The decision of the multibillion-dollar 1Malaysia Improvement Bhd (1MDB) scandal, by which Goldman Sachs GS is engulfed, appears removed from over. The U.S. District Choose, Vernon Broderick, lately declined requests from the corporate, its former CEO, Lloyd Blankfein, and former chief working officer, Gary Cohn, to dismiss the lawsuit filed by its shareholders. Nonetheless, the financial institution’s former co-CEO, Harvey Schwartz, has been dropped from the case. The information was reported by Reuters.

Shareholders, being led by the Swedish pension fund, Sjunde AP-Fonden, had sued Goldman in late 2018, alleging it of conning them in regards to the agency’s work with the sovereign wealth fund, arranging three bond choices elevating $6.5 billion and garnering charges estimated at $600 million. Goldman has rebuffed any accountability within the scandal and put the blame on a former associate, Tim Leissner, who had pleaded responsible and collaborated with the federal government.

Authorities have claimed that the sovereign wealth fund’s officers and allies plundered the bond proceeds for extravagance and to finance Hollywood movies, whereas Goldman’s bankers greased palms of Malaysian and Abu Dhabi officers to acquire the 1MDB enterprise.

The choose remarked that the shareholders had appropriately asserted that quite a few statements made bythe financial institution and its prime executives on the 1MDB case have been misleading and unambiguous. Among the many examples specified have been Blankfein’s remark in a 2018 interview that he was “not conscious” of any crimson flags, in addition to the chairing of a committee by Cohn, approving Goldman’s 1MDB offers.

Broderick remarked, “Taking these allegations as true, I discover it unlikely that Blankfein wouldn’t have been conscious of any warning indicators about 1MDB previous to the scandal breaking.”

Goldman had argued that the shareholders had not portrayed that the misstatements have been essential to traders, have been faux or uncared for data, or that the financial institution deliberate to delude shareholders or induced their losses.

Albeit the choose mentioned that Goldman’s assertion of being “devoted to complying absolutely with the letter and spirit of the regulation, guidelines and moral ideas that govern us” would ordinarily be “puffery”, thereby exempting its claims from being deceptive, he furthered by saying that different courts have discovered such statements to be topic to authorized motion when “paired with illegal habits or different actionable statements.”

Final yr, the financial institution entered into the long-awaited settlement with the Malaysian Authorities. The phrases included cost of $2.5 billion as penalties. Additionally, Goldman had assured that the authorities would obtain $1.four billion from the proceeds of belongings, which have been seized globally as these have been associated to the 1MDB scandal.

Earlier in Could, 1MDB and SRC Worldwide Sdn Bhd filed lawsuits towards JPMorgan JPM and Deutsche Financial institution DB to recoup belongings price greater than $23 billion.

Backside Line

Though Goldman has resolved fairly just a few litigation points, it nonetheless faces probes and queries from numerous federal companies, and some overseas governments for companies carried out through the pre-crisis interval. Because of this, the corporate’s authorized bills are anticipated to stay elevated, which could partially impede its bottom-line development within the close to time period.

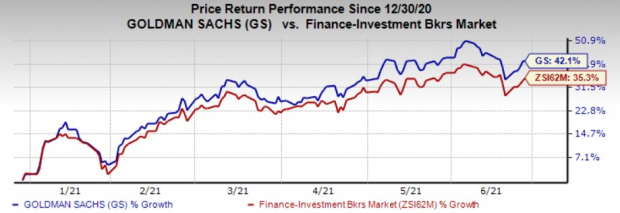

Shares of this Zacks Rank #3 (Maintain) inventory have gained 42.1% previously six months, outperforming the 35.3% rally of the business.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

A inventory price contemplating within the finance area is Gladstone Funding Company GAIN. Its current-year earnings estimate moved north in 60 days’ time. Additional, the corporate’s shares have surged 44.1% over the previous six months. At current, it holds a Zacks Rank of two (Purchase). You’ll be able to see the whole record of at the moment’s Zacks #1 Rank (Robust Purchase) shares right here.

+1,500% Progress: One in every of 2021’s Most Thrilling Funding Alternatives

Along with the shares you examine above, would you prefer to see Zacks’ prime picks to capitalize on the Web of Issues (IoT)? It is among the fastest-growing applied sciences in historical past, with an estimated 77 billion gadgets to be related by 2025. That works out to 127 new gadgets per second.

Zacks has launched a particular report that can assist you capitalize on the Web of Issues’s exponential development. It reveals four under-the-radar shares that may very well be a few of the most worthwhile holdings in your portfolio in 2021 and past.

Click on right here to obtain this report FREE >>

Click on to get this free report

The Goldman Sachs Group, Inc. (GS): Free Inventory Evaluation Report

JPMorgan Chase & Co. (JPM): Free Inventory Evaluation Report

Deutsche Financial institution Aktiengesellschaft (DB): Free Inventory Evaluation Report

Gladstone Funding Company (GAIN): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.