JinkoSolar Holding Co., Ltd.’s JKS subsidiary Jinko Photo voltaic Co not too long ago inked a long-term deal to purchase greater than 70,000 tons of polysilicon from Wacker Chemie AG throughout the September 2021-December 2026 interval. Per the phrases, buy worth can be based mostly on the one prevalent out there, and the latter will provide from its manufacturing websites in Germany and the US.

Rationale Behind the Deal

Because of the COVID-19 pandemic, a scarcity in provide of polysilicon together with an increase within the worth of the identical continues to hamper photo voltaic module producers like JinkoSolar. Since polysilicon is the important thing materials within the manufacturing of photo voltaic cells and modules, a clean provide of the identical is crucial for a producing firm.

To deal with the supply-shortage state of affairs and improve its manufacturing capability, JinkoSolar signed the most recent settlement. With related purpose in view, one other subsidiary of the corporate ShangraoJinkoSolar Business introduced its plan to speculate roughly $74 million in Internal Mongolia Xinte Silicon Supplies, a unit of Xinte Vitality, in June 2021. The funding can be used for the development of a high-purity polysilicon manufacturing line with an annual capability of 100,000 tons.

Certainly such initiatives of JinkoSolar will assist it stabilize the silicon materials provide, thereby lowering supply-chain volatility and increasing its footprint within the world photo voltaic market.

Peer Strikes

Per a Analysis and Markets report, the worldwide photo voltaic power market is projected to succeed in $223.three billion by 2026, seeing a CAGR of 20.5% throughout the 2019-2026 forecast interval. JinkoSolar and different photo voltaic gamers are investing closely in analysis and improvement (R&D) to supply excessive effectivity modules for widening their presence within the rising world photo voltaic market. JinkoSolar’s funding of $59.6 million in R&D actions throughout 2020 allowed it to efficiently improve the conversion effectivity of its high-efficiency photo voltaic module.

Equally, FirstSolar FSLR invested $93.7 million in R&D actions final 12 months to spice up the efficiency and decrease the price of its photo voltaic modules. One other photo voltaic panel producer SunPower Company SPWR spent $22.four million on R&D actions in the identical interval to develop its high-efficiency photo voltaic panels. Canadian Photo voltaic CSIQ, one other distinguished photo voltaic module producer, invested $45.2 million in R&D actions in 2020 for additional improvement of its high-efficiency, multi-crystalline and mono-crystalline modules.

Value Efficiency and Zacks Rank

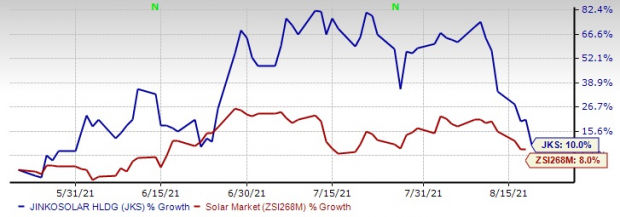

Up to now three months, shares of JinkoSolar, presently a Zacks Rank #5 (Robust Promote) participant, have gained 10%, outperforming the trade’s 8% development.

You possibly can see the whole record of at this time’s Zacks #1 Rank (Robust Purchase) shares right here.

Three Months Value Efficiency

Picture Supply: Zacks Funding Analysis

Bitcoin, Just like the Web Itself, May Change All the things

Blockchain and cryptocurrency has sparked some of the thrilling dialogue subjects of a technology. Some name it the “Web of Cash” and predict it might change the way in which cash works perpetually. If true, it might do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early phases of this expertise, and because it grows, it’ll create a number of investing alternatives.

Zacks’ has simply revealed three firms that may assist traders capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them immediately.

See three crypto-related shares now >>

Click on to get this free report

JinkoSolar Holding Firm Restricted (JKS): Free Inventory Evaluation Report

First Photo voltaic, Inc. (FSLR): Free Inventory Evaluation Report

Canadian Photo voltaic Inc. (CSIQ): Free Inventory Evaluation Report

SunPower Company (SPWR): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.