MarketAxess Holdings Inc. MKTX

MarketAxess Holdings Inc. MKTX just lately introduced that Barclays PLC BCS has agreed to develop into its devoted market maker. It’s streaming costs for US funding grade company bonds to the MarketAxess Stay Markets order e book for institutional credit score markets.

Notably, Barclays PLC is a significant world banking and monetary companies firm, which additionally joined Goldman Sachs and one other systematic devoted market maker as a streaming liquidity supplier.

Launched in 2019, Stay Markets achieve traction from the nameless all-to-all Open Buying and selling market. It provides a singular view of two-way, actionable costs for probably the most energetic US funding grade bonds comprising benchmark points, recently-issued debt and news-driven securities. Institutional credit score traders and sellers are allowed to position resting reside orders out there whereas participating agency costs issued by traders and sellers simply with one click on.

This transfer is well-timed because the credit score market is evolving and made it vital to supply entry to liquidity. Prospects can now take pleasure in real-time, systematic liquidity at reside markets. A slew of buying and selling protocols will help the individuals in taking advantage of their buying and selling technique, thereby driving larger market turnover.

On this regard, it needs to be famous that quantity performed by Open Buying and selling reached a milestone of $246.Three billion within the March quarter, up 20% 12 months over 12 months. It represents 33% of MarketAxess’ whole world credit score buying and selling volumes.

The Open Buying and selling-led strengthened world liquidity lowered transaction prices price $196 million for each liquidity takers and suppliers within the March quarter.

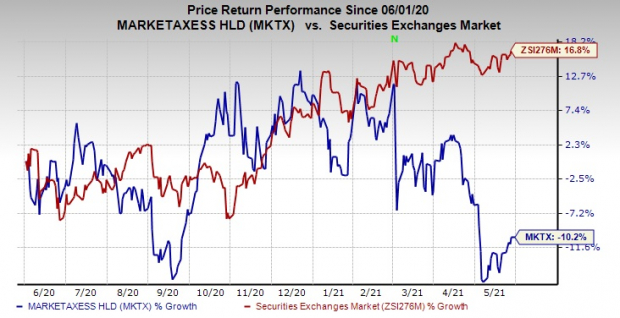

Shares of the corporate have misplaced 10.2% prior to now 12 months towards its business’s development of 16.8%. Nonetheless, the inventory will possible bounce again owing to its rising high line, pushed by a constant improve in fee acquired on buying and selling volumes and the inclusion of treasury buying and selling commissions and a sequence of alliances.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Additional, MarketAxess is repeatedly increasing its presence within the U.S. credit score market on the again of its Open Buying and selling platform. The platform makes approach for hassle-free buying and selling by connecting worldwide market individuals with greater than 1,700 energetic institutional traders and vendor corporations, thereby delivering value financial savings by accelerating buying and selling efficiencies. The corporate’s rising worldwide enterprise may also bump up total revenues.

This operator of a number one digital buying and selling platform for fixed-income securities and a supplier of market information and post-trade companies at the moment has a Zacks Rank #5 (Robust Promote).

Shares to Think about

Some better-ranked shares in the identical area are OTC Markets Group Inc. OTCM and Nasdaq, Inc. NDAQ, each presently holding a Zacks Rank #2 (Purchase). You may see the entire record of right this moment’s Zacks #1 Rank (Robust Purchase) shares right here.

OTC Markets Group and Nasdaq have a trailing four-quarter earnings shock of 33.5% and eight.3%, on common, respectively.

Zacks’ Prime Picks to Money in on Synthetic Intelligence

In 2021, this world-changing know-how is projected to generate $327.5 billion in income. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ pressing particular report reveals Three AI picks traders have to find out about right this moment.

See Three Synthetic Intelligence Shares With Excessive Upside Potential>>

Click on to get this free report

Nasdaq, Inc. (NDAQ): Free Inventory Evaluation Report

Barclays PLC (BCS): Free Inventory Evaluation Report

MarketAxess Holdings Inc. (MKTX): Free Inventory Evaluation Report

OTC Markets Group Inc. (OTCM): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.