Armstrong World Industries, Inc

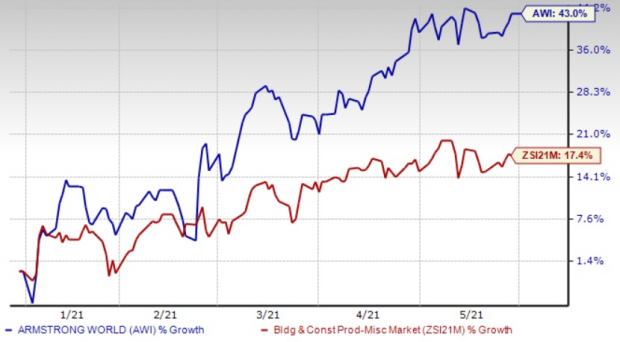

Armstrong World Industries, Inc. AWI has been gaining energy from the architectural specialty enterprise, buyout synergies, sturdy backlog and prudent investments. Shares of this world producer of ceiling programs have gained 43% to date this yr, outperforming the Zacks Constructing Merchandise – Miscellaneous business’s 17.4% rally.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Earnings estimates for the second quarter, third quarter and full-year 2021 have moved up 9.9%, 6.4%, and 0.8%, respectively, over the previous 60 days. This development signifies bullish analyst sentiments, indicating strong fundamentals and the expectation of outperformance within the close to time period. This Zacks Rank #3 (Maintain) firm additionally has a strong earnings shock historical past. Armstrong World’s earnings surpassed the Zacks Consensus Estimate in 4 of the trailing seven quarters. You may see the whole checklist of immediately’s Zacks #1 Rank (Robust Purchase) shares right here.

Nevertheless, COVID-induced quantity reductions within the natural enterprise and a rise in SG&A bills are issues.

Main Development Drivers

Architectural Specialty Enterprise: First-quarter 2021 was highlighted by report order consumption for Architectural Specialties merchandise. This enterprise delivered strong top-line development of 25% yr over yr pushed backed by 2020 acquisitions of Turf, Moz and Arktura. A major quarterly spotlight was the acceleration so as consumption, given sequential natural order consumption at a report degree that resulted in stronger-than-expected backlog. Within the first quarter, the corporate continued funding in architectural specialties to additional lengthen capabilities to help sturdy development on this phase.

Inorganic Drive: Armstrong World follows a scientific inorganic technique to reinforce its portfolio. In 2020, the corporate made acquisitions of Arktura (a designer and fabricator of ceilings, partitions, partitions and facades), Moz Designs (a Northern California-based designer and fabricator of customized architectural metallic ceilings, partitions, dividers, and column covers for inside in addition to exterior functions) and Turf Design (a Chicago-based business interiors design home and maker of customized felt ceiling in addition to wall options). All these buyouts have been included as a element of the Architectural Specialties phase, thereby enhancing its product portfolio.

Strong Prospects: Given sturdy backlog, the corporate stays assured in delivering 2021 gross sales development of greater than 30%. It has strong prospects, as is obvious from the anticipated earnings development charge for 2021, which is pegged at 33.3%. The Zacks Consensus Estimate for 2021 revenues signifies a rise of 28.3% from a yr in the past.

Increased ROE: Armstrong World’s return on fairness (ROE) is indicative of development potential. The corporate’s ROE of 37.2% compares favorably with the business common of 10.7%, implying that it’s environment friendly in utilizing shareholders’ funds.

Headwinds

COVID-Induced Decrease Volumes: Armstrong World’s first-quarter 2021 adjusted earnings declined 23.4% and adjusted gross sales grew simply 2% from a yr in the past. Contributions from acquisitions made in 2020 had been partly offset by COVID-induced quantity reductions within the natural enterprise. Adjusted EBITDA for the mentioned quarter fell 12% from the comparable year-ago interval owing to COVID-related quantity declines, persevering with investments in development initiatives and resumption of spending that was deferred when the pandemic hit.

Uncooked Materials Inflation: Increased uncooked materials prices stay a priority for Armstrong World and firms like Masco MAS, TopBuild BLD and Owens Corning Inc. OC. The corporate has been experiencing rising enter and freight prices in Mineral Fiber and Architectural Specialties segments. Though the corporate has been working to get well greater prices by value will increase, the continued volatility in materials prices and tightened capability stay issues.

Time to Spend money on Authorized Marijuana

For those who’re in search of large features, there couldn’t be a greater time to get in on a younger business primed to skyrocket from $17.7 billion again in 2019 to an anticipated $73.6 billion by 2027.

After a clear sweep of 6 election referendums in 5 states, pot is now authorized in 36 states plus D.C. Federal legalization is anticipated quickly and that might be a nonetheless higher bonanza for traders. Even earlier than the most recent wave of legalization, Zacks Funding Analysis has advisable pot shares which have shot up as excessive as +285.9%

You’re invited to take a look at Zacks’ Marijuana Moneymakers: An Investor’s Information. It encompasses a well timed Watch Checklist of pot shares and ETFs with distinctive development potential.

At present, Obtain Marijuana Moneymakers FREE >>

Click on to get this free report

Masco Company (MAS): Free Inventory Evaluation Report

Owens Corning Inc (OC): Free Inventory Evaluation Report

Armstrong World Industries, Inc. (AWI): Free Inventory Evaluation Report

TopBuild Corp. (BLD): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.