Landstar System LSTR is benefiting from strong freight demand and high trucking rates. The company’s top line surged 59.8% year over year in the third quarter of 2021 owing to strong performances of the truck transportation, rail intermodal, and ocean and air-cargo carriers segments. The bottom line surged 60.3% year over year in the same period.

Landstar’s primary revenue generating segment, the truck transportation unit, is being aided by strong demand in the van truckload business. Segmental revenues increased 61.4% year over year in the first nine months of 2021.

Landstar’s commitment to reward its shareholders through dividends and share buybacks is encouraging. In July, the company increased its quarterly dividend by 19% to 25 cents per share (annualized $1) in July 2021. In the first nine months of 2021, LSTR rewarded its shareholders with $50 million through share repurchases and $102.5 million through dividends. Strong free cash flow-generation capacity supports the company’s shareholder-friendly activities. In 2020, LSTR generated $177.3 million of free cash flow. The same increased to $198.4 million in the first nine months of 2021.

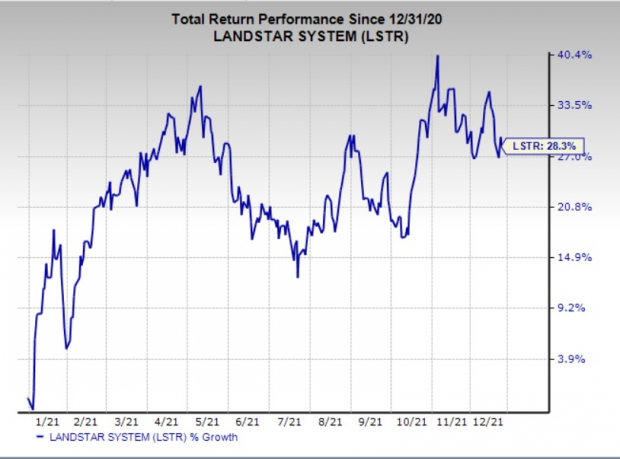

Shares of LSTR have surged 28.3% so far this year, primarily due to improved freight market conditions and the company’s efforts to reward shareholders.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The positivity surrounding the stock is evident from the Zacks Consensus Estimate for 2021 and 2022 earnings being revised upward by 3.9% and 7.2% in the past 60 days, respectively.

In light of the above-mentioned positives, we believe investors should add the Landstar stock to their portfolios, as is suggested by its Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Key Picks

Some other top-ranked stocks in the Transportation – Truck industry are as follows:

ArcBest Corporation ARCB sports a Zacks Rank #1. The company has a stellar earnings surprise history having outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 27.4%.

Shares of ArcBest have surged more than 100% so far this year.

Saia SAIA carries a Zacks Rank #1. The company’s earnings have outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 14.8%.

Shares of Saia have rallied more than 73% in the year-to-date period.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Click to get this free report

ArcBest Corporation (ARCB): Free Stock Analysis Report

Landstar System, Inc. (LSTR): Free Stock Analysis Report

Saia, Inc. (SAIA): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com