular report that will help you capitalize on the Web of Issues’s exponential development. It reveals Four under-the-radar shares that may very well be among the most worthwhile holdings in your portfolio in 2021 and past.

Click on right here to obtain this report FREE >>

Click on to get this free report

ConocoPhillips (COP): Free Inventory Evaluation Report

Marriott Worldwide, Inc. (MAR): Free Inventory Evaluation Report

Cincinnati Monetary Company (CINF): Free Inventory Evaluation Report

EOG Sources, Inc. (EOG): Free Inventory Evaluation Report

Common Motors Firm (GM): Free Inventory Evaluation Report

Beneath Armour, Inc. (UAA): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.