Previously week, Azul AZUL reported wider-than-expected loss per share for second-quarter 2021. Nevertheless, the loss narrowed from the year-ago quarter’s degree with passenger revenues escalating greater than 100% 12 months over 12 months as an increasing number of individuals take to the skies.

Spirit Airways SAVE additionally dominated headlines previously week because it gave a bearish income outlook for the September quarter attributable to a number of flight cancellations following disruptions within the type of inclement climate, technical snags and workers crunch.

Alaska Airways, the wholly-owned subsidiary of Alaska Air Group ALK, expanded its fleet by exercising the choice to amass 12 extra Boeing 737-9 jets, sooner than deliberate. JetBlue Airways JBLU was additionally in information when it began working transatlantic flights between New York and London.

Recap of the Previous Week’s Most Necessary Tales

1. Azul’s second-quarter loss (excluding $3.41 from non-recurring objects) of $1.91 per share was wider than the Zacks Consensus Estimate of a lack of $1.53. Within the year-ago quarter, loss was $2.38 per share. Whole revenues of $321.Four million outperformed the Zacks Consensus Estimate of $302.1 million. The highest line jumped greater than 100% 12 months over 12 months as air-travel demand improves, courtesy of widespread vaccination packages in Brazil.

Owing to improved air-travel demand, Azul’s consolidated site visitors for July surged 253% 12 months over 12 months as reported in final week’s write-up.

Azul at present carries a Zacks Rank #3 (Maintain). You’ll be able to see the entire listing of at the moment’s Zacks #1 Rank (Sturdy Purchase) shares right here.

2. Spirit Airways’ administration introduced that adversarial climate circumstances and airport staffing shortages induced 2,826 flight cancellations within the Jul 30-Aug 9 timeframe. That is prone to depart a detrimental impression of roughly $50 million on its revenues. Spirit Airways estimates a further headwind of $80-$100 million on revenues within the third quarter on account of weak point in bookings. The corporate expects third-quarter revenues between $885 million and $955 million.

As a result of irregular operations, the service incurred surplus bills related to re-accommodation of consumers whose journey plans had been hampered. Additional labor bills additionally bumped up prices. Adjusted working bills for the September quarter are actually predicted within the band of $1,030-$1,040 million in contrast with the earlier expectation within the $1,000-$1,010 million vary.

3. Alaska Airways expects 12 further Boeing jets to be delivered between 2023 and 2024. Following the most recent order , Alaska Airways’ agency order for Boeing 737-9 planes totals 93. 5 of those plane are at present in service. The 737-9 jets encompass 16 firstclass seats and 24 premium class seats apart from being able to hold 178 company.

4. Ryanair Holdings RYAAY launched 11 routes from the UK for winter journey. With this, the service’s UK Winter 2021 schedule features a whole of greater than 2,000 weekly flights to above 400 locations.

5. JetBlue began working flights connecting New York’s John F. Kennedy Worldwide Airport (JFK) with London Heathrow Airport (LHR) from Aug 12. Following this newly initiated service to the UK, the service now operates in 26 nations. Earlier this month, the UK opened its borders to completely vaccinated vacationers from america. JetBlue expects to profit from pent-up demand for journey between these two nations. The JFK-LHR flights are operational day by day within the present month. The service might be accessible 4 occasions every week in September.

Efficiency

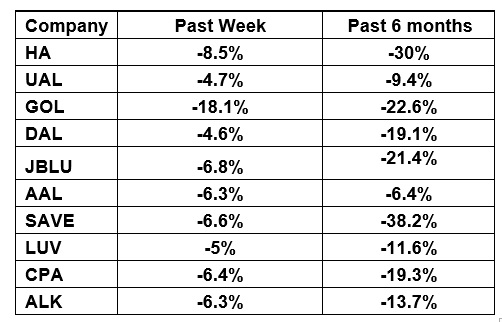

The next desk reveals the worth motion of main airline gamers over the previous week and throughout the previous six months.

Picture Supply: Zacks Funding Analysis

The desk above reveals that the majority airline shares have traded within the pink over the previous week, inducing the NYSE ARCA Airline Index to say no 6.2% to $86.65 with the Delta variant hurting air-travel demand. Over the course of the previous six months, the NYSE ARCA Airline Index has dropped 16.5%.

What’s Subsequent within the Airline Area?

Updates on the impression of the Delta variant on air-travel prospects are doubtless within the coming days.

Breakout Biotech Shares with Triple-Digit Revenue Potential

The biotech sector is projected to surge past $2.Four trillion by 2028 as scientists develop therapies for 1000’s of illnesses. They’re additionally discovering methods to edit the human genome to actually erase our vulnerability to those illnesses.

Zacks has simply launched Century of Biology: 7 Biotech Shares to Purchase Proper Now to assist buyers revenue from 7 shares poised for outperformance. Suggestions from earlier editions of this report have produced positive aspects of +205%, +258% and +477%. The shares on this report may carry out even higher.

See these 7 breakthrough shares now>>

Click on to get this free report

Ryanair Holdings PLC (RYAAY): Free Inventory Evaluation Report

JetBlue Airways Company (JBLU): Free Inventory Evaluation Report

Alaska Air Group, Inc. (ALK): Free Inventory Evaluation Report

Spirit Airways, Inc. (SAVE): Free Inventory Evaluation Report

AZUL SA (AZUL): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.