Chewy CHWY inventory benefitted enormously from the stay-at-home economic system throughout the top of the pandemic. The e-commerce pet retailer then received hammered within the early a part of 2021, as Wall Avenue dumped covid high-flyers. Fortunately for traders who missed out on that run, Chewy’s outlook stays robust and it’s beginning to regain momentum.

Fashionable Pet Retailer Star

Chewy was based roughly a decade in the past as a pet retailer resolution for the Amazon AMZN age. The corporate has spent the previous ten years increasing its buyer base and its portfolio in an effort to thrive for the subsequent decade and past as extra clients crave comfort and are prepared to pay for it.

The agency sells pet meals, provides, treats, medicines, and far more for quite a lot of animals. Chewy has discovered success by including loyal pet house owners to its ranks, with roughly 70% of gross sales coming from its Autoship enterprise that permits individuals to have meals and extra delivered at common intervals.

Picture Supply: Zacks Funding Analysis

Traders ought to love the steadiness of those repeat clients who’ve come to like having merchandise akin to pet meals and drugs delivered in common intervals. Individuals additionally clearly have the power to order the rest obtainable on Chewy each time they need or want it.

Chewy final October launched a telehealth service known as Join with a Vet, which it has continued to enhance. The corporate has additionally boosted its pharmacy choices, and it has nationwide pet adoption providers. All of those choices ought to assist it compete towards the titans of e-commerce from AMZN to Goal TGT, whereas additionally leaping to the forefront of pet-based telehealth, which has actual legs far past the coronavirus.

Latest Quarter

Chewy added 43% extra customers in 2020 to shut the yr with 19.2 million, with income up 47% to $7.15 billion. This topped 37% gross sales progress throughout its first yr as a public agency in FY19. The corporate then topped our Q1 estimates (interval ended on Might 2) in early June, with income and new lively clients each up 32%. CHWY’s gross margin grew by 4.2% to 27.6%.

Picture Supply: Zacks Funding Analysis

On high of that, the corporate posted optimistic adjusted earnings for the second quarter in a row. Chewy’s adjusted +$0.15 a share Q1 earnings crushed our estimate that known as for a lack of -$0.02 a share and marked a giant climb from the -$0.12 a share loss it posted a yr in the past.

Maybe most significantly, Chewy closed the quarter with 19.Eight million lively clients, up 600Okay sequentially. “Additional, retention charges remained regular because the 2020 cohort matures into their second yr on our platform. Taking a broader view, over the previous two years, we have now elevated our lively buyer base by 8.Four million or 75%,” CEO Sumit Singh stated on the corporate’s earnings name.

Different Fundamentals

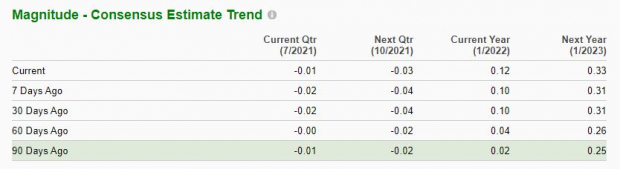

Chewy has blown away our bottom-line estimates within the trailing 4 intervals. Analysts additionally raised their EPS estimates for fiscal 2021 and 2022 following the robust Q1 report. And there have been extra optimistic revisions within the final seven days.

Trying down the highway, Zacks estimates name for Chewy’s FY21 income to climb 26% or $1.Eight billion greater to achieve $9.Zero billion, with it projected so as to add one other $1.9 billion or 21% greater gross sales in 2022 to come back in at $10.84 billion. In the meantime, its adjusted FY21 earnings are anticipated to climb 33% to $0.12 a share, with FY22 set to skyrocket 179% to $0.33 a share.

Chewy’s optimistic earnings revisions, together with the latest pop in its longer-term consensus estimates helps it land a Zacks Rank #1 (Robust Purchase) in the intervening time. The inventory additionally grabs an “A” grade for Development in our Model Scores system and its Client Merchandise–Staples is within the high 30% of our over 250 Zacks industries.

Picture Supply: Zacks Funding Analysis

Value Motion & Extra

Chewy shares had soared over 300% from their March 2020 lows to their February highs of round $120 a share. CHWY received crushed when Wall Avenue bought high-flyers and pandemic winners. The inventory, like many different growth-focused corporations and tech giants like Apple AAPL, regained momentum round mid-Might as Wall Avenue determined it was time to purchase up their favourite long-term shares at reductions.

CHWY has climbed 32% since Might 13, proper after it briefly fell into oversold RSI territory of 30. The inventory has additionally surged within the final week, together with a powerful leap throughout common hours Friday to shut round $87 a share.

Chewy’s latest run has pushed it again above its 200-day transferring common and it nonetheless trades 28% beneath its data, even because the market is again at contemporary highs. Regardless of the rip greater, CHWY trades beneath overbought RSI (70) ranges in the intervening time at round 60. And it trades at a 50% low cost to its highs at 3.5X ahead gross sales. All of this might give the inventory loads of room to run.

Backside Line

Wall Avenue stays largely excessive on Chewy, with 9 of the 14 brokerage suggestions Zacks has at “Robust Buys,” with just one beneath a “Maintain.” Traders may need to take a chew out of CHWY since e-commerce was booming lengthy earlier than the pandemic and folks using supply, particularly automated supply for necessities like pet meals are unlikely to return at the same time as they return to their regular lives.

Time to Put money into Authorized Marijuana

For those who’re on the lookout for massive positive factors, there couldn’t be a greater time to get in on a younger business primed to skyrocket from $17.7 billion again in 2019 to an anticipated $73.6 billion by 2027.

After a clear sweep of 6 election referendums in 5 states, pot is now authorized in 36 states plus D.C. Federal legalization is anticipated quickly and that could possibly be a nonetheless larger bonanza for traders. Even earlier than the most recent wave of legalization, Zacks Funding Analysis has advisable pot shares which have shot up as excessive as +285.9%.

You’re invited to take a look at Zacks’ Marijuana Moneymakers: An Investor’s Information. It incorporates a well timed Watch Record of pot shares and ETFs with distinctive progress potential.

Right now, Obtain Marijuana Moneymakers FREE >>

Click on to get this free report

Amazon.com, Inc. (AMZN): Free Inventory Evaluation Report

Apple Inc. (AAPL): Free Inventory Evaluation Report

Goal Company (TGT): Free Inventory Evaluation Report

Chewy Inc. (CHWY): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.