Worth investing is definitely p

Worth investing is definitely probably the most standard methods to search out nice shares in any market atmosphere. In any case, who wouldn’t need to discover shares which might be both flying underneath the radar and are compelling buys, or provide up tantalizing reductions when in comparison with honest worth?

One solution to discover these firms is by taking a look at a number of key metrics and monetary ratios, a lot of that are essential within the worth inventory choice course of. Let’s Chubb Restricted CB inventory into this equation and discover out if it’s a good selection for value-oriented traders proper now, or if traders subscribing to this system ought to look elsewhere for high picks:

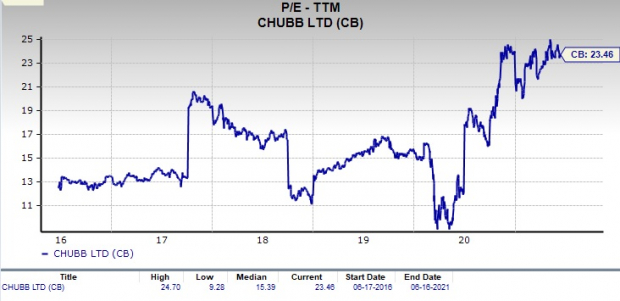

PE Ratio

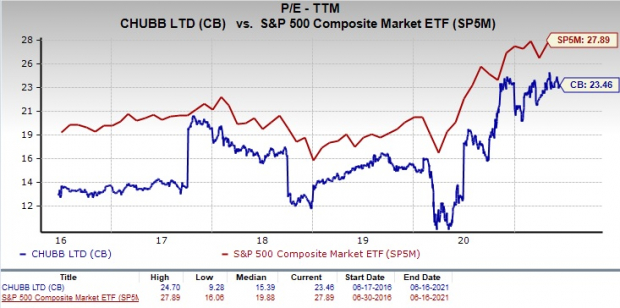

A key metric that worth traders all the time take a look at is the Worth to Earnings Ratio, or PE for brief. This reveals us how a lot traders are prepared to pay for every greenback of earnings in a given inventory, and is definitely probably the most standard monetary ratios on this planet. The very best use of the PE ratio is to check the inventory’s present PE ratio with: a) the place this ratio has been prior to now; b) the way it compares to the common for the business/sector; and c) the way it compares to the market as a complete.

On this entrance, Chubb Restricted has a trailing twelve months PE ratio of 23.46, as you may see within the chart beneath:

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

This stage truly compares favorably with the market at giant, because the PE for the S&P 500 stands at about 27.89. If we give attention to the long-term PE pattern Chubb Restricted’s present PE stage places it beneath its midpoint over the previous 5 years. Furthermore, the present stage is pretty beneath the highs for this inventory, suggesting it is likely to be entry level.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

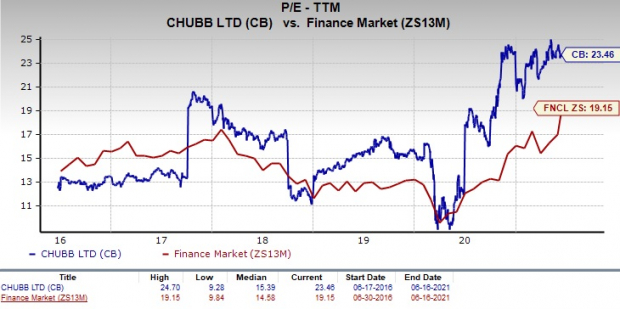

Nonetheless, the inventory’s PE additionally compares favorably with the Zacks Finance sector’s trailing twelve months PE ratio, which stands at 19.15. On the very least, this means that the inventory is barely overvalued proper now, in comparison with its friends.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

We also needs to level out that Chubb Restricted has a ahead PE ratio (value relative to this yr’s earnings) of simply 14.68, so it’s honest to say {that a} barely extra value-oriented path could also be forward for Chubb Restricted’s inventory within the close to time period too.

