Mastercard Inc.’s MA enterprise quantity is ready to develop with a rebound in cross-border journey, which is the slowest sector to revive normalcy. Nevertheless, there are some inexperienced shoots that point out folks’s intention to see the world round.

Cross-border is the best margin enterprise class for Mastercard. This enterprise line has suffered because the pandemic struck, thus weighing on the corporate’s earnings.

Nevertheless, as lockdown is being lifted in a number of components of the globe and vaccination jabs are administered efficiently, the touring pattern is quick catching up.

Private Journey to Resume Quickly

Inside journey, private journey will decide up the tempo sooner than company excursions on important pent-up demand. Additionally, virtually-conducted company conferences dampened the necessity for company journey to some extent.

Nevertheless, per a current American Specific report, company journey will improve its frequency quickly. It said that whereas some conferences are simply carried out on-line, others are far more precious after they happen on one-on-one foundation. Additionally, the U.S. workforce is craving for in-person enterprise connections after an prolonged interval of distant working and monotony. 88% of enterprise vacationers believes that enterprise journey can contribute to stronger management expertise.

It appears that evidently enterprise journey is simply not far away. 83% choice makers are optimistic that enterprise journey will return to pre-coronavirus ranges over the following two years. Whereas the enterprise journey is but to indicate indicators of restoration, private journey is already gaining a formidable momentum.

Within the first quarter of 2021, Mastercard witnessed energy in private home journey in each america and the U.Okay. The U.S. airline spend is just too catching up quick.

Regardless of this uptick, the general journey enterprise is down from its pre-pandemic ranges.

Cross-border journey spending continues to be within the stabilization part whereby spending is restricted because of closed borders. This part is the second stage of the four-phase (containment, stabilization, normalization and progress) framework it established for navigating the COVID setting.

In the meantime, the corporate is firmly centered on constructing on its already robust place in journey, participating vacationers early by means of its loyalty applications and increasing relationships with its companions in journey.

Corporations like Visa Inc. V, American Specific Co. AXP and Uncover Monetary Providers DFS are all more likely to see sunny days forward with folks travelling and spending extra on their playing cards.

Different Tailwinds

Cross-border journey is the one blot on the corporate whereas the remainder of its progress pillars, resembling digital, cybersecurity, information analytics, B2B and multi-rail options, look stable.

Mastercard’s essential working metrics, specifically gross greenback quantity (the quantity of purchases made and money disbursements obtained with MasterCard-branded card) and switched transactions, which measure the variety of occasions the corporate’s merchandise have been used to facilitate transactions, are bettering.

Per administration, lots of the firm’s markets are transitioning from normalization part to the expansion part domestically, which is a optimistic.

The continuing enlargement of e-commerce can be an enormous tailwind for Mastercard that can proceed lengthy after COVID-19 ceases to hassle.

Furthermore, Mastercard is reinforcing its place in offering real-time funds and to this finish, it acquired the Company Providers division of Nets.

The corporate is bolstering its multi-rail capabilities, that are essential to its efforts in open banking as properly. It gives its banks and fintech clients with higher flexibility in managing each its fee and information flows.

Mastercard’s enlargement in Open Banking, permitting crypto currencies on its community, a number of new crypto partnerships and investments in blockchain know-how will take it very far. The corporate can be participating with governments the world over for his or her digital forex through its digital testing platform.

Just lately, the corporate introduced that it’ll purchase Ekata, which advances its digital id efforts. Notably, Ekata has entry to validated id data on a world foundation and leverages AI to supply extremely correct id scores.

The corporate goals to depart a broader influence on the society by executing its dedication to convey 1 billion folks into the digital financial system by 2025.

The icing on the cake for Mastercard is its stable capital place with ample free money flows. This permits dividend fee, share buybacks in addition to acquisitions and strategic initiatives to assist progress.

Mastercard is clearly a long-term choice for buyers who should retain it of their portfolio.

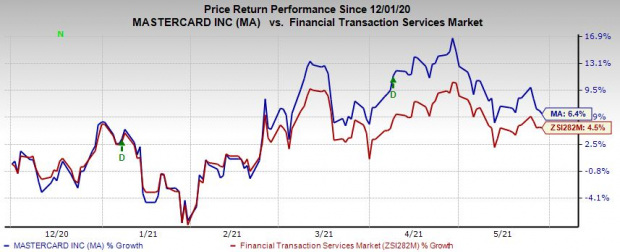

In six months’ time, the inventory has gained 6.4% in contrast with its trade’s progress of 4.6%.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Mastercard carries a Zacks Rank #3 (Maintain), presently. You possibly can see the entire checklist of in the present day’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Zacks’ Prime Picks to Money in on Synthetic Intelligence

In 2021, this world-changing know-how is projected to generate $327.5 billion in income. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ pressing particular report reveals Three AI picks buyers must learn about in the present day.

See Three Synthetic Intelligence Shares With Excessive Upside Potential>>

Click on to get this free report

American Specific Firm (AXP): Free Inventory Evaluation Report

Mastercard Integrated (MA): Free Inventory Evaluation Report

Visa Inc. (V): Free Inventory Evaluation Report

Uncover Monetary Providers (DFS): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.