Gilead Sciences, Inc. GILD introduced that the FDA has accredited a label growth of its hepatitis C virus (HCV) drug, Epclusa.

The drug has now been accredited for treating kids as younger as Three years of age, no matter HCV genotype or liver illness severity. The FDA accredited a New Drug Software (NDA) for 2 strengths of an oral pellet formulation of Epclusa (sofosbuvir 200 mg/velpatasvir 50 mg and sofosbuvir 150 mg/velpatasvir 37.5 mg) developed to be used by youthful kids who can not swallow tablets. The really helpful dosage of Epclusa in kids aged Three years and older is predicated on weight.

The brand new oral pellet formulation permits therapy in early childhood with pangenotypic, panfibrotic routine.

The approval was based mostly on knowledge from a part II, open-label medical research that enrolled 41 kids, aged Three years to lower than 6 years, to be handled with Epclusa for 12 weeks. At 12 weeks after therapy completion, Epclusa achieved a sustained virologic response (SVR12) or remedy fee of 83% (34/41) amongst all sufferers, 88% (28/32) in kids with HCV genotype 1, 50% (3/6) in kids with HCV genotype 2, and 100% in kids with HCV genotype 3 (2/2) and HCV genotype 4 (1/1) every. Of the seven sufferers who didn’t obtain a remedy, all discontinued therapy inside one to 20 days of beginning therapy.

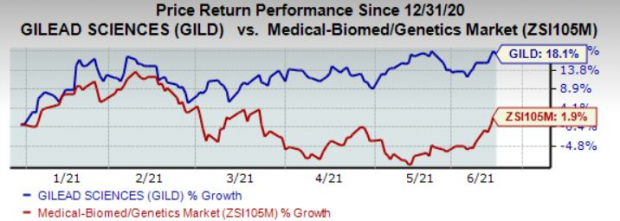

Gilead’s inventory has gained 18.1% this 12 months in contrast with the business’s achieve of 1.9%.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

The corporate’s first-quarter outcomes had been disappointing because the HIV enterprise was adversely impacted by the continuing pandemic. Competitors is stiff as properly from the likes of GlaxoSmithKline GSK.

The COVID-19 pandemic is anticipated to adversely influence HCV therapy initiations and HIV new begins and switches. Gilead expects a extra gradual restoration in COVID-related dynamics, beginning the second quarter of 2021.

The corporate is trying to diversify its income base because the virology enterprise faces challenges. Gilead lately expanded its collaboration with Novo Nordisk NVO in non-alcoholic steatohepatitis (“NASH”) with plans to launch a brand new part IIb research for a triple mixture routine in NASH sufferers with cirrhosis.

Gilead at present carries a Zacks Rank #3 (Maintain). A greater-ranked inventory within the well being care sector consists of Repligen Corp. RGEN, which carries a Zacks Rank #2 (Purchase). You’ll be able to see the entire record of as we speak’s Zacks #1 Rank (Robust Purchase) shares right here.

Repligen’s earnings estimates for 2021 have elevated to $2.21 from $1.91 prior to now 90 days.

+1,500% Progress: One among 2021’s Most Thrilling Funding Alternatives

Along with the shares you examine above, would you wish to see Zacks’ prime picks to capitalize on the Web of Issues (IoT)? It is likely one of the fastest-growing applied sciences in historical past, with an estimated 77 billion gadgets to be linked by 2025. That works out to 127 new gadgets per second.

Zacks has launched a particular report that can assist you capitalize on the Web of Issues’s exponential progress. It reveals Four under-the-radar shares that could possibly be a few of the most worthwhile holdings in your portfolio in 2021 and past.

Click on right here to obtain this report FREE >>

Click on to get this free report

GlaxoSmithKline plc (GSK): Free Inventory Evaluation Report

Novo Nordisk AS (NVO): Free Inventory Evaluation Report

Gilead Sciences, Inc. (GILD): Free Inventory Evaluation Report

Repligen Company (RGEN): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.