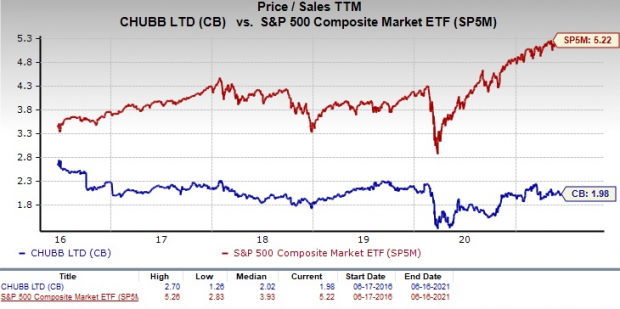

P/S Ratio

One other key metric to notice is the Worth/Gross sales ratio. This strategy compares a given inventory’s value to its complete gross sales, the place a decrease studying is usually thought-about higher. Some individuals like this metric greater than different value-focused ones as a result of it seems to be at gross sales, one thing that’s far more durable to govern with accounting methods than earnings.

Proper now, Chubb Restricted has a P/S ratio of about 1.98. That is decrease than the S&P 500 common, which is available in at 5.22 proper now. Additionally, as we are able to see within the chart beneath, that is considerably beneath the highs for this inventory particularly over the previous few years.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Broad Worth Outlook

In mixture, Chubb Restricted presently has a Worth Rating of A, placing it into the highest 20% of all shares we cowl from this look. This makes Chubb Restricted a strong alternative for worth traders, and a few of its different key metrics make this gorgeous clear too.

For instance, the PEF ratio for Chubb Restricted is available in at 1.47, which is best than the business common of two.16. Clearly, CB is a strong alternative on the worth entrance from a number of angles.

What Concerning the Inventory Total?

Although Chubb Restricted is likely to be a good selection for worth traders, there are many different elements to think about earlier than investing on this title. Specifically, it’s value noting that the corporate has a Progress Rating of C and Momentum Rating of D. This provides Chubb Restricted a Zacks VGM rating — or its overarching elementary grade — of B. (You’ll be able to learn extra concerning the Zacks Type Scores right here >>)

In the meantime, the corporate’s current earnings estimates have been blended. The present quarter estimate witnessed 4 upward revisions prior to now sixty days in comparison with none downward revision, whereas the present yr estimate witnessed three upward revisions in comparison with two downward revisions in the identical time interval.

This has had a noticeable impression on the consensus estimate, as the present quarter consensus estimate improved 4.4% prior to now two months, whereas the present yr estimate improved 2.4% prior to now two months. You’ll be able to see the consensus estimate pattern and up to date value motion for the inventory within the chart beneath:

Chubb Restricted Worth and Consensus

Chubb Restricted price-consensus-chart | Chubb Restricted Quote

Even with higher estimate developments, the inventory has a Zacks Rank #3 (Maintain), which is why we’re in search of in-line efficiency from the corporate within the close to time period.

Backside Line

Chubb Restricted is an impressed alternative for worth traders, as it’s onerous to beat its unimaginable lineup of statistics on this entrance. Nonetheless, with a Zacks Rank #3, it’s onerous to get too enthusiastic about this firm total. In reality, over the previous two years, the sector has clearly underperformed the market at giant, as you may see beneath:

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

So, worth traders would possibly need to anticipate estimates, analyst sentiment and broader elements to show round on this title first, however as soon as that occurs, this inventory could possibly be a compelling decide.

Time to Spend money on Authorized Marijuana

For those who’re in search of huge positive aspects, there couldn’t be a greater time to get in on a younger business primed to skyrocket from $17.7 billion again in 2019 to an anticipated $73.6 billion by 2027.

After a clear sweep of 6 election referendums in 5 states, pot is now authorized in 36 states plus D.C. Federal legalization is anticipated quickly and that could possibly be a nonetheless larger bonanza for traders. Even earlier than the most recent wave of legalization, Zacks Funding Analysis has really helpful pot shares which have shot up as excessive as +285.9%

You’re invited to take a look at Zacks’ Marijuana Moneymakers: An Investor’s Information. It encompasses a well timed Watch Record of pot shares and ETFs with distinctive progress potential.

Right this moment, Obtain Marijuana Moneymakers FREE >>

Click on to get this free report

Chubb Restricted (CB): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.