Earthstone Vitality, Inc. ESTE not too long ago acquired working pursuits in oil and gas-producing Eagle Ford property from 4 totally different sellers. The inventory has jumped 8.5% because the announcement of the acquisition on Jun 14.

The bolt-on acquisition has an efficient date of Apr 1. The corporate paid a reduced worth of $48 million in money for the transaction from money out there readily available and borrowing below the revolving credit score facility. As of Mar 31, 2021, it solely had $1.Four million in money and $136.6 million of undrawn borrowing capability. Lengthy-term debt was $223.Four million.

The low-cost property are operated by the corporate itself, whereby internet manufacturing is round 1,150 barrels of oil equal per day. Of the overall manufacturing volumes, 89% is estimated to be crude oil. Manufacturing decline fee is low on the web site. Related reserves on the web site are round 3.Four million barrels of oil equal. The transfer is predicted to spice up its footprint within the Eagle Ford Shale.

This marks the third acquisition in 2021 by the corporate, submit the buyouts of Tracker, introduced in April, and Independence Sources Administration, closed in January. The most recent acquisition will doubtless enhance oil weightage in Earthstone’s portfolio. Given the truth that oil worth has surged to greater than the $70 per barrel mark, the newest acquisition can place the corporate for enormous money good points.

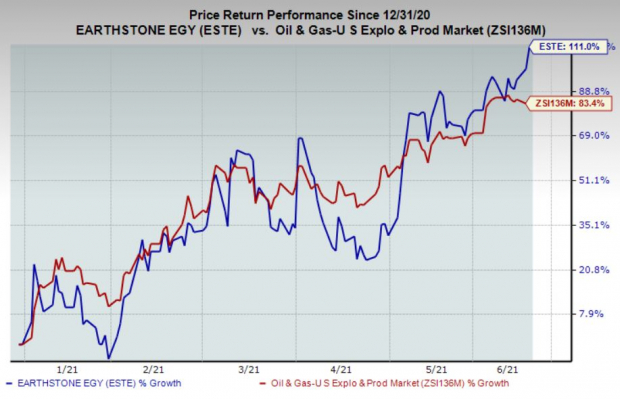

Worth Efficiency

The corporate’s shares have jumped 111% within the year-to-date interval in contrast with 83.4% rise of the trade it belongs to.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Zacks Rank & Different Shares to Think about

The corporate presently carries a Zacks Rank #2 (Purchase). Different top-ranked gamers within the power house embrace PDC Vitality, Inc. PDCE, Pembina Pipeline Company PBA and PHX Minerals Inc. PHX, every having a Zacks Rank #2 (Purchase). You’ll be able to see the entire record of right this moment’s Zacks #1 Rank (Sturdy Purchase) shares right here.

PDC Vitality’s earnings for 2021 are anticipated to leap 123.7% 12 months over 12 months.

Pembina Pipeline’s backside line for 2021 is predicted to rise 37.4% 12 months over 12 months.

PHX Minerals’ backside line for 2021 is predicted to surge 140% 12 months over 12 months.

Zacks’ Prime Picks to Money in on Synthetic Intelligence

In 2021, this world-changing expertise is projected to generate $327.5 billion in income. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ pressing particular report reveals Three AI picks traders must learn about right this moment.

See Three Synthetic Intelligence Shares With Excessive Upside Potential>>

Click on to get this free report

PDC Vitality, Inc. (PDCE): Free Inventory Evaluation Report

Pembina Pipeline Corp. (PBA): Free Inventory Evaluation Report

Earthstone Vitality, Inc. (ESTE): Free Inventory Evaluation Report

PHX Minerals Inc. (PHX): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.