The U.S. hospitality trade had a horrible 2020, with resort occupancy beginning to decline on the finish of the primary quarter when the pandemic hit, and remaining beneath 40% by way of January this yr. There was a gradual enhance in every successive month thereafter, taking the quantity to 59.3% in Could. The typical each day fee (ADR) adopted an analogous pattern, however solely began recovering in March. And equally for Income per obtainable room (RevPAR).

STR knowledge exhibits that demand for resort lodging dropped to its lowest stage in April 2020, when it was beneath 40% of the comparable 2019 stage. It has improved steadily since, reaching 87% of the comparable 2019 stage in Could this yr. Nonetheless, income development reached solely 71% of the 2019 stage, gross working revenue was at 72% and EBITDA at 64%.

Labor is a constraint, in accordance with STR, with labor prices reaching solely 64% in the course of the month. The American Resort & Lodging Affiliation (AHLA) says that as of Jan 21, the trade employed Four million fewer folks than in 2019. A PWC report says that resort unemployment improved in April to 13.8% from 19.9% in March).

This ties in with the weekly survey knowledge from Vacation spot Analysts, which discovered that within the week ending Jun 25, 43% of current vacationers felt that the journey trade was having bother offering providers. In addition they discovered that on account of these experiences, 17.3% had determined to do extra analysis when planning their subsequent journey, 14.9% had determined to chop again on their journey whereas 11.8% had already modified their vacation spot/attraction for an upcoming journey.

Nonetheless, of the 44.6% of Individuals which have taken in a single day journeys within the final three months, 60.3% have been happy or very happy with their restaurant expertise. There was much less enthusiasm about inns, occasions, points of interest, onboard industrial airways and in-airport companies. Nonetheless, 28.2% have been inspired to journey extra.

The AHLA sees specific weak spot in enterprise journey, with solely 29% of vacationers taking a visit in first-half 2021, 36% within the second half with a further 20% coming subsequent yr. 2019 ranges aren’t anticipated to be achieved till 2023 or 2024. This can be a huge blow for the trade as a result of enterprise journey tends to be extra steady and better-distributed by way of the yr.

An Accenture report concludes that this could drive inns to focus on the leisure buyer, who has additionally undergone an enormous change on account of the pandemic and now expects a greater concentrate on well being and security. The overwhelming majority additionally prefers native journey the place they don’t should board a aircraft.

Most vacationers need to bodily join with family and friends, so plenty of the journeys are prone to be to their houses relatively than inns.

Which is why this summer season is prone to be one other good one for the Leisure and Recreation Merchandise trade, at present positioned on the high 7% of 250+ Zacks-classified industries. And as many people already know, when an trade is positioned within the high 50% (the upper the higher), there’s historic knowledge displaying that it’s prone to provide above-market returns. Particularly so, if the shares we’re contemplating even have a Zacks #1 (Robust Purchase) or #2 (Purchase) rank.

So let’s see what we’ve got here-

Academy Sports activities and Outside, Inc. ASO, which gives outside, attire, footwear and sports activities & recreation gear has the #1 rank we’re on the lookout for. With Worth and Development Scores of A; anticipated income development of 9.9% and anticipated earnings development of 23.8%; and a 90- day change within the fiscal 2022 (ending January) and 2023 earnings estimates of 62.9% and 28.1%, respectively, this inventory appears like a strong decide.

Quantity two on the checklist is Clarus Company CLAR, which designs and manufactures outside gear and attire for climbing, mountaineering, backpacking, snowboarding and different outside recreation actions. Whereas this Zacks Rank #1 inventory’s Worth and Development Scores of F are lower than fascinating, the anticipated income development of 32.7% and earnings development of 81.4% are fairly encouraging. The estimate revision pattern for 2021 exhibits a 23-cent enhance to $1.27 within the final 90 days. The 2022 estimate exhibits a 30-cent enhance to $1.55.

Subsequent we’ve got Smith & Wesson Manufacturers, Inc. SWBI, the well-known producer of pistols, revolvers, rifles, handcuffs and different associated merchandise and equipment. Other than its Worth, Development and Momentum Scores of A, SWBI additionally has a Zacks #1 rank, which collectively point out robust upside potential. And whereas the corporate is seeing considerably tough comps from a powerful 2020, the estimate revision pattern exhibits that it continues to maneuver in the suitable course.

So we discover that the fiscal 2022 (ending April) earnings estimate is up 145.8% within the final 90 days. The 2023 wasn’t obtainable 90 days in the past, however because it grew to become obtainable 60 days in the past, it has elevated 66.3%.

#1 ranked YETI Holdings, Inc. YETI is understood for its outside merchandise concentrating on actions like looking, fishing, tenting, barbecue, farm and ranch, and so on. The inventory has received an encouraging B for Development, however an F for all the things else, which isn’t so scorching. However a take a look at its double-digit income and earnings development estimates for 2021 and 2022 are nothing in need of thrilling.

Furthermore, there’s additionally a optimistic estimate revision pattern: the 2021 earnings estimate is up 8.8% whereas the 2022 estimate is up 9.1% within the final 90 days.

Lazydays Holdings, Inc. LAZY is the final one I’m discussing right here. You possibly can head over to the trade web page on zacks.com for extra selections (it’s a very lengthy checklist). This one has received an A for each Worth and Development and a B for Momentum. It’s at present anticipated to develop income and earnings by a respective 20.7% and 22.4% this yr.

Whereas estimates from 90 days in the past aren’t obtainable, I’m seeing a 17-cent leap within the 2021 estimate within the final 60 days and a 20-cent leap within the 2022 estimate. And that is positively a great pattern.

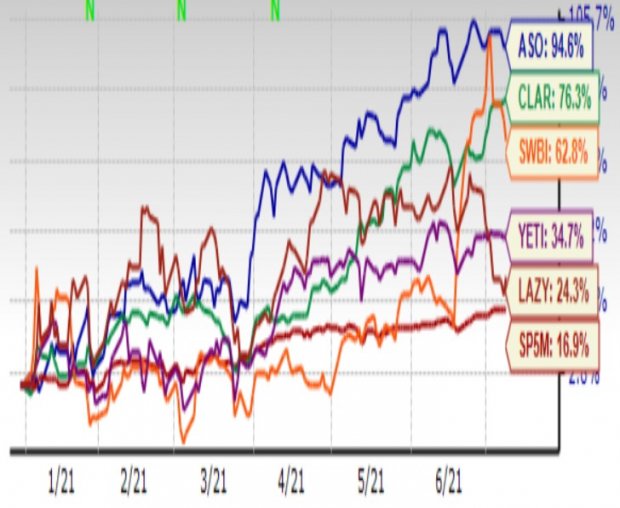

12 months-to-Date Worth Efficiency

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

5 Shares Set to Double

Every was hand-picked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2020. Every comes from a unique sector and has distinctive qualities and catalysts that might gas distinctive development.

A lot of the shares on this report are flying beneath Wall Road radar, which supplies an awesome alternative to get in on the bottom ground.

At the moment, See These 5 Potential Dwelling Runs >>

Click on to get this free report

Clarus Company (CLAR): Free Inventory Evaluation Report

LAZYDAYS HOLDINGS, INC. (LAZY): Free Inventory Evaluation Report

YETI Holdings, Inc. (YETI): Free Inventory Evaluation Report

Smith & Wesson Manufacturers, Inc. (SWBI): Free Inventory Evaluation Report

Academy Sports activities and Outside, Inc. (ASO): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.