Seagen Inc. SGEN incurred a loss of $1.61 per share in the third quarter of 2021, much wider than the Zacks Consensus Estimate of a loss of 56 cents. The company reported earnings of $3.50 per share in the year-ago.

Net loss in the third-quarter was impacted by an upfront payment of $200 million owed to RemeGen.

Revenues of $424.1 million declined 60% year over year. The top line, however, beat the Zacks Consensus Estimate of $387 million. In the year-ago quarter, revenues included $725 million in upfront license revenues from its collaboration with Merck MRK. Net product revenues in the third quarter were $366.5, up 37% year-over-year, driven by the strong uptake of Seagen’s marketed drugs.

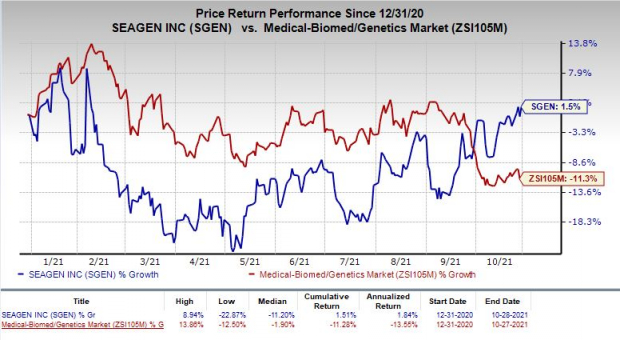

Shares of Seagen have rallied 1.5% so far this year against the industry’s decrease of 11.3%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Quarter in Detail

Seagen’s top line mainly comprises of product revenues, collaboration and license agreement revenues, and royalties.

Adcetris generated net sales of $184.8 million in the United States and Canada, up 13% year over year. The drug is being evaluated in several label expansion studies. A successful development and potential approval should boost its sales in the future.

Padcev sales in the third quarter totaled $95 million, up 15.3% sequentially. Sale of the drug rose 54% on a year-over-year basis.

Tukysa’s third-quarter net sales were $86.6 million, up 4.3% sequentially. Tukysa sales soared significantly on a year-over-year basis.

Collaboration and license agreement revenues were $16.6 million, reflecting a significant decrease year over year. Royalty revenues of $41 million rose from the year-ago quarter’s $35.9 million. Seagen recorded royalty revenues on the sales of Adcetris from Takeda in the ex-U.S. markets from its collