Shares of Danaher Company DHR have gained impressively prior to now three months. Sound monetary efficiency together with strong fundamentals and earnings progress prospects helps the inventory’s attractiveness. It presently carries a Zacks Rank #2 (Purchase).

The corporate engages in manufacturing varied merchandise to be used in industrial, skilled, industrial and shopper markets. It belongs to the Zacks Diversified Operations business. The business is within the prime 23% (with a rank of 58) of greater than 250 Zacks industries. It’s based mostly in Washington, DC, and has a market capitalization of $228.9 billion.

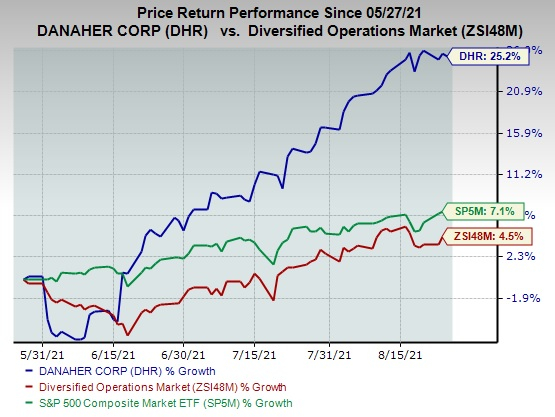

Prior to now three months, the corporate’s shares have gained 25.2% in contrast with the business’s progress of 4.5%. Notably, the S&P 500 has gained 7.1% throughout the identical interval.

Picture Supply: Zacks Funding Analysis

Components Influencing the Inventory

Prior to now three months, Danaher delivered monetary outcomes for the second quarter of 2021. Its earnings beat within the quarter was 20.6%, whereas gross sales shock was 7.8%. Pushed by year-over-year gross sales progress of 36.5% and margin enchancment, the corporate’s earnings within the second quarter expanded 70.8%.

Beside sound monetary efficiency, Danaher’s give attention to product high quality and innovation, strengthening market demand, and its environment friendly workforce are another tailwinds. The pandemic-led companies are anticipated to extend core gross sales by 10% in 2021 (with a high-single-digit enhance anticipated for the third quarter).

Core revenues are predicted to develop within the mid to high-teens vary for the third quarter and high-teens for 2021. Notably, COVID and non-COVID-related demand for bioprocessing merchandise, molecular testing, consumables and gear are prone to be wholesome within the 12 months. Additionally, the corporate’s sound shareholder-friendly insurance policies elevate its enchantment.

Concerning the corporate’s inorganic actions, Danaher agreed to amass Fargo, ND-based Aldevron for $9.6 billion in June. Upon completion, the buyout is anticipated to strengthen Danaher’s enterprise within the genomic medication subject.

The Zacks Consensus Estimate for the corporate’s earnings per share is pegged at $9.40 for 2021 and $9.60 for 2022, marking will increase of 5.5% and 6.7% from the respective 90-day-ago figures. The consensus estimate for third-quarter earnings improved from $2.03 per share to $2.13. Notably, there have been 5 upward revisions for the third quarter prior to now 90 days, whereas seven and eight optimistic revisions had been recorded for 2021 and 2022, respectively.

Danaher Company Value and Consensus

Danaher Company price-consensus-chart | Danaher Company Quote

Such upward revisions in earnings estimates are reflective of wholesome working situations for the corporate.

Danaher’s Efficiency Versus Trade Gamers

Danaher’s efficiency prior to now three months has been higher than Carlisle Firms Integrated CSL, Crane Co. CR and 3M Firm MMM. The businesses belong to the identical business as Danaher. Prior to now three months, Carlisle’s shares have gained 9.4% and Crane expanded 5.2%, whereas 3M declined 4.4%.

Notably, Carlisle and Crane presently carry a Zacks Rank #2, whereas 3M has a Zacks Rank #3 (Maintain). You possibly can see the entire checklist of right now’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Zacks Names “Single Finest Choose to Double”

From 1000’s of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have essentially the most explosive upside of all.

You already know this firm from its previous glory days, however few would count on that it is poised for a monster turnaround. Contemporary from a profitable repositioning and flush with A-list celeb endorsements, it might rival or surpass different latest Zacks’ Shares Set to Double like Boston Beer Firm which shot up +143.0% in a bit greater than 9 months and Nvidia which boomed +175.9% in a single 12 months.

Free: See Our High Inventory and Four Runners Up >>

Click on to get this free report

3M Firm (MMM): Free Inventory Evaluation Report

Danaher Company (DHR): Free Inventory Evaluation Report

Carlisle Firms Integrated (CSL): Free Inventory Evaluation Report

Crane Co. (CR): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com