The Chemours Company CC recently earmarked a new facility for the expansion of its non-ozone depleting, low global warming potential (GWP), hydrofluoroolefin (HFO) platform, Opteon 1150, which is chemically known as HFO-1336mzzE. The plant, located in El Dorado, AR, will open before the initial 10% phase down of CO2 equivalents scheduled before Jan 1, 2022, per the American Innovation and Manufacturing Act in the United States.

Opteon 1150 is an addition to the Chemours portfolio of non-flammable foam blowing agents, besides Opteon 1100. This is the latest innovation by Chemours and is testimony to its commitment to providing sustainable and energy-efficient products globally.

With the unique properties of HFO-1336mzzE, Opteon 1150 promises to mitigate some of the most difficult challenges in its industry through sustainable solutions, as well as to provide higher yields and a broader application window.

The company noted that the technology will be critical across multiple industries in transitioning to low GWP technology while maintaining the established high-performance standards. The product will bring more options and more control of formulations to Chemours’ customers. The company has already started accepting orders for Opteon 1150.

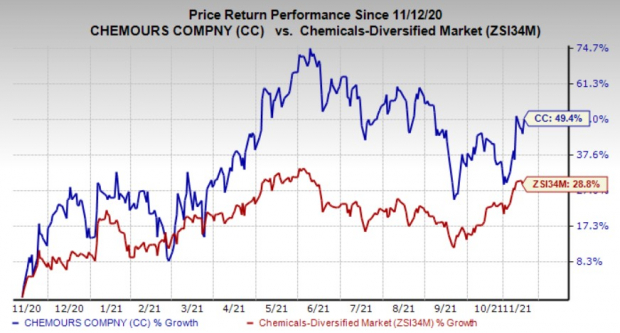

Chemours shares have grown 49.4% over the past year compared with the industry’s 28.8% rise. The company’s estimated earnings growth rate for the current year is pegged at 105.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Chemours, in its third-quarter call, raised expectations for full-year 2021 on the back of its strong third-quarter performance. It now sees adjusted EBITDA within the range of $1,300-$1,340 million compared with the prior guidance in the top end of the $1,100-$1,250 million range.

The company also expects adjusted earnings per share in the band of $3.93-$4.13 compared with the prior guidance in the top end of the $2.84-$3.56 range.

Free cash flow for 2021 is now forecast to be more than $500 million, up from prior guidance of above $450 million.

The Chemours Company Price and Consensus

The Chemours Company price-consensus-chart | The Chemours Company Quote

Zacks Rank & Other Key Picks

Chemours currently carries a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks in the basic materials space are Dow Inc. DOW, Univar Solutions Inc. UNVR, each flaunting a Zacks Rank #1, and Celanese Corporation CE, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Dow has an expected earnings growth rate of 447% for the current year. The Zacks Consensus Estimate for earnings for the current year has been revised 8.7% upward over the last 60 days.

Dow beat the Zacks Consensus Estimate for earnings in all the four trailing quarters. The company pulled off a trailing four-quarter earnings surprise of roughly 14.12%, on average. Its shares have also gained around 12.6% over a year.

Univar has an expected earnings growth rate of 55.2% for the current year. The Zacks Consensus Estimate for the current year has been revised around 9% upward over the last 60 days.

Univar beat the Zacks Consensus Estimate for earnings in all of the four trailing quarters. The company delivered a trailing four-quarter earnings surprise of roughly 24.1%, on average. Its shares have also rallied around 68.2% over a year.

Celanese has an expected earnings growth rate of 139.7% for the current year. The Zacks Consensus Estimate for the current year has been revised 9.1% upward over the last 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in all of the four trailing quarters. The company pulled off a trailing four-quarter earnings surprise of roughly 12.7%, on average. Its shares have also rallied around 37% over a year.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Click to get this free report

Dow Inc. (DOW): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

Univar Solutions Inc. (UNVR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com