AvalonBay Communities, Inc. AVB

AvalonBay Communities, Inc. AVB is witnessing enhancements in occupancy stage in addition to like-term efficient rents in Could. Additionally, the typical asking hire climbed from the fourth-quarter 2020, whereas the typical concession per new move-in lease executed in Could 2021 declined from the fourth-quarter stage.

Within the recently-released second-quarter working replace, this residential REIT reported that the typical bodily occupancy for its established communities improved to 96% in Could from 95.7% in April. This additionally marks a rise from 95% in first-quarter 2021 in addition to 93.9% in fourth-quarter 2020.

As anticipated, suburban communities are having fun with higher occupancy in contrast with city communities. The common bodily occupancy for suburban communities improved to 96.3% in Could, from 96.1% in April and 95.5% in first-quarter 2021 and 94.9% in fourth-quarter 2020. In case of city communities, common bodily occupancy improved 95.1% in Could, from 94.5% in April and 93.6% in first-quarter 2021 and 91.4% in fourth-quarter 2020.

Per the working replace, the like-term efficient hire change for established communities was a destructive 1.9% in Could. This marks an enchancment from a destructive 5.1% in April, a destructive 8.3% within the first quarter and 11% in fourth-quarter 2020. Whereas Northern California recorded the sharpest Could hire stoop, marking an 8.3% decline, Denver and Southeast Florida noticed notable restoration, with 9.5% and 6.8% improve, respectively, within the month.

AvalonBay additionally witnessed a rise in common move-in hire worth, which climbed to $2,436 in Could from $2,340 in April and $2,248 in fourth-quarter 2020. This displays a rise of 8.3% from fourth-quarter 2020 to Could 2021.

The common asking hire in Could 2021 was roughly 14% above the typical month-to-month asking hire throughout fourth-quarter 2020. Furthermore, common concession per new move-in lease executed in Could was $465 in contrast with $1,872 throughout fourth-quarter 2020.

The corporate additionally reaffirmed its second-quarter outlook for established communities whole residential rental income change, which is anticipated to lower 5.5%, yr on yr, resulting in a 0.0% change in established communities whole residential rental revenues in comparison with first-quarter 2021.

For the U.S. residence market, the primary quarter, which is usually a gradual leasing interval in different years, gave the impression to be a stable one this yr, with spectacular demand for rental models, because of employment development that spurs family formation and housing absorption. As well as, the restoration continued in April and Could, with enchancment in rental fee and wholesome occupancy ranges, which is encouraging.

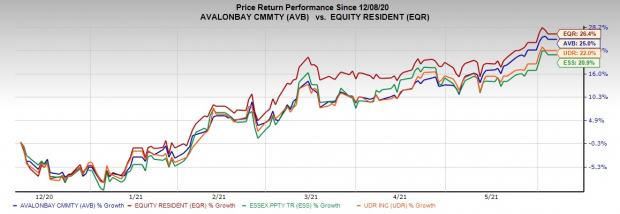

The widespread vaccinations and reopening of native economies are elevating hopes for residential REITs, together with AvalonBay, Fairness Residential EQR, Essex Property ESS and UDR Inc. UDR. Enchancment within the job market and a major family formation amongst younger adults are serving to on this buoyancy in rental demand.

Additional, although the conversion of renters to householders has been bogging the residential actual property marketplace for the previous yr, the substantial improve in for-sale residence costs is proscribing the variety of renters who can afford to buy, in flip, aiding rental demand.

Presently, AvalonBay, Fairness Residential, Essex Property and UDR Inc. carry a Zacks Rank of three (Maintain). You may see the whole checklist of in the present day’s Zacks #1 Rank shares right here.

Right here’s the value efficiency chart of the above-mentioned residential REITs prior to now six months.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Breakout Biotech Shares with Triple-Digit Revenue Potential

The biotech sector is projected to surge past $775 billion by 2024 as scientists develop remedies for hundreds of illnesses. They’re additionally discovering methods to edit the human genome to actually erase our vulnerability to those illnesses.

Zacks has simply launched Century of Biology: 7 Biotech Shares to Purchase Proper Now to assist traders revenue from 7 shares poised for outperformance. Our current biotech suggestions have produced positive factors of +50%, +83% and +164% in as little as 2 months. The shares on this report might carry out even higher.

See these 7 breakthrough shares now>>

Click on to get this free report

United Dominion Realty Belief, Inc. (UDR): Free Inventory Evaluation Report

AvalonBay Communities, Inc. (AVB): Free Inventory Evaluation Report

Fairness Residential (EQR): Free Inventory Evaluation Report

Essex Property Belief, Inc. (ESS): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.