Apple Inc. AAPL posted blowout first quarter fiscal 2022 financial results on January 27 that helped the market start to bounce back from the wave of selling that had plagued stocks throughout the first month of the year. The iPhone maker once again flexed its financial firepower, resilient supply chain, expanding services segment, and more.

Quick Q1 Recap

Apple easily topped our Q1 estimates, with revenue up 11% to an all-time high of $123.9 billion. Meanwhile, its adjusted earnings climbed 25% to $2.10 a share vs. the Zacks consensus estimate of $1.89 per share. Sales of the company’s flagship smartphone climbed roughly 9% to account for around 58% of total quarterly revenue.

The iPhone posted strong quarterly results for its holiday period after its iPhone 13 lineup launched in September. Apple thrived in Greater China during the period, with revenue up 21%, as iPhones started to grab more market share from local rival Huawei. Apple’s overall iPhone growth highlighted its ability to successfully navigate global supply chain bottlenecks that included a chip shortage and the strength of its growing in-house semiconductor segment.

Four of its five segments grew during the first quarter, with iPad being the exception. Its Wearables, Home and Accessories unit, which includes AirPods and the Apple Watch, popped 14% and Services surged 23% to account for the second-most revenue behind iPhone—services were the 2nd-biggest revenue driver in FY21, having pulled in $68 billion vs. $38 billion for 3rd place.

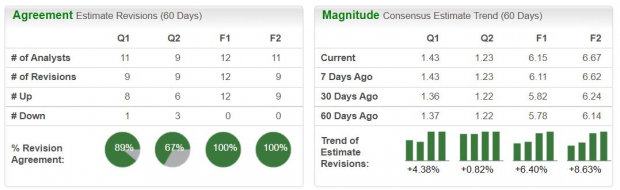

Apple didn’t provide revenue guidance due to near-term economic uncertainty, but expects to “achieve solid year-over-year revenue growth and set a March quarter revenue record despite significant supply constraints, which we estimate to be less than what we experienced during the December quarter.” And the nearby chart shows that analysts have upped their FY22 and FY23 EPS estimates recently.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Long-Term Bull Case

Countless Apple customers rarely consider buying anything other than an iPhone or other AAPL devices, opting to stay in the broader Apple universe for various reasons. This is the case even if there aren’t game-changing differences in the latest release and highlights Apple’s impressive marketing and brand-building prowess that’s elevated its tech despite lower-priced competition.

Wall Street also never discounts how addicted people are to their smartphones and devices, even if popular apps come and go and social media allegiances change. Crucially, chief executive Tim Cook has successfully transformed Apple far beyond a device company through various subscriptions offerings that help it continually make money from its loyal customer base.

Apple’s services feature everything from Netflix and Spotify competitors to fitness apps and a slew of other offerings outside of its lucrative app store. The company closed the first quarter with 785 million paid subscriptions, up 165 million during the last 12 months.

The company ended the period with over 1.8 billion active devices. And Apple is also rolling out a potentially impactful new service geared toward business customers dubbed Apple Business Essentials—set to debut in “Spring 2022.”

Apple ended the period with $203 billion in cash and marketable securities and a total of $80 billion in net cash (cash, minus debt). Its impressive free cash flow also helped it return $27 billion to shareholders in Q1. The company’s massive cash position is helping it successfully build out its in-house chip efforts.

Apple could conceivably enter almost any new growth segment. This goes far beyond rumors that it might acquire beaten-down Peloton or get into the electric vehicle market, because the next game-changing tech innovation or space might not even be possible at the moment. And Apple’s new privacy features are attractive to customers, while also negatively impacting Facebook, now Meta, and other mobile advertising-heavy companies

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Other Fundamentals

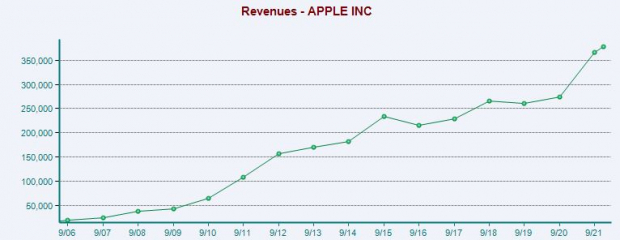

Apple’s fiscal 2021 sales soared 33% to crush FY20’s 6%. Last year’s top-line expansion marked its best growth since 2012, topping FY15’s 28%. Looking ahead, Zacks estimates call for 8.3% stronger sales in 2022 and 7% higher revenue in FY23 to reach approximately $423 billion—vs. $366 billion in FY21.

At the bottom end, Apple’s adjusted EPS are set to climb another 10%, even as they come up against 71% earnings growth last year. The tech giant’s earnings power is on full display with it then projected to post 9% higher earnings in 2023. Apple almost always tops quarterly earnings estimates and its bottom-line outlook has popped since its January release to help it grab a Zacks Rank #1 (Strong Buy).

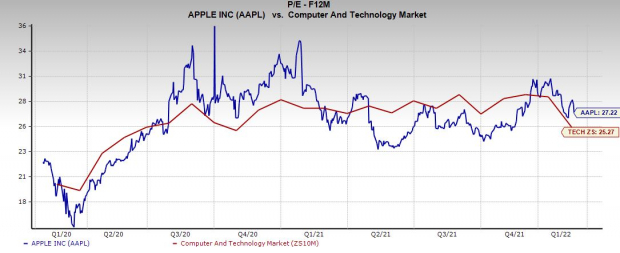

Apple shares are still down around 3% in 2022 after rebounding following its Q1 release. The stock closed regular trading Monday at $171.66 per share, which gives AAPL 11% more room to run before it hits its current Zacks consensus price target of $191.12 per share.

Apple stock also trades at a 25% discount to its two-year highs at 27.2X forward 12-month earnings and right in-line with its median during this stretch. And it also trades at only a slight premium compared to the broader Tech sector despite blowing away the group over the past five years—up 420% vs. 140%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Apple stock is hovering right at its 50-day moving average and it could clearly face more near-term volatility and selling. And higher interest rates do impact growth-focused tech firms, which could be a drag on the sector as a whole.

Nonetheless, buying Apple amid the uncertainty of 2022 hardly seems like an outsized risk, especially for long-term investors. Apple is a money-printing machine and the world’s most valuable company that Wall Street remains infatuated with. For instance, 18 of the 21 brokerage recommendations Zacks has are “Strong Buys,” with two more “Buys,” and none below a “Hold.”

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com