One distinctive facet of all pr

One distinctive facet of all present financial and earnings information is the distortion attributable to comparisons to final yr’s numbers, when most financial and enterprise actions got here to a halt because of Covid-driven lockdowns. We noticed this ‘base-year impact’ within the current Might inflation studying and different month-to-month readings associated to housing begins, industrial manufacturing and even shopper spending.

With respect to company earnings, this ‘impact’ was in play to some extent within the March-quarter earnings season, however will likely be very pronounced within the coming Q2 earnings season that may actually get underway in mid-July.

Earnings development was very robust in Q1 2021 and is anticipated to be even stronger within the Q2 reporting cycle, with comparisons to the comparable Covid-depressed intervals of 2020 a serious supply of the expansion.

We should always consider, nevertheless, that the robust earnings development we noticed in Q1 and the even stronger development anticipated in Q2 can also be reflective of real development within the absolute sense, not only a results of straightforward comparisons.

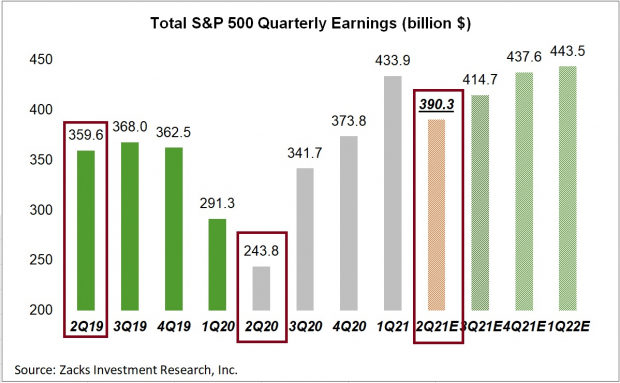

Check out the chart under to get a greater sense of this actuality:

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

These are quarterly earnings totals, with mixture earnings estimates for 2021 Q2, and truly reported earnings for 2020 Q2 and 2019 Q2 highlighted.

You’ll be able to see that 2021 Q2 earnings for the S&P 500 index are anticipated to be up 60.1% from the Covid-hit 2020 Q2 interval. However even relative to the pre-Covid 2019 Q2 interval, 2021 Q2 earnings are anticipated to be up +8.5%.

In actual fact, 9 of the 16 Zacks sectors are anticipated to earn extra in 2021 Q2 than they did within the pre-Covid 2019 Q2 interval. These sectors embody Primary Supplies (+70.7% larger earnings relative to the 2019 interval), Building (+52.2%), Expertise (+30.6%), Retail (+24.5%) and Medical (+20.6%). Even the Finance sector is anticipated to have +5.4% larger earnings in 2021 Q2 relative to Q2 2019.

Transportation, Shopper Discretionary, Vitality, Aerospace and Autos are among the main sectors which might be anticipated to earn considerably lower than what they earned within the comparable 2019 interval.

The underside line is that whereas comparisons to the Covid-affected 2019 interval is little doubt giving us the outsized development tempo in 2021 Q2 (+60.1%), development would nonetheless be optimistic with out such a base-year impact.

The Large Image

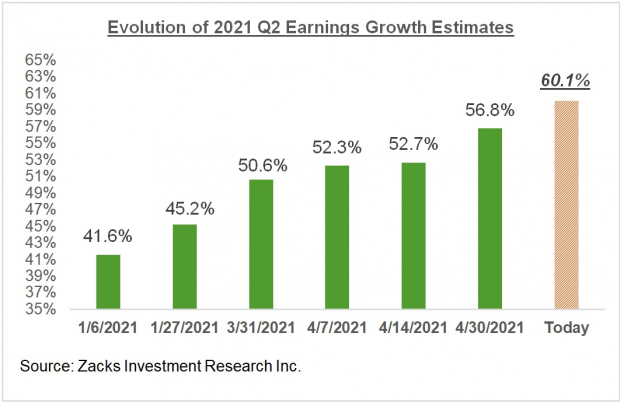

Estimates have been steadily going up, as we have now been persistently mentioning in our earnings commentary, although the favorable revisions development has eased off in current weeks. The chart under reveals earnings development expectations for 2021 Q2 have modified since early January:

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

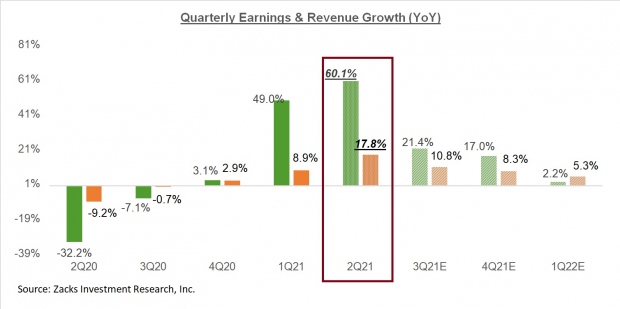

The chart under takes a big-picture view of the quarterly earnings and income development tempo:

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

The chart under presents the big-picture view on an annual foundation. As you’ll be able to see under, 2021 earnings and revenues are anticipated to be up 34.8% and 10.5%, respectively, which follows the Covid-driven decline of 13.1% in 2020:

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

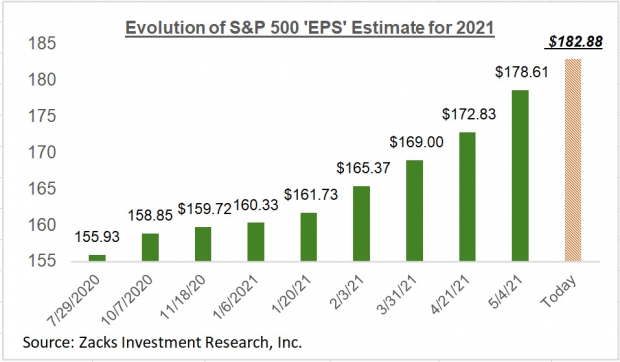

On an index ‘EPS’ foundation, the 2021 expectation works out to $182.88, up from $135.67 per ‘Index share’ in 2020.

These full-year estimates have been going up as effectively, because the chart under reveals:

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

For an in depth have a look at the general earnings image, together with expectations for the approaching intervals, please take a look at our weekly Earnings Developments report >>>> Trying Forward to Q2 2021 Earnings Season

Infrastructure Inventory Growth to Sweep America

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions will likely be spent. Fortunes will likely be made.

The one query is “Will you get into the suitable shares early when their development potential is best?”

Zacks has launched a Particular Report that can assist you just do that, and as we speak it’s free. Uncover 7 particular firms that look to realize essentially the most from building and restore to roads, bridges, and buildings, plus cargo hauling and power transformation on an nearly unimaginable scale.

Obtain FREE: The right way to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

SPDR S&P 500 ETF (SPY): ETF Analysis Reviews

Invesco QQQ (QQQ): ETF Analysis Reviews

SPDR Dow Jones Industrial Common ETF (DIA): ETF Analysis Reviews

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.