Bristol-Myers Squibb Firm BMY introduced a world strategic collaboration settlement with Eisai. Each firms struck the deal to co-develop and co-commercialize MORAb-202, an antibody drug conjugate (ADC).

Per the phrases of the pact, the businesses will collectively develop and market MORAb-202 within the following collaboration territories of Japan, China, nations within the Asia-Pacific area, america, Canada, Europe together with the European Union and the UK and Russia. Whereas Bristol Myers shall be solely answerable for creating and commercializing the drug in areas outdoors the collaboration territories, Eisai shall be accountable for the manufacturing and provide of MORAb-202, globally.

Bristol Myers can pay $650 million to Eisai together with $200 million as fee towards analysis and improvement bills. Eisai can be entitled to obtain as much as $2.45 billion as potential future improvement, regulatory and industrial milestones.

The businesses will share income, analysis and improvement and commercialization prices within the collaboration territories. Bristol Myers Squibb can pay Eisai a royalty on gross sales outdoors the collaboration territories. Whereas Eisai is predicted to document gross sales of MORAb-202 in Japan, China, nations within the Asia-Pacific area, Europe and Russia, the corporate is entitled to the identical in america and Canada.

MORAb-202 consists of Eisai’s in-house developed anticancer agent farletuzumab and its in-house developed anticancer agent eribulin, utilizing an enzyme cleavable linker. The candidate is at the moment being evaluated for FRα-positive stable tumors (inclusive of endometrial, ovarian, lung and breast cancers) in two research, particularly a section I in Japan and a section I/II program in america.

Each firms intend to maneuver the candidate into the registrational stage of improvement as early as subsequent yr.

The collaboration will strengthen Bristol Myers’ place within the oncology area and complement its broad stable tumor portfolio.

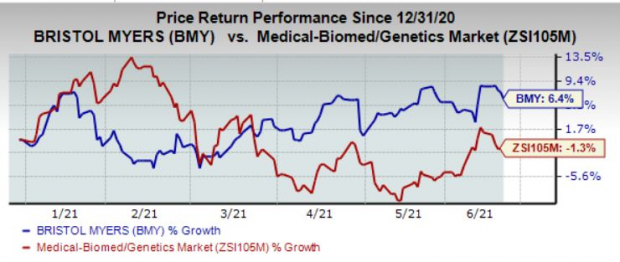

Bristol-Myers’ shares have gained 6.4% yr thus far in opposition to the business’s decline of 1.3%.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

The corporate’s efficiency within the first quarter of 2021 was dismal as its immuno-oncology drug Opdivo’s gross sales declined going through stiff competitors from the likes of Merck’s MRK Keytruda. Furthermore, Revlimid gross sales weren’t spectacular.

Nonetheless, the latest approval of latest medication provides a stream of revenues, which ought to propel progress within the coming quarters.

In March, the corporate and companion bluebird bio, Inc. BLUE secured the FDA approval for Abecma (idecabtagenevicleucel; ide-cel) as the primary B-cell maturation antigen (BCMA)-directed chimeric antigen receptor (CAR) T cell immunotherapy for the therapy of grownup sufferers with relapsed or refractory MM.

Final month, the FDA gave a nod to Zeposia (ozanimod) 0.92 mg for the therapy of adults with moderately-to-severely energetic ulcerative colitis (UC), a persistent inflammatory bowel illness (IBD).

Bristol-Myers at the moment carries a Zacks Rank #3 (Maintain). A greater-ranked inventory within the well being care sector is Repligen Company RGEN, which presently carries a Zacks Rank #2 (Purchase). You may see the entire listing of in the present day’s Zacks #1 Rank (Robust Purchase) shares right here.

Repligen’s earnings estimates for 2021 have elevated to $2.21 from $1.91 up to now 60 days.

Zacks Names “Single Greatest Choose to Double”

From 1000’s of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have essentially the most explosive upside of all.

You understand this firm from its previous glory days, however few would count on that it’s poised for a monster turnaround. Recent from a profitable repositioning and flush with A-list celeb endorsements, it may rival or surpass different latest Zacks’ Shares Set to Double like Boston Beer Firm which shot up +143.0% in slightly greater than 9 months and Nvidia which boomed +175.9% in a single yr.

Free: See Our Prime Inventory and Four Runners Up >>

Click on to get this free report

Bristol Myers Squibb Firm (BMY): Free Inventory Evaluation Report

Merck & Co., Inc. (MRK): Free Inventory Evaluation Report

Repligen Company (RGEN): Free Inventory Evaluation Report

bluebird bio, Inc. (BLUE): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.