SL Green SLG is poised to bank on the improving office real-estate market in the New York City, backed by its high-quality office properties at key locations. Nonetheless, the rising supply of office properties and remote working environment are concerns for SLG’s office assets.

SL Green has a mono-market strategy with an enviable footprint in the large and high-barrier-to-entry New York real estate market. This, along with ownership of premier Manhattan office assets, has enabled the company to enjoy a decent occupancy at its portfolio over the years. Also, its near-term leasing pipeline is robust with more than450,000 square feet leased in the third quarter. SLG remains on track to meet or exceed its leasing goal of 1.5 million square feet for 2021.

Recently, SL Green signed a 191,207-square-foot expansion lease with Bloomberg at 919 Third Avenue. In addition, SLG signed a new 19,522-square-foot lease with Flexpoint Ford and a 6,554-square-foot expansion lease with Stone Point Capital LLC at One Vanderbilt Avenue. With these, One Vanderbilt is now 92.7% leased.

SL Green also enjoys a robust balance-sheet position and has ample financial flexibility. SLG made efforts to bolster liquidity on the back of financing, refinancing, sale of real-estate assets and joint venture stakes as well as the repayment of existing positions in the debt and preferred equity portfolio. In December, SL Green announced refinancing its corporate credit facility. With this, SLG extended the maturity date as well as reduced the borrowing cost and the overall size of its unsecured corporate credit facility.

Moreover, SL Green has been following an opportunistic investment policy to enhance its overall portfolio quality. It continues selling non-core assets and redeploy the proceeds to the development pipeline, share buybacks and debt repayment. In line with this, in December, the REIT announced the sale of its ownership interest in 707 Eleventh Avenue to a domestic buyer for a gross sale price of $95 million. It plans to use the proceeds from the sale to repay corporate debt.

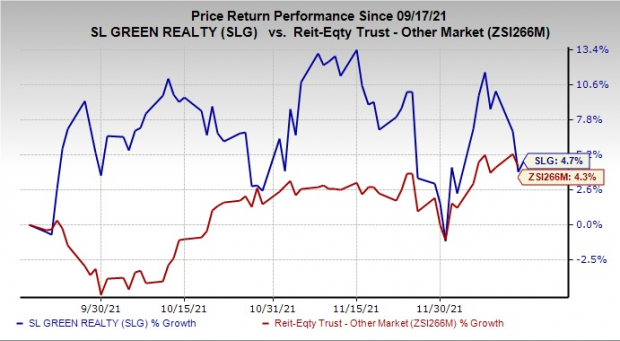

Shares of this presently Zacks Rank #3 (Hold) player have appreciated 4.7% in the past three months, outperforming the industry’s growth of 4.3%. Further, the recent trends in estimate revisions for 2021 funds from operations (FFO) per share indicate a favorable outlook for the company, with estimates having moved marginally upward in the past week.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

However, though dispositions are a strategic fit for the long term, dilution in earnings is a concern for the near term.

Rising supply of office properties in SL Green’s markets also remains a concern for SL Green. SLG faces intense competition from developers, owners and operators of office properties and other commercial real estate, including sublease space available from its tenants. This restricts its ability to attract and retain tenants at relatively higher rents than its competitors.

Stocks to Consider

Some better-ranked stocks from the REIT sector are OUTFRONT Media OUT, Cedar Realty Trust CDR and CubeSmart CUBE.

The Zacks Consensus Estimate for OUTFRONT Media’s 2021 FFO per share has been raised 13.8% over the past two months. OUT’s 2021 FFO per share is expected to increase 45.71% from the year-ago quarter’s reported figure. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

OUTFRONT Media flaunts a Zacks Rank 1 (Strong Buy) at present. Shares of OUT have rallied 3.5% in the past three months.

The Zacks Consensus Estimate for Cedar Realty’s current-year FFO per share has been raised marginally to $2.38 in the past week. Over the last four quarters, CDR’s FFO per share surpassed the consensus mark twice and missed the same in the other two, the average surprise being 6.4%.

Currently, CDR sports a Zacks Rank of 1. Shares of Cedar Realty have appreciated 51.7% in the past six months.

CubeSmart carries a Zacks Rank #2 (Buy) at present. Over the last four quarters, CUBE’s FFO per share surpassed the consensus mark on all occasions, the average being 7.10%.

The Zacks Consensus Estimate for CubeSmart’s 2021 FFO per share has been revised 2.4% upward in the past month to $2.10. Shares of CUBE have appreciated 17.9% in the past six months.

Note: Anything related to earnings presented in this write-up represent FFO — a widely used metric to gauge the performance of REITs.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Click to get this free report

SL Green Realty Corporation (SLG): Free Stock Analysis Report

CubeSmart (CUBE): Free Stock Analysis Report

Cedar Realty Trust, Inc. (CDR): Free Stock Analysis Report

OUTFRONT Media Inc. (OUT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com