Dow Inc. DOW has introduced a s

Dow Inc. DOW has introduced a sequence of incremental, high-return capability expansions to cater to the rising demand throughout key finish markets. The entire expansions assist sustainable options and proceed to develop sooner than GDP.

In its Shopper Options enterprise, a number of key development initiatives are deliberate to come back on-line globally all through 2021 and are anticipated to extend the capability of a wide range of supplies. These embrace Silicone elastomers, polymers, sealants, pressure-sensitive adhesives and thermally conductive supplies in addition to CatHEC (cationic hydroxyethylcellulose) polymers and PEGs (polyethylene glycols). These may have a variety of utilization in decreasing carbon footprint.

These initiatives journey on the again of the corporate’s prior investments in its Shopper Options enterprise, consisting of greater than 20 key debottleneck, effectivity enchancment and development capital initiatives throughout 2019 and 2020.

As a part of its capital expenditure targets, the corporate has chalked out quite a lot of investments. To extend manufacturing in its Polyurethanes & Development Chemical compounds unit, it plans to lift the propylene glycol (PG) capability on the present facility in Map Ta Phut, Thailand, by 80,000 tons per yr, taking over the full capability to 250,000 tons per yr. The ability, which is predicted to come back on-line in 2024, would be the largest of its sort within the Asia Pacific. It additionally has plans to construct an built-in MDI distillation and pre-polymers facility in Freeport, TX, with a view to assist the rising demand for downstream polyurethane methods merchandise. The challenge is predicted to additional strengthen Dow’s main positions in development, shopper and industrial markets.

Dow famous that it’s eager on driving innovation and development, and thereby devoted to investing in differentiated silicone and specialty materials property. The elevated PG capability optimizes its present framework and allows sustained development in high-value purposes, permitting it to raised serve its clients in fast-growing markets.

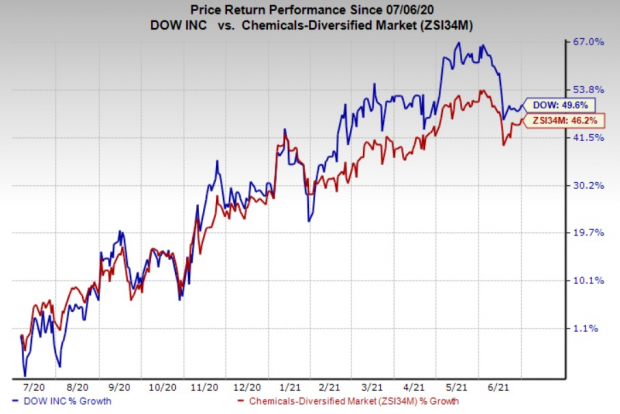

Shares of Dow have surged 49.6% in a yr, outperforming the business’s development of 46.2%. The corporate’s estimated earnings development charge for the present yr is pegged at 326.5%.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

The corporate, in its final earnings name, famous that it expects its companies to learn from the continued financial restoration, supported by the progress in vaccine distribution and tight market fundamentals. It’s nicely positioned for sustained worth creation all through this yr and past, on the again of its geographic scale, advantageous price positions, differentiated feedstock flexibility, management place in high-growth markets and top-quartile money era.

Zacks Rank & Different Shares to Think about

At the moment, Dow carries a Zacks Rank #2 (Purchase).

Different top-ranked shares within the primary supplies area are Cabot Company CBT, Avient Company AVNT and Univar Options Inc. UNVR, every sporting a Zacks Rank #1 (Sturdy Purchase). You possibly can see the entire record of right this moment’s Zacks #1 Rank shares right here.

Cabot has a projected earnings development charge of 125.9% for the present yr. The corporate’s shares have soared round 53.4% in a yr.

Avient has a projected earnings development charge of 64.1% for the present yr. The corporate’s shares have jumped almost 81.8% in a yr.

Univar has a projected earnings development charge of 35.2% for the present yr. The corporate’s shares have gained 36.8% in a yr.

Time to Put money into Authorized Marijuana

In the event you’re on the lookout for large positive factors, there couldn’t be a greater time to get in on a younger business primed to skyrocket from $17.7 billion again in 2019 to an anticipated $73.6 billion by 2027.

After a clear sweep of 6 election referendums in 5 states, pot is now authorized in 36 states plus D.C. Federal legalization is predicted quickly and that might be a nonetheless better bonanza for buyers. Even earlier than the newest wave of legalization, Zacks Funding Analysis has really useful pot shares which have shot up as excessive as +285.9%.

You’re invited to take a look at Zacks’ Marijuana Moneymakers: An Investor’s Information. It incorporates a well timed Watch Listing of pot shares and ETFs with distinctive development potential.

Right now, Obtain Marijuana Moneymakers FREE >>

Click on to get this free report

Dow Inc. (DOW): Free Inventory Evaluation Report

Cabot Company (CBT): Free Inventory Evaluation Report

Univar Options Inc. (UNVR): Free Inventory Evaluation Report

Avient Company (AVNT): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.