Inter Parfums, Inc. IPAR seems

Inter Parfums, Inc. IPAR seems to be on stable footing, due to its fixed deal with product launches and good points from strategic alliances. Notably, the corporate posted splendid first-quarter 2021 outcomes final month, whereby each high and backside traces surged yr over yr and the latter cruised previous the Zacks Consensus Estimate. Moreover, administration’s 2021 view suggests year-over-year earnings and gross sales progress.

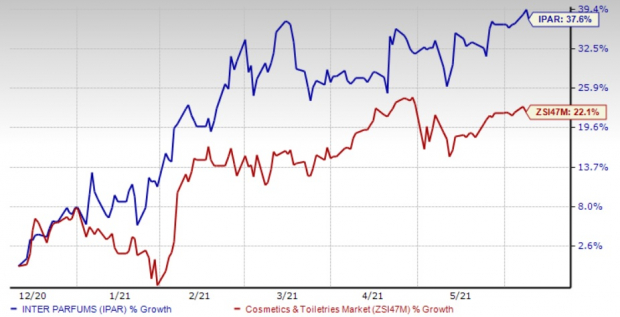

The Zacks Consensus Estimate for 2021 has climbed 1.2% to $1.72 over the previous 30 days. Additional, this Zacks Rank #1 (Sturdy Purchase) inventory has rallied 37.6% up to now six months in contrast with the business’s progress of 22.1%. Let’s delve deeper.

Inter Parfums, Inc. Worth, Consensus and EPS Shock

Inter Parfums, Inc. price-consensus-eps-surprise-chart | Inter Parfums, Inc. Quote

Strong Q1 Final result

Inter Parfums posted earnings per share of 87 cents, which simply surpassed the Zacks Consensus Estimate of 63 cents and elevated considerably from 32 cents reported within the year-ago quarter. Internet gross sales surged 37.1% to $198.5 million in contrast with $144.Eight million recorded within the year-ago interval. Nicely, Inter Parfums’ enterprise has been significantly sturdy in areas the place lockdowns have been eased, shops have reopened and actions have reverted to the previous regular, particularly in Asia and North America.

European product gross sales surged 40% to $159.7 million and U.S.-based product gross sales grew 26.2% to $38.Eight million from the year-ago interval. In European operations, Montblanc, Jimmy Choo, Coach and Lanvin manufacturers registered gross sales progress of 27.4%, 66.7%, 8.8% and 91.2%, respectively. Transferring to the U.S. operations, which additionally recorded strong progress within the quarter underneath overview, the corporate benefited from energy in GUESS, Abercrombie & Fitch, Hollister and Dunhill manufacturers. Additionally, the debut of MCM’s signature scent towards the tip of the primary quarter led to the upside. Administration anticipates 2021 web gross sales to be practically $700 million, whereas web revenue per share is predicted to be $1.65. This means progress from web gross sales and web revenue per share of $539 million and $1.21 per share reported in 2020, respectively.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Main Drivers

Inter Parfums’ deal with product launches to spice up assortment energy is spectacular. The corporate’s new product launches of Jimmy Choo’s I Need Choo, Kate Spade Signature scent and Rochas Woman delivered stable high-margin gross sales within the first quarter. The corporate continues to roll out merchandise that had been launched within the first quarter of 2021, which embrace Oscar de la Renta’s Alibi , GUESS’s Bella Vita , the debut of MCM scent and Hollister’s Canyon Escape. Product pipeline for the remaining a part of the yr contains model extensions corresponding to flankers for Montblanc Explorer, Coach Desires, Jimmy Choo City Hero, the Oscar de la Renta Bella household, the Hollister Wave assortment, and the Anna Sui Fantasia pillar. Aside from these, the corporate has completely new fragrances deliberate for the approaching quarters, together with a Lanvin girls’s line, Abercrombie & Fitch’s new duo, Dunhill’s Pushed assortment for males and GUESS’s males’s grooming assortment.

Aside from these, Inter Parfums has been gaining on its strategic partnerships with Origines-parfums and Moncler SpA. In July 2020, Inter Parfums’ majorly owned subsidiary, Interparfums SA, acquired 25% of Divabox’s capital. Notably, Divabox is the proprietor of Origines-parfums, which is a famend French firm within the on-line magnificence market. In June 2020, Interparfums SA signed an settlement with famend luxurious model, Moncler SpA. The deal gave Inter Parfums rights to fragrance-related objects in Moncler monobrand shops together with just a few different specialty retailers, malls and duty-free retailers. Actually, the primary scent from the Moncler model is predicted to launch in the beginning of first-quarter 2022. The deal, which can final until December 2026, has the potential for a five-year extension.

All mentioned, we count on Inter Parfums to proceed climbing up the expansion ladder.

Three Different Client Staple Shares

Medifast MED, which at the moment carries a Zacks Rank #1, has a trailing four-quarter earnings shock of 12.7%, on common. You possibly can see the entire listing of at this time’s Zacks #1 Rank shares right here.

Nu Pores and skin NUS has a Zacks Rank #2 (Purchase) and a trailing four-quarter earnings shock of 18.8%, on common.

Nomad Meals NOMD has a Zacks Rank #2 and its backside line outpaced the Zacks Consensus Estimate by 10.3% within the trailing 4 quarters, on common.

Bitcoin, Just like the Web Itself, May Change The whole lot

Blockchain and cryptocurrency has sparked one of the crucial thrilling dialogue matters of a era. Some name it the “Web of Cash” and predict it may change the way in which cash works endlessly. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early levels of this expertise, and because it grows, it’s going to create a number of investing alternatives.

Zacks’ has simply revealed Three corporations that may assist buyers capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them straight.

See Three crypto-related shares now >>

Click on to get this free report

Nu Pores and skin Enterprises, Inc. (NUS): Free Inventory Evaluation Report

Inter Parfums, Inc. (IPAR): Free Inventory Evaluation Report

MEDIFAST INC (MED): Free Inventory Evaluation Report

Nomad Meals Restricted (NOMD): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.