Expertise shares ha

Expertise shares have been lower than stellar performers this yr, with a variety of final yr’s leaders struggling to seek out traction in an surroundings that made the beforehand shunned cyclical/worth shares extra enticing.

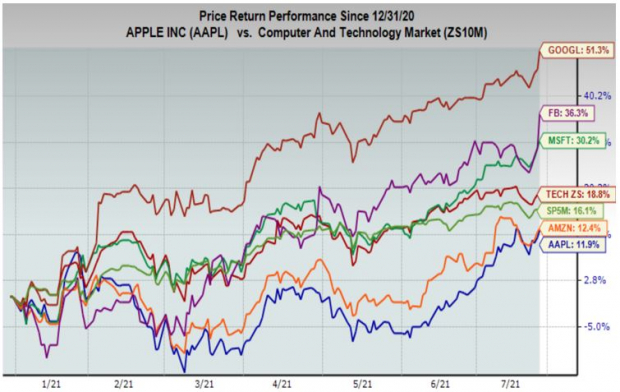

You possibly can see the group’s current efficiency within the chart beneath that reveals the year-to-date efficiency of the Zacks Expertise sector (purple line; center of the pack, up +18.8%) and the S&P 500 index (gentle inexperienced line; third from backside, up +16.1%), Microsoft MSFT – darkish inexperienced line; third from the highest, up +30.2%), Apple AAPL – blue line on the backside, up +11.9%) and Amazon AMZN – orange line, second from the underside, up +12.4%) and Fb FB – purple line, second from the highest, up +36.3%).

Picture Supply: Zacks Funding Analysis

As you may see above, Apple and Amazon are clearly the laggards this yr, with Alphabet and Fb actually standing out. The reason for the Alphabet and Fb outperformance doubtless has to do with these operators’ leverage to promoting spending, which was additionally obvious within the Snap SNAP and Twitter TWTR outcomes that additional boosted these shares.

Microsoft has grow to be a singular Tech participant that enjoys a number of development engines, from enterprise software program to cloud management and lots of different issues.

Apple and Amazon shares have undoubtedly perked up a bit these days, however nonetheless, stay laggards. It seems the market sees these two leaders’ pandemic outperformance being on the expense of future durations. This view doubtless explains why the market successfully shrugged standout outcomes from each these gamers again in April. Will probably be fascinating to see if this week’s quarterly outcomes will assist change sentiment on these two shares.

These 5 firms mixed now account for 23.3% of the entire market capitalization of the S&P 500 index, second solely to the Expertise sector’s weight within the index at 32.5% and above the opposite 15 sectors, together with Finance at 13.4% (Finance’s weight elevated from 12.1% in October final yr).

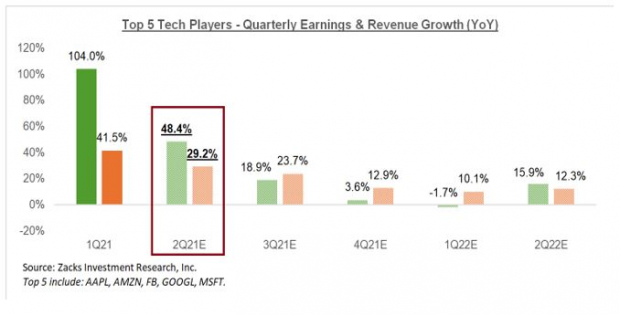

The chart beneath reveals the earnings and income image for this group of 5 firms within the mixture, on a quarterly foundation, with expectations for 2021 Q2 highlighted.

Picture Supply: Zacks Funding Analysis

The desk beneath reveals the group’s earnings image on an annual foundation.

Picture Supply: Zacks Funding Analysis

Check out the pandemic impacted numbers for 2020 for the group and distinction that to the general profitability image for the S&P 500 when the index’s earnings and revenues declined by -13.1% and -1.7%, respectively.

When some individuals refer to those firms as ‘defensive’ Tech, they’re basically referring to this earnings energy that has visibility and stability. The one considerably damaging spin that one might placed on these in any other case spectacular numbers for the expansion is the anticipated deceleration within the coming durations.

