Abiomed, Inc. ABMD lately introduced its buyout of preCARDIA to boost remedy for sufferers with acute decompensated coronary heart failure (“ADHF”). The acquisition of preCARDIA, a developer of a proprietary catheter and controller, is anticipated to enrich Abiomed’s product portfolio for higher affected person outcomes.

For traders’ observe, the preCARDIA system has acquired Breakthrough System Designation by the FDA. Additional, the system is on the market for investigational use solely, and isn’t accepted to be used outdoors of medical research. Nevertheless, a commercialization announcement of the system is prone to be made later within the yr.

It also needs to be famous that preCARDIA has accomplished enrollment of 30 sufferers in an FDA early feasibility examine, which demonstrated favorable outcomes.

With the current buyout, Abiomed goals to solidify its foothold within the world cardiac enterprise.

Rationale Behind the Buyout

Per estimates, yearly, greater than one million sufferers are admitted to hospitals in the US with ADHF. Additional, regardless of the provision of pharmaceutical remedies, coronary heart failure is the first reason behind hospitalization in sufferers above the age of 65 years.

The preCARDIA system aids coronary heart failure specialists by providing a minimally-invasive answer having the potential to supply higher affected person outcomes. Additionally, price of care is anticipated to be lowered with the availability of early intervention with this newest know-how. The preCARDIA system has been developed to speed up the remedy of ADHF-related quantity overload by successfully decreasing cardiac filling pressures and selling decongestion to spice up the general cardiac and kidney capabilities.

Different potential advantages of the system embrace lesser period of hospital keep, decreased re-hospitalizations and improved high quality of life.

Per an professional related to the preCARDIA system, the know-how regulates the blood flowing into the center, in flip decreasing congestion and bettering coronary heart and renal operate.

Business Prospects

Per a report by Allied Market Analysis, the worldwide congestive coronary heart failure remedy gadgets market was valued at $10,127.2 million in 2015 and is estimated to achieve $14,823.three million by 2022 at a CAGR of 5.5%. Elements like rising emphasis on early intervention and first prevention of heart-related issues, together with technological developments in remedy gadgets, are anticipated to drive the market.

Given the market potential, the most recent acquisition is anticipated to considerably increase Abiomed’s world enterprise.

Notable Developments

Of late, Abiomed has witnessed a number of notable developments throughout its enterprise.

The corporate, in its fiscal fourth-quarter 2021 leads to April, recorded a strong income development, primarily pushed by its energy in worldwide Impella coronary heart pump gross sales.

The identical month, Abiomed introduced the ultimate outcomes of the physician-led Nationwide Cardiogenic Shock Initiative Research. The outcomes demonstrated a big survival to discharge with better than 90% native coronary heart restoration when finest practices are used, together with placement of an Impella coronary heart pump previous to revascularization.

Additionally in April, the corporate introduced the enrollment of the primary affected person in PROTECT IV, which is a big, potential, multi-center randomized managed trial designed to supply the extent of medical proof wanted to realize a Class I guideline suggestion for Impella in high-risk percutaneous coronary intervention.

Worth Efficiency

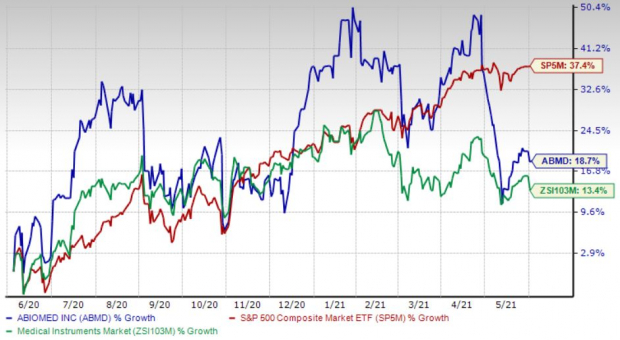

Shares of the corporate have gained 18.8% prior to now yr in contrast with the trade’s 13.4% development and the S&P 500’s 37.5% rise.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Zacks Rank & Shares to Contemplate

At the moment, Abiomed carries a Zacks Rank #5 (Robust Promote).

Some better-ranked shares from the broader medical area are Henry Schein, Inc. HSIC, DaVita Inc. DVA and Veeva Methods Inc. VEEV, every carrying a Zacks Rank #2 (Purchase). You possibly can see the whole checklist of at the moment’s Zacks #1 Rank (Robust Purchase) shares right here.

Henry Schein’s long-term earnings development fee is estimated at 11.2%.

DaVita’s long-term earnings development fee is estimated at 14.4%.

Veeva Methods’ long-term earnings development fee is estimated at 15.8%.

Infrastructure Inventory Growth to Sweep America

A large push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions shall be spent. Fortunes shall be made.

The one query is “Will you get into the precise shares early when their development potential is biggest?”

Zacks has launched a Particular Report that will help you do exactly that, and at the moment it’s free. Uncover 7 particular firms that look to realize probably the most from development and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an virtually unimaginable scale.

Obtain FREE: Revenue from Trillions on Spending for Infrastructure>>

Click on to get this free report

DaVita Inc. (DVA): Free Inventory Evaluation Report

ABIOMED, Inc. (ABMD): Free Inventory Evaluation Report

Henry Schein, Inc. (HSIC): Free Inventory Evaluation Report

Veeva Methods Inc. (VEEV): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.