Citizens Financial Group CFG recently launched numerous initiatives to make banking articulate, carefree and accessible, in a bid to aid customers to better steer their financial lives. New ways for customers to avoid overdraft fees and a promise to help undeserved communities’ easy entry to banking services were also included in the new initiatives announced.

The bank has inaugurated a new deposit feature, Citizens Peace Of Mind, which provides customers the facility to avoid costs of unanticipated overdraft fees. This feature was added to all Citizens’ checking accounts on Oct 1. The consumers, who unexpectedly overdraw their accounts, are allowed to deposit or transfer sufficient money to bring their accounts back to a positive available balance before the close of business the next day. This will automatically waive off any overdraft fees charged.

Citizens Peace Of Mind complements the $5 Overdraft Pass, an overdraft protection feature through which consumers are not charged if they overdraw their account with a $5 transaction or less. The bank has been offering this feature for several years on all its checking and money market accounts.

The new feature also brings forth new avant-garde technological competencies that oversee and alert customers about overdraft withdrawals, keeping them informed about their finances, thereby easing decision making.

Brendan Coughlin, head of Consumer Banking at Citizens, said, “Life can be hectic, and we believe a bank should operate as a transparent and trusted financial partner, helping customers keep more of their hard-earned money in their pockets.”

Over the past few months, Citizens has also rolled out a student checking account with no zero overdraft fees, and an automatic, yearly overdraft rebate on selective products.

Apart from this, continuing with its commitment to help underbanked communities, Citizens also announced that it will unveil a new checking account with zero overdraft fees and features in the first quarter of 2022 that will meet the Bank On National Account standards. These standards are established to assure that everyone has admittance to a clear-cut, smooth, and cost-effective transactional account.

Citizens consorts with 100 banks and credit unions across the United States in delivering to the standards, which are addressed at bolstering the underbanked with access to the banking system in a safe and efficient manner.

Coughlin further said, “Through financial literacy and empowerment, the banking community has a responsibility to help all Americans reach economic security. The CFE Fund’s national Bank On platform supports local coalition and financial institution efforts to connect consumers to safe, affordable bank accounts.”

Rolling out the Citizens Peace Of Mind service is a commendable move by the bank to retain its consumers as well as to bring in new ones. The new checking account to be rolled out next year, meeting the specific affordability criteria for low-income people is also a laudable move. Its strategy to expand its presence by investing in technology will bear fruit over the long term.

However, waiving off overdraft fess is expected to result in lower fee income, thereby straining top-line growth.

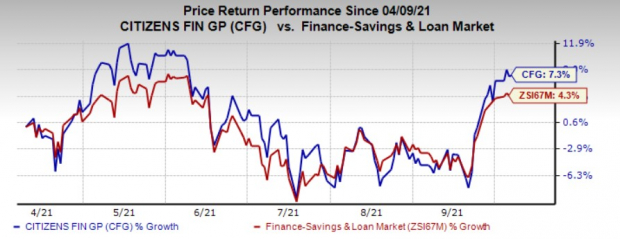

Citizens’ shares have gained around 7.3% in the past six months, outperforming the industry’s growth of 4.3%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

Following the U.S. Senate hearings in May 2021 into how banks charge overdraft fees and criticized the practice during the pandemic, banks have started removing the fees and rolled out alternatives at lower costs.

Earlier this month, Regions Financial Corporation’s RF subsidiary, Regions Bank, announced a new checking account with no overdraft fees, Regions Now Checking account. The account will include the convenience of modern banking, while eliminating the overdraft fees.

In June, Ally Bank, an indirect, wholly-owned banking subsidiary of Ally Financial Inc. ALLY, announced eliminating overdraft fees on all accounts, with no requirements or restrictions.

During the same month, Toronto Dominion Bank’s TD subsidiary, TD Bank, revealed its plans to introduce TD Essential Banking, offering a low-cost, no-overdraft-fee deposit account.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Click to get this free report

Regions Financial Corporation (RF): Free Stock Analysis Report

Toronto Dominion Bank The (TD): Free Stock Analysis Report

Ally Financial Inc. (ALLY): Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com