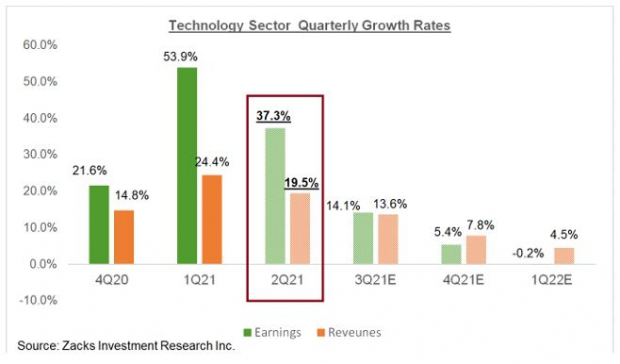

Past the large 5 Tech gamers, whole Q2 earnings for the Expertise sector as a complete are anticipated to be up +37.3% from the identical interval final yr on +19.5% larger revenues. The chart beneath reveals the sector’s Q2 earnings and income development expectations within the context of the place development has been in current quarters and what’s anticipated within the coming three durations.

Picture Supply: Zacks Funding Analysis

This large image view of the ‘Massive 5’ gamers in addition to the sector as entire reveals that present estimates for the approaching durations replicate a decelerating development development.

Microsoft, Alphabet and Apple will report after the market’s shut on Tuesday this week (7/27), whereas Fb will report after the market’s shut on Wednesday (7/28) and Amazon on Thursday (7/29).

Different notable experiences this week embody Tesla TSLA after the market’s shut on Monday (7/26), Spotify SPOT and a number of blue-chip operators in different sectors. In all, this week brings outcomes from greater than 820 firms in whole, together with 176 S&P 500 members or greater than a 3rd of the index’s whole membership.

Q2 Earnings Season Scorecard

We now have Q2 outcomes from 120 S&P 500 members or 24% of the index’s whole membership. With one other 176 index members on deck to report Q2 outcomes this week, we could have seen outcomes from greater than 59% of the index’s whole membership by the tip of this week.

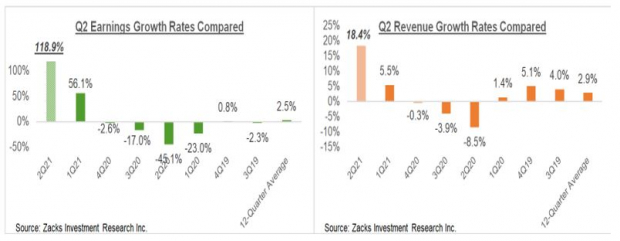

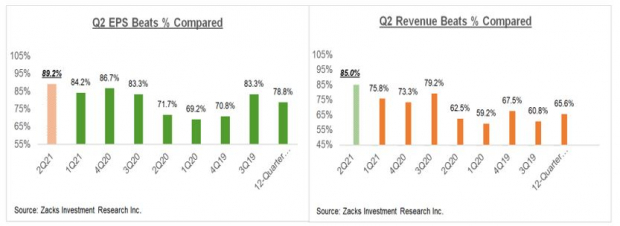

Complete earnings (or mixture internet revenue) for these 120 firms are up +118.9% from the identical interval final yr on +18.4% decrease revenues, with 89.2% beating EPS estimates and a file 85% beating income estimates.

The 2 units of comparability charts beneath put the Q2 outcomes from these 120 index members in a historic context, which ought to give us a way how the Q2 earnings season is monitoring at this stage relative to different current durations.

The primary set of comparability charts examine the earnings and income development charges for these 120 index members.

Picture Supply: Zacks Funding Analysis

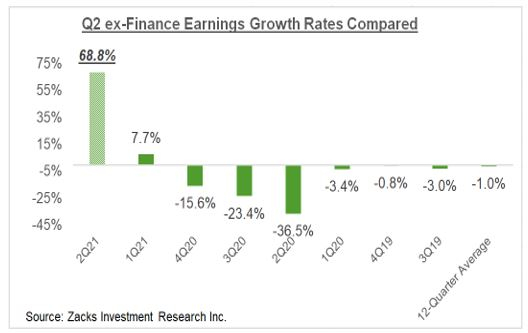

The expansion comparability is probably going not honest, given the unusually excessive year-over-year development charges within the Finance sector, a operate of massive reserve releases and straightforward comparisons in 2021 Q2. earnings development for the remaining firms which have reported drops to solely +68.8%. This reveals you the ability of straightforward comps, because the year-earlier interval was actually battered by the Covid-driven lockdowns and different enterprise disruptions.

Picture Supply: Zacks Funding Analysis

The second set of charts examine the proportion of those 120 index members beating EPS and income estimates.

Picture Supply: Zacks Funding Analysis

These are spectacular numbers, any manner you have a look at them. The momentum on the income entrance is notably putting, each when it comes to the expansion charge in addition to the beats percentages.

This can be a considerably higher efficiency than we’ve seen from these banks in current quarters.

What’s Anticipated for 2021 Q2 & Past?

Q2 on a blended foundation, combining the outcomes which have come out with estimates for the still-to-come firms, whole earnings for the S&P 500 index are presently anticipated to be up +74.3% from the identical interval final yr on +20% larger revenues, with the expansion charge steadily going up as firms come out with better-than-expected outcomes. This may observe the +49.3% earnings development on +10.3% larger revenues in 2021 Q1.

A giant a part of the unusually robust earnings development anticipated within the Q2 earnings season is because of straightforward comparisons to final yr’s Covid-hit interval. However as we’ve been persistently stating, not all the development is a results of straightforward comparisons.

Given how robust earnings surprises turned out to be within the previous reporting cycle (2021 Q1) and the numbers out already, the ultimate earnings development tally for 2021 Q2 might be simply north of +80%.

The chart beneath takes a big-picture view of the quarterly earnings and income development tempo.

Picture Supply: Zacks Funding Analysis

The chart beneath reveals the mixture bottom-up quarterly earnings tallies, precise earnings for the reported durations and estimates for 2021 Q2 and past, to provide us a greater sense of the easy-comps query.

Picture Supply: Zacks Funding Analysis

As you may see right here, 2021 Q2 at $425 billion is +69% above the Covid-hit $243.Eight billion tally achieved in 2020 Q2. You may as well see right here that 2021 Q2 is +18.2% above the comparable pre-Covid 2019 interval.

The chart beneath presents the big-picture view on an annual foundation. As you may see beneath, 2021 earnings and revenues are anticipated to be up +37.4% and +11.2%, respectively, which follows the Covid-driven decline of -13.1% in 2020.

Picture Supply: Zacks Funding Analysis

Please notice the double-digit earnings development anticipated in every of the following two years. This means that the market isn’t searching for a one-off rebound this yr, however relatively an everlasting development cycle that continues over the following couple of years.

To the extent that this development outlook can enhance as we transfer into the again half of 2021 will decide whether or not the general earnings image is getting higher or leveling off.

For an in depth have a look at the general earnings image, together with expectations for the approaching durations, please take a look at our weekly Earnings Traits report >>>>All-Round Earnings Power

Infrastructure Inventory Growth to Sweep America

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions can be spent. Fortunes can be made.

The one query is “Will you get into the appropriate shares early when their development potential is biggest?”

Zacks has launched a Particular Report that will help you just do that, and in the present day it’s free. Uncover 7 particular firms that look to achieve essentially the most from development and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an virtually unimaginable scale.

Obtain FREE: The best way to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

Amazon.com, Inc. (AMZN): Free Inventory Evaluation Report

Apple Inc. (AAPL): Free Inventory Evaluation Report

Microsoft Company (MSFT): Free Inventory Evaluation Report

Tesla, Inc. (TSLA): Free Inventory Evaluation Report

Fb, Inc. (FB): Free Inventory Evaluation Report

Twitter, Inc. (TWTR): Free Inventory Evaluation Report

Snap Inc. (SNAP): Free Inventory Evaluation Report

Spotify Expertise SA (SPOT): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.