Most of us are in search of shares that we will purchase and maintain for the long run. That may very well be as a result of the ups and downs of the inventory markets is disconcerting for us.

Or it may very well be as a result of we don’t have the time or inclination to maintain a detailed eye in the marketplace always. Or, it may very well be that we’ve heard of this tried and examined technique, in keeping with which we will generate robust returns by merely choosing the shares correctly after which hanging on to them for lengthy sufficient.

No matter could be the motive we’re trying to find these winners, it goes with out saying that each good inventory shouldn’t be going to be one other Apple or Google or Fb, for that matter. These are a number of the tech titans that benefited from a lot of components that labored in conjunction, of their favor. And so, these shares introduced outsized returns to traders.

However there are lots of different seemingly boring names that even have the potential to generate robust returns. It’s comparatively simpler to find out which shares have upside potential within the close to to medium time period as a result of analysts are capable of venture outcomes for just a few years based mostly on current efficiency, the historic progress profile and present/recent components impacting the inventory or business.

In truth, if a inventory’s income or earnings doesn’t mirror its worth, it’s the surest signal that the shares are undervalued, which once more signifies that they symbolize upside potential.

At Zacks, we even have the proprietary inventory rating system, in keeping with which each inventory in our universe is allotted a 1 to five rank based mostly on its upside potential and different parameters. So a #1 rank is the strongest with #5 being the weakest. The Zacks Rank has proved itself for 20+ years, with #1 ranked shares having outperformed the market by enormous margins yearly.

When shares are picked by pairing the inventory rank with the Zacks Business Rank, which grades 250+ Zacks-classified industries, the probabilities of success enhance nonetheless additional. A beautiful business also can play a giant position in longer-term progress prospects.

For instance, many of the shares in semiconductor industries are more likely to see regular progress over the subsequent few years due to the speedy tempo of know-how adoption. So these shares may very well be comparatively extra engaging than shopper staples, that are extra depending on slower-moving components like inhabitants dimension.

The purpose right now is to seek out shares which have good long-term potential (recognized via the estimated long-term progress fee) but in addition vital upside potential within the close to time period (recognized via the current energy in outcomes, estimated progress charges for the subsequent two years and the present valuation). All these shares additionally belong to engaging industries with each brief and long-term implications. So let’s take a look-

PVH Corp. PVH

Zacks #1 (Sturdy Purchase) ranked PVH (previously Phillips-Van Heusen Corp) is a well known model within the enterprise of designing and advertising and marketing branded gown shirts, neckwear, sportswear, jeans, intimate attire, swim merchandise, footwear, purses and associated merchandise.

The Textile – Attire business to which it belongs is presently on the high 11% of Zacks-classified industries. The highest 50% have traditionally outperformed the underside 50% by an element of two to 1.

Within the final quarter, the corporate topped estimates by 134.2% with the final 4-quarter common shock being 171.7%.

Within the 12 months ending Jan 2022, PVH is predicted to generate income and earnings progress of 26.3% and 436.6%, respectively. This can be adopted by a 7.4% progress in income and a 30.0% progress in earnings within the following fiscal 12 months. What’s extra, it has a long-term estimated earnings progress fee of 18.0%.

Now you’d anticipate an organization like this, which is benefiting massively from the reopening, to have an costly valuation. However no. Its ahead price-to-earnings (P/E) of 15.35X is extraordinarily cheap, even low. Likewise for the price-to-sales (P/S) ratio, which at 0.92X, stays engaging.

City Outfitters, Inc. URBN

#1 ranked City Outfitters is a life-style specialty retailer providing style attire and equipment, footwear, residence décor and presents via its shops, catalogs, name facilities and e-commerce platforms within the U.S., Canada and Europe.

URBN belongs to the Retail – Attire and Footwear business, which is within the high 17% of Zacks-ranked industries.

Within the final quarter, it topped the Zacks Consensus Estimate by 237.5%. The common shock within the final 4 quarters is 129.2%.

The corporate’s ahead progress estimates are extremely encouraging. It’s anticipated to develop earnings 23,500% this 12 months ending Jan 2021 (the large leap is after all the results of simple comps from the pandemic hit 2020). It’s presently anticipated to develop 4.9% in 2023. Earnings are anticipated to develop 11.5% in the long run.

However progress prospects must also ideally be seen from the place revenues are going as a result of if revenues don’t develop, there’s solely a lot you are able to do with value efficiencies. So with out income progress, earnings have a tendency to come back beneath stress as effectively. On this case, it’s encouraging to notice that URBN can also be anticipated to develop income: at 24.1% within the present 12 months and 4.9% within the following 12 months.

The valuation additionally appears cheap at a P/E of 15.8X and P/S of 0.97X.

WESCO Worldwide, Inc. WCC

WESCO is among the largest gamers within the extremely fragmented marketplace for the distribution {of electrical} development merchandise in North America.

The Zacks Rank #2 (Purchase) inventory belongs to the Electronics – Elements Distribution business, which is within the high 4% of Zacks-ranked industries.

The corporate’s current shock historical past presents indication of its potential. The corporate beat the Zacks Consensus Estimate by a whopping 88.2% within the final quarter, which took the final four-quarter common shock to 52.0%.

