Generac Holdings Inc. GNRC has closed the acquisition of ecobee Inc.

Founded in 2007 and headquartered in Toronto, Canada, ecobee is a leader in sustainable smart home solutions.

On Nov 1, 2021, Generac announced that it inked an agreement to acquire ecobee. The transaction was valued at up to $770 million, depending on the achievement of certain performance targets.

ecobee offers several ENERGY STAR-certified thermostats and a suite of home monitoring products. Its smart thermostats optimize heating and cooling systems to deliver significant energy savings for homeowners.

With 2 million connected homes, ecobee’s customers in North America have saved more than 20 terawatt-hour of energy. ecobee’s solutions are an important addition to Generac’s residential energy technology portfolio.

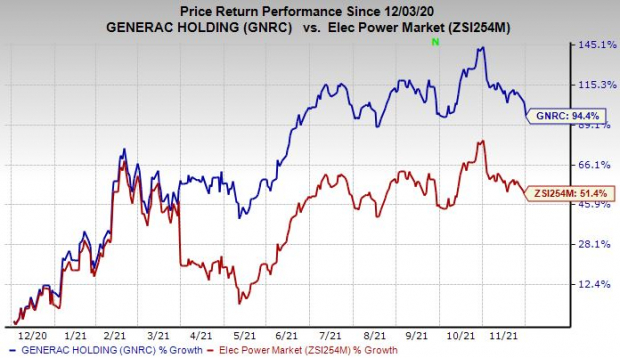

Generac continues to evolve into an energy technology solutions company. The stock has gained 94.4% in the past year compared with the industry’s growth of 51.4%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The combination of ecobee’s innovative technologies with Generac’s power generation, energy storage and energy management devices will allow the latter to create an efficient home energy ecosystem.

This, in turn, will help homeowners save money on their energy costs and allow grid operators to better balance supply and demand in more cost-effective ways.

At closing, Generac has paid $200 million in cash and $450 million in its stock to ecobee’s shareholders. Upon achieving certain performance targets between closing and Jun 30, 2023, ecobee may get up to $120 million in additional Generac stock.

Generac has created a new group, Generac Grid Services, to provide solutions directly to utilities, grid operators and energy markets. Climate change and an aging electrical grid with power outages are spurring growth opportunities for the company.

GNRC currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearfield, Inc. CLFD is a better-ranked stock in the broader Zacks Computer and Technology sector, carrying a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for its current-year earnings has been revised 8.8% upward over the past 30 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.8%, on average. It has soared 163% in the past year.

Qualcomm, Inc. QCOM, carrying a Zacks Rank #2, is another solid pick for investors. The consensus estimate for current-year earnings has been revised upward by 14.1% over the past 30 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 11.2%, on average. It has appreciated 17.1% in the past year.

Sierra Wireless, Inc. SWIR carries a Zacks Rank #2. The consensus mark for current-year earnings has been revised upward by 20.5% over the past 30 days.

Sierra has a trailing four-quarter earnings surprise of 34.2%, on average. The stock has returned 8.8% in the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Sierra Wireless, Inc. (SWIR): Free Stock Analysis Report

Generac Holdings Inc. (GNRC): Free Stock Analysis Report

Clearfield, Inc. (CLFD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com