G-III Attire Group, Ltd. GIII s

G-III Attire Group, Ltd. GIII seems robust on the again of its strong enterprise methods together with digital growth and model energy. Markedly, the corporate is steadily witnessing strong outcomes on the web sites of DKNY and Karl Lagerfeld Paris. Administration additionally stays optimistic about its portfolio of manufacturers together with the 5 highly effective names, DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger and Karl Lagerfeld. As well as, the corporate accomplished streamlining its retail division and the brand new retail mannequin is poised to attain profitability

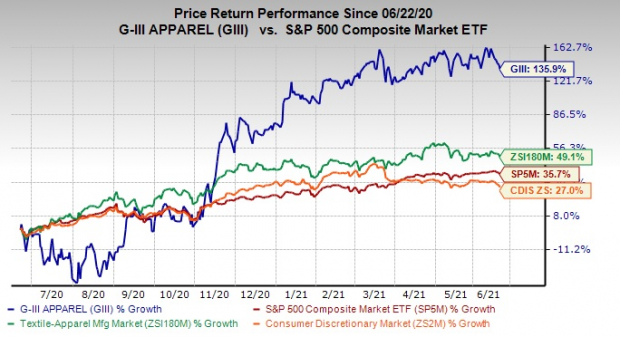

Encouragingly, this presently Zacks Rank #2 (Purchase) inventory is seeing energy, having surged 135.9% and in addition surpassed its business’s rally of 49.1% in a yr’s time. Additionally, the New York-based firm has outpaced the broader Client Discretionary sector’s 27% rise and the S&P 500 Index’s 35.7% progress in the identical time-frame. This outperformance can be led by sturdy first-quarter fiscal 2022 outcomes adopted by an upbeat outlook.

Furthermore, analysts are optimistic about this inventory as it’s seeing greater earnings estimate revisions. The Zacks Consensus Estimate for fiscal 2022 earnings stands at $2.70 and the identical for fiscal 2023 is pegged at $3.06, indicating progress of 15.4% and 9.3%, respectively, over the previous 30 days. Additionally, the consensus mark for second-quarter fiscal 2022 earnings of 11 cents has elevated about 83% in the identical time interval.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Let’s Discover Out Extra

We observe that G-III Attire is concentrated on rising its digital enterprise with growth within the distribution channel. In the course of the first quarter of fiscal 2022, gross sales of the product via e-commerce have been praiseworthy. Furthermore, the corporate’s personal websites for DKNY and Karl Lagerfeld Paris mixed comparable gross sales rose practically 40% yr over yr. Its enterprise in China noticed one other quarter of serious progress with momentum in e-commerce. Therefore, administration is on observe to drive progress throughout the digital panorama through investments in inner expertise, e-commerce websites, improved logistics capabilities and loyalty program.

As well as, G-III Attire undertakes a number of methods together with acquisitions and licensing of well-known manufacturers to develop its product portfolio and gasoline progress. Additionally, its Worldwide enterprise stays a key driver for the corporate. Aside from these, GIII-Attire is pursuing model enhancement throughout channels with new launches, improved advertising methods and a broader shopper attain.

Now talking of name energy, the corporate’s strong manufacturers together with DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger and Karl Lagerfeld have an annual web wholesale gross sales potential of $Four billion. Furthermore, G-III Attire sees alternatives to develop athleisure for manufacturers together with Calvin Klein, Tommy Hilfiger, DKNY and Karl Lagerfeld Paris. The corporate’s informal choices are additionally constantly driving its sportswear class. Additionally, the footwear and purse companies continued to stay robust. It had additionally launched the Karl Lagerfeld Paris ladies’s model throughout 75 new doorways at Macy’s M.

Quarterly Efficiency & Outlook

In the course of the first quarter of fiscal 2022, each the corporate’s prime and the underside line beat the Zacks Consensus Estimate and in addition improved yr over yr. Administration said that gross sales for the broader way of life attire together with sportswear, wear-to-work apparel and clothes have been spectacular for some time now. Moreover, the corporate’s general enterprise in North America is appreciative.

For second-quarter fiscal 2022, G-III Attire forecasts web gross sales of about $460 million, indicating progress from $297 million delivered in the identical quarter a yr in the past. Additional, earnings per share are more likely to come within the bracket of 3-13 cents versus a web lack of 31 cents seen within the year-earlier quarter. Moreover, the corporate envisions earnings within the vary of $2.60-$2.70 per share for fiscal 2022, implying important progress from 48 cents delivered final fiscal. Additional, the China enterprise is anticipated to be up 50% for a similar fiscal yr.

Wrapping up, G-III Attire is more likely to proceed its momentum, given the aforementioned methods and sound fundamentals. Nicely, a Momentum Rating of A with anticipated long-term earnings progress of 11.6% additional speaks volumes for the corporate.

Don’t Miss These Stable Bets Too

Crocs CROX has a long-term earnings progress fee of 15% and a Zacks Rank #1 (Robust Purchase), presently. You’ll be able to see the entire record of right this moment’s Zacks #1 Rank shares right here.

Gildan Activewear GIL, presently a Zacks #1 Ranked inventory, has a long-term earnings progress fee of 28.6%.

Infrastructure Inventory Growth to Sweep America

A large push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions might be spent. Fortunes might be made.

The one query is “Will you get into the fitting shares early when their progress potential is biggest?”

Zacks has launched a Particular Report that can assist you just do that, and right this moment it’s free. Uncover 7 particular firms that look to achieve probably the most from building and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an virtually unimaginable scale.

Obtain FREE: Learn how to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

Macys, Inc. (M): Free Inventory Evaluation Report

Crocs, Inc. (CROX): Free Inventory Evaluation Report

GIII Attire Group, LTD. (GIII): Free Inventory Evaluation Report

Gildan Activewear, Inc. (GIL): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.