And this progress trajectory is predicted to proceed in 2021 with 38.9% income progress and 65.5% earnings progress. Within the following 12 months, income is predicted to develop 3.7% and earnings 16.3%. Its estimated long-term progress is presently pegged at 10.0%.

The inventory trades at a P/E a number of of 13.7X and a P/S a number of of 0.34X, each of that are indicative of a very low cost valuation.

GIII Attire Group, LTD. GIII

The corporate manufactures, designs and distributes attire and equipment of licensed, owned and personal label manufacturers. Its product line contains attire, sportswear, swimwear, ladies’s fits, efficiency put on, purses, footwear, small leather-based items, chilly climate equipment and baggage.

GIII additionally belongs to the Textile – Attire business, so it’ll profit from the optimistic working local weather.

The Zacks Rank #2 inventory additionally has a horny shock historical past with a optimistic shock of 278.6% within the final quarter and a median 122.8% within the final 4 quarters.

The earnings progress estimate for the 12 months ending Jan 2022 represents progress of 275.0%. Development for the next 12 months is predicted to be 13.4%. Lengthy-term progress is predicted to be 11.6%. Income progress is presently estimated at 25.7% in 2022 and eight.6% in 2023.

The corporate is buying and selling at 11.6X P/E and 0.7X P/S, so it’s going low cost.

AGCO Corp. AGCO

AGCO is a number one producer and distributor of agricultural gear and associated alternative components with supplier networks and distributors throughout 140 nations. Its product traces embody tractors, combines, software gear like self-propelled sprayers, hay instruments and forage gear, implements, and so on.

The Zacks Rank #2 inventory operates within the Manufacturing – Farm Gear business, which is on the high 12% of Zacks-ranked industries.

The corporate has topped estimates at double and triple-digit charges in every of the final 4 quarters at a median fee of 428.4%. Within the final quarter, it topped the Zacks Consensus Estimate by 80.2%.

Its estimated earnings progress potential is extraordinarily engaging. Analysts presently anticipate it to develop 54.6% in 2021, 11.5% in 2022 and 16.4% in the long run. They’re projecting income progress of 17.2% this 12 months and 5.6% within the subsequent.

Regardless of the robust progress prospects, the inventory is buying and selling fairly low cost, at 14.1X earnings and 0.96X gross sales.

ArcBest Corp. ARCB

ArcBest supplies freight transportation companies and options together with motor freight, business-to-business air transportation companies; ocean transport companies; world customizable provide chain options and built-in warehousing companies. Via its premium section, it additionally presents expedited freight transportation companies to business and authorities clients; premium logistics companies; and home and worldwide freight transportation via air, ocean and floor companies.

The Zacks Rank #2 inventory belongs to the Transportation – Truck business (high 9%).

ARCB has topped the Zacks Consensus Estimate by 71.2% within the final quarter. Given its very robust efficiency within the three previous quarters as effectively, the 4-quarter common shock involves 618.3%.

It’s presently anticipated to develop earnings 57.6% this 12 months and 6.0% within the subsequent. Lengthy-term earnings progress is presently estimated at 15.3%. Income progress within the present and following years are anticipated to be a respective 18.5% and 5.0%.

The inventory presently trades at a P/E of 10.7X and P/S of 0.5X. So it’s engaging from the valuation perspective as effectively.

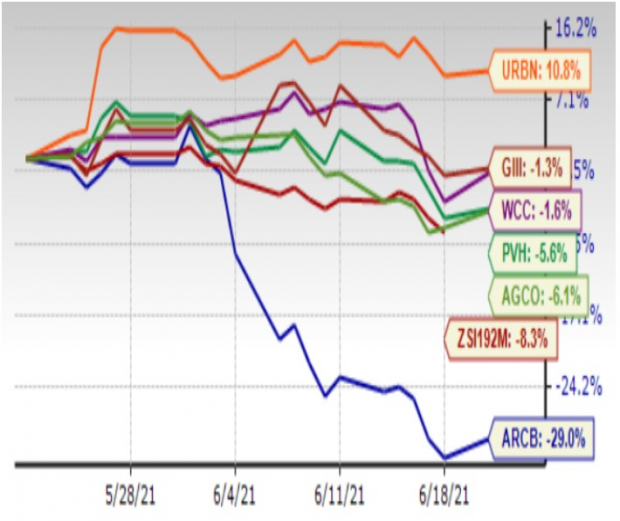

One-Month Value Efficiency

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Infrastructure Inventory Growth to Sweep America

A large push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions can be spent. Fortunes can be made.

The one query is “Will you get into the proper shares early when their progress potential is biggest?”

Zacks has launched a Particular Report that will help you do exactly that, and right now it’s free. Uncover 7 particular corporations that look to realize essentially the most from development and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an nearly unimaginable scale.

Obtain FREE: Find out how to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

WESCO Worldwide, Inc. (WCC): Free Inventory Evaluation Report

AGCO Company (AGCO): Free Inventory Evaluation Report

City Outfitters, Inc. (URBN): Free Inventory Evaluation Report

PVH Corp. (PVH): Free Inventory Evaluation Report

GIII Attire Group, LTD. (GIII): Free Inventory Evaluation Report

ArcBest Company (ARCB): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.