Cigna Corp. CI will be divesting its life, accident and supplemental benefits businesses to insurer Chubb Limited (CB).

Per the deal, the company’s life, accident and supplemental benefits businesses in seven countries will be sold for $5.75 billion dollars. The transaction is expected to be completed in 2022.

This move is in sync with Cigna’s efforts to focus more on its global health services portfolio.

The deal will sell off Cigna’s life, accident and supplemental benefits businesses in Hong Kong, Indonesia, Korea, New Zealand, Taiwan and Thailand as well its interest in a joint venture in Turkey.

Cigna will, however, continue to operate its robust international health businesses in the Middle East, Europe, Hong Kong, Singapore and its joint ventures in Australia, China and India.

Proceeds from the deal will be used primarily for share repurchase.

Cigna is steadily streamlining its business to focus on core growth areas. To this end, it divested its non-health insurance unit Group Life and Disability insurance business to New York Life, America’s largest mutual life insurer. Funds from this sale were used in paying off debt and share buybacks.

Time and again, Cigna has pursued acquisitions or partnered with healthcare systems for bolstering its partner networks and strengthening its U.S. presence. These initiatives provided a boost to the medical membership of the company. This year, the company’s medical customer growth is anticipated to be a minimum of 350,000 customers.

The healthcare provider has a strong cash balance and solid cash-generation abilities in place. These tailwinds enabled it to undertake several growth-related efforts and tactically deploy capital through share buybacks and dividend payments. Cigna has been a regular dividend paying company for a while now. Its dividend yield of 2% is higher than the industry’s figure of 1.2%. The company’s leverage ratio of 40.5% at the second-quarter end was almost in line with the company’s long-term debt-to-capitalization target of around 40%.

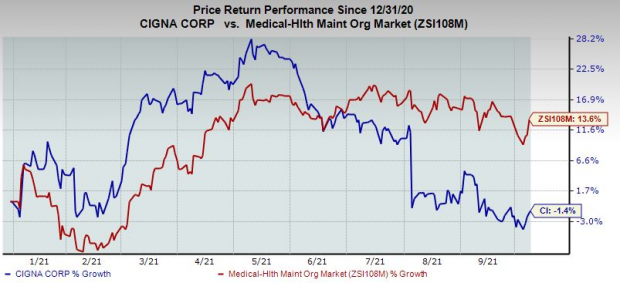

Cigna carries a Zacks Rank #3 (Hold), currently. Year to date, the stock has slipped 1.4% against its industry’s rise of 13.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Some better-ranked stocks in the medical space are UnitedHealth Group Inc. UNH, HCA Healthcare, Inc. HCA and Tenet Healthcare Corporation THC, each presently carrying a Zacks Rank #2 (Buy).

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Click to get this free report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Cigna Corporation (CI): Free Stock Analysis Report

Tenet Healthcare Corporation (THC): Free Stock Analysis Report

HCA Healthcare, Inc. (HCA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com