Despite lingering fears of the Delta variant of coronavirus and supply chain bottlenecks, U.S. retail sales rebounded in August, after taking a dip in July. This unexpected increase defies concerns related to slowdown in consumption activity. Prominently, the back-to-school shopping season and payments under the Child Tax Credit program to qualifying families supported the metric. Sales rose across most of the categories during the month.

The Commerce Department stated that U.S. retail and food services sales in August rose 0.7% sequentially to $618.7 billion, following a revised reading of 1.8% decline in July. Sales results for the month of August caught most analysts by surprise, who were expecting a decline. Retail sales advanced despite continued sluggishness in sales at motor vehicle and parts dealers, thanks to global chip shortage that has severely hit the auto industry.

Impressively, higher sales across non-store retailers, home furnishing outlets, grocery stores and general merchandise outlets helped offset softness at auto dealers. We note that excluding motor vehicle and parts dealers, retail sales jumped 1.8% on a sequential basis. Restaurants and bars, the only service category included in the retail sales data, saw flat sales on a month-over-month basis.

Demand for big-ticket items and goods was healthy, as consumer preference shifted away from services. Michael Pearce, Senior U.S. Economist at Capital Economics said, “The rise in online and grocery store spending, which contrasts with stagnant spending at bars and restaurants, suggests Delta fears are playing a key role.”

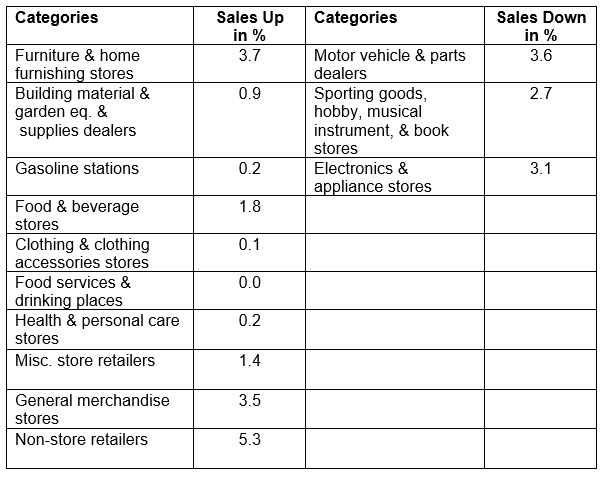

Let’s take a look at category-wise sales on a month-over-month basis.

Image Source: U.S. Census Bureau

Markedly, U.S. retail sales climbed 15.1% from August last year. Sales at clothing & clothing accessories stores, and food services & drinking places surged 38.8% and 31.9% year over year, respectively. Meanwhile, receipts at gasoline stations jumped 35.7% on a year-on-year basis.

Wrapping Up

Surge in retail sales is a positive indicator ahead of the holiday season, especially when the industry is currently dealing with supply chain woes, rising freight charges and labor shortages. Evidently, retailers need to address any logistical or inventory issues and roll out strategies to provide a seamless shopping experience, whether offline or online.

Industry experts cited that with more people returning to their workplace and record household savings, consumer spending activity is likely to receive a boost this festive season. Per Mastercard SpendingPulse, U.S. retail sales, excluding automotive and gas, are anticipated to increase 7.4% from a year earlier during the traditional holiday period that runs from Nov 1-Dec 24. With e-commerce still being one of the preferred modes for shopping, Mastercard SpendingPulse foresees online sales to rise by 7.6%.

The survey further projects year-over-year increase in sales for myriad categories — 45.9% for apparel, 13.2% for electronics, 59% for jewelry and 92.8% for luxury items (excluding jewelry). Department stores are likely to register sales growth of 14.8%, per the report.

Retailers such as Walmart WMT, Kohl’s Corporation KSS, DICK’S Sporting Goods DKS, Ollie’s Bargain Outlet OLLI and 1-800-FLOWERS.COM FLWS have ramped up hiring to ensure that they are adequately staffed for the upcoming shopping season.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Click to get this free report

Kohls Corporation (KSS): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

DICKS Sporting Goods, Inc. (DKS): Free Stock Analysis Report

1800 FLOWERS.COM, Inc. (FLWS): Free Stock Analysis Report

Ollies Bargain Outlet Holdings, Inc. (OLLI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com