Eli Lilly and Company LLY announced that it has entered into a research collaboration and licensing agreement with a Massachusetts-based privately held company, Regor Therapeutics, for developing and commercializing novel therapies for metabolic disorders.

Per the agreement, Lilly will lead the clinical development, manufacturing and commercialization of products across the world except for China, Macau, Hong Kong and Taiwan, where Regor will be responsible for the same.

Per the terms of the agreement, Lilly will make an upfront payment of up to $50 million, which includes a partial equity investment in Regor. Regor is also eligible to receive up to $1.5 billion as potential development and commercial milestone payments, as well as tiered royalties ranging from low-single to low-double digits on net sales upon potential approval of a product.

With the above agreement, both Lilly and Regor are looking to leverage their existing compounds and technologies to maximize the treatment options available to patients suffering from metabolic disorders across the world.

Regor’s proprietary Computer Accelerated Rational Discovery platform will also help Lilly innovate and develop breakthrough therapies in obesity and diabetes – an area where LLY already has a strong foothold.

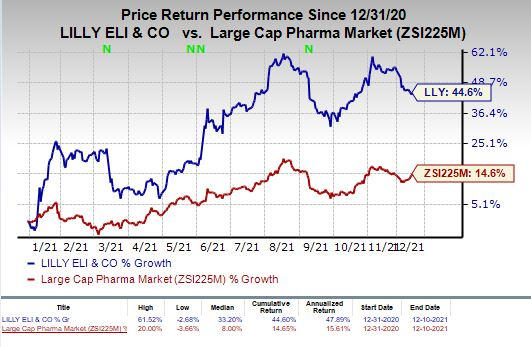

Shares of Lilly have rallied 44.6% so far this year compared with the industry’s increase of 14.6%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Please note that Lilly already has a strong portfolio of medicines to treat diabetes, with revenue growth being driven by higher demand for Trulicity, Taltz among others. The company also has some intriguing pipeline assets in its portfolio for diabetes as well.

Lilly has filed regulatory applications in the United States and Europe for its novel diabetes candidate, tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA), this year. The candidate has shown impressive blood sugar reductions and weight loss in type II diabetes patients in phase III studies.

However, competition for Lilly’s diabetes care products has increased with the entry of Novo Nordisk’s NVO Victoza.

Novo Nordisk’s Ozempic/semaglutide poses strong competition to Lilly’s key growth driver, Trulicity. Several other competitors are entering the diabetes space, which remains a concern.

Zacks Rank & Stocks to Consider

Lilly currently carries a Zacks Rank of #3 (Hold). Some better-ranked stocks in the healthcare sector include GlaxoSmithKline plc GSK and Endo International plc ENDP, both sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

GlaxoSmithKline’s earnings estimates have been revised 8.9% upward for 2021 and 5.5% upward for 2022 over the past 60 days. The stock has rallied 17.3% year to date.

GlaxoSmithKline’s earnings have surpassed estimates in two of the trailing four quarters, missed the same once and matched it once.

Endo International’s earnings estimates have been revised 24% upward for 2021 and 10.3% upward for 2022 over the past 60 days.

Endo International’s earnings have surpassed estimates in each of the trailing four quarters.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Click to get this free report

GlaxoSmithKline plc (GSK): Free Stock Analysis Report

Endo International plc (ENDP): Free Stock Analysis Report

Novo Nordisk AS (NVO): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com