PNM Resources, Inc.’s PNM strategic infrastructure-related investments and efforts to provide reliable and affordable clean power will enhance its existing performance. Also, PNM’s adequate liquidity will allow it to meet its debt obligations.

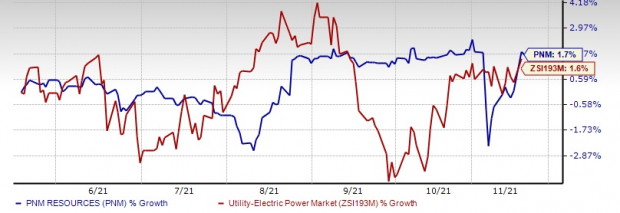

The long-term (three-five years) earnings growth rate is pegged at 5.18%. In the past six months, shares of this currently Zacks Rank #3 (Hold) PNM Resources have gained 1.7%, outperforming the industry’s growth of 1.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Six Months’ Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

What’s Driving the Stock?

PNM Resources continues to invest in its utility infrastructure and develop cost-effective power generation units to provide reliable and affordable power.PNM inked a deal to sell all its outstanding shares to AVANGRID so that the combined entity will have an enhanced credit profile, greater financial flexibility and lower cost of capital.

In New Mexico, PNM Resources received approvals from both the Federal Energy Regulatory Commission and the New Mexico Public Regulation Commission to acquire the Western Spirit Transmission Line. Construction from the same started at the beginning of this year. The activity will increase PNM’s capacity to cater to the rising clean energy production in the state.

PNM is also steadily taking measures to expand its renewable and battery storage capacity, thus moving toward clean energy transition. To this end, PNM Resources is focused on exiting coal-fired generation by 2024 and targets an emission-free portfolio within 2040 to bring cleaner energy sources to its production process. These efforts will make it completely carbon neutral before 2045.

Other electric utilities also adopting measures to supply clean and reliable energy to their customers include Duke Energy DUK, DTE Energy DTE and Alliant Energy LNT. While DUK and DTE carry a Zacks Rankof 3 at present, LNT holds a Zacks Rank#2 (Buy). All three stocks are planning to provide absolute clean energy by 2050.

DTE Energy remains committed to reducing carbon emissions of its electric utility operations by 32% within 2023, 50% by 2030 and 80% by 2040 from the 2005 carbon emissions levels. Duke Energy plans to reduce carbon footprint between approximately 55% and 75% through 2035. Alliant Energy targets to retire all the existing coal-fired generation units by 2040 to lower emissions from its 2005 baseline by 50% within 2030.

Woes

However, the risk involved in operating at nuclear plants apart from abiding by the climate change-related stringent environmental policies and regulations remains a headwind to PNM.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Click to get this free report

Duke Energy Corporation (DUK): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Alliant Energy Corporation (LNT): Free Stock Analysis Report

PNM Resources, Inc. (PNM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com