Exxon Mobil Company XOM by means of its subsidiary, Esso S.A.F., signed a memorandum of understanding (MoU) with a number of firms to collaborate on a decarbonization undertaking in France.

The collaboration, which includes TotalEnergies SE TTE and industrial firms, Air Liquide S.A., Borealis AG and Yara Worldwide ASA, is aimed toward decarbonizing an industrial basin in France’s Normandy area.

Per the phrases of the MoU, the businesses will discover the event of business carbon seize and storage (“CCS”) infrastructure for the decarbonization of the Normandy platform. The undertaking intends to scale back carbon dioxide (CO2) emissions from the economic basin by as much as Three million tonnes per yr by 2030.

Throughout the first part, Exxon and companions will discover the technical and financial feasibility of the undertaking. The undertaking will search funds from European, French and regional schemes, whereas maintaining its door open for collaboration with different potential industrial firms.

Since 2015, Air Liquide has been utilizing its Cryocap know-how at its Port Jerome unit in Normandy. Cryocap is a carbon seize know-how, which might seize as much as 90% of CO2 emissions. The corporate would carry its distinctive experience in CO2 seize and liquefaction applied sciences to the partnership.

The CCS initiative helps Yara’s ambition of changing into carbon impartial by 2050. It could assist decarbonize the corporate’s manufacturing websites and all of its worth chains. Furthermore, the businesses will develop ecosystems and search to attain the manufacturing of 80 hydrogen gas cell-powered vehicles for TotalEnergies’ French clients by 2023.

Exxon holds greater than 30 years of expertise in CCS know-how and its experience in CCS will assist accomplish the undertaking targets. Notably, the businesses collaborated to keep up and enhance the sustainability of business actions and ecosystems in Normandy.

Firm Profile & Value Efficiency

Headquartered in Irving, TX, Exxon is likely one of the main built-in power firms on the earth.

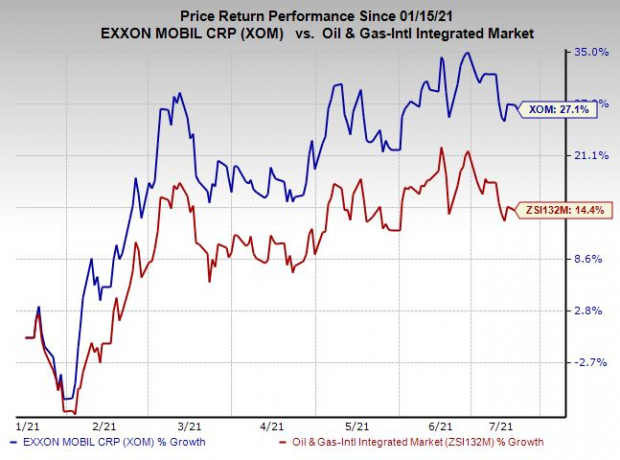

Shares of the corporate have outperformed the business previously six months. Its inventory has gained 27.1% in contrast with the business’s 14.4% progress.

Picture Supply: Zacks Funding Analysis

Zacks Rank & Shares to Contemplate

Exxon at present carries a Zack Rank #3 (Maintain).

Some better-ranked gamers within the power area are Equinor ASA EQNR and Matador Sources Firm MTDR, every at present flaunting a Zacks Rank #1 (Sturdy Purchase). You’ll be able to see the whole checklist of right this moment’s Zacks #1 Rank shares right here.

Over the previous 60 days, the Zacks Consensus Estimate for Equinor’s 2021 earnings has been raised by 10.8%.

Matador’s earnings for 2021 are anticipated to extend 26.5% yr over yr.

Infrastructure Inventory Growth to Sweep America

A large push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions shall be spent. Fortunes shall be made.

The one query is “Will you get into the best shares early when their progress potential is biggest?”

Zacks has launched a Particular Report that can assist you just do that, and right this moment it’s free. Uncover 7 particular firms that look to achieve probably the most from building and restore to roads, bridges, and buildings, plus cargo hauling and power transformation on an nearly unimaginable scale.

Obtain FREE: Tips on how to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

Exxon Mobil Company (XOM): Free Inventory Evaluation Report

Matador Sources Firm (MTDR): Free Inventory Evaluation Report

Equinor ASA (EQNR): Free Inventory Evaluation Report

TotalEnergies SE Sponsored ADR (TTE): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.