SB Monetary Group, Inc. SBFG is rewarding shareholders with an enhanced capital-deployment plan. The corporate’s board of administrators has approved the repurchase of 750,000 shares, which accounts for almost 10% of its frequent shares. The authorization expires on Mar 31, 2022.

Following the announcement final week, shares of SB Monetary have declined 1%.

Earlier in June 2019, the corporate had introduced a share-repurchase program to purchase again 400,000 frequent shares. The plan expired on Dec 31, 2020.

Along with share repurchases, the corporate pays money dividends on a quarterly foundation. In Might, SB Monetary paid a quarterly money dividend of 11 cents per share, marking a hike of 4.8% from the prior payout. Contemplating final day’s closing value of $19.80, the dividend yield at the moment stands at 2.2%. This yield appears fairly enticing to earnings buyers.

Notably, SB Monetary has been rising its quarterly dividend regularly. Previous to the present hike, the corporate had introduced a 5% hike to 10.5 cents per share in November 2020.

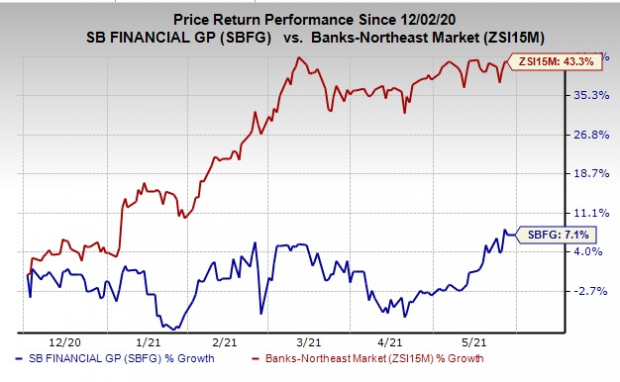

Over the previous six months, shares of SB Monetary have rallied 7.1%, underperforming the trade’s rally of 43.3%.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

At present carries a Zacks Rank #5 (Robust Promote).

You possibly can see the whole listing of as we speak’s Zacks #1 Rank (Robust Purchase) shares right here.

Different Banks Making Related Strikes

A number of banks have introduced new share-repurchase applications in current months. A few of these are Metropolis Holding Firm CHCO, Cathay Normal Bancorp CATY and Civista Bancshares, Inc. CIVB.

Metropolis Holding approved the buyback of as much as 1 million shares or 6% of its excellent shares, with no expiration date. Cathay Normal’s board of administrators has approved the repurchase of as much as $75 million value of shares with no expiration date. Additional, Civista Bancshares’ board of administrators has approved buyback of as much as $13.5 million of its excellent shares.

Time to Spend money on Authorized Marijuana

For those who’re in search of massive positive aspects, there couldn’t be a greater time to get in on a younger trade primed to skyrocket from $17.7 billion again in 2019 to an anticipated $73.6 billion by 2027.

After a clear sweep of 6 election referendums in 5 states, pot is now authorized in 36 states plus D.C. Federal legalization is predicted quickly and that could possibly be a nonetheless higher bonanza for buyers. Even earlier than the most recent wave of legalization, Zacks Funding Analysis has really useful pot shares which have shot up as excessive as +285.9%

You’re invited to take a look at Zacks’ Marijuana Moneymakers: An Investor’s Information. It contains a well timed Watch Record of pot shares and ETFs with distinctive progress potential.

Right now, Obtain Marijuana Moneymakers FREE >>

Click on to get this free report

Cathay Normal Bancorp (CATY): Free Inventory Evaluation Report

Metropolis Holding Firm (CHCO): Free Inventory Evaluation Report

Civista Bancshares, Inc. (CIVB): Free Inventory Evaluation Report

SB Monetary Group, Inc. (SBFG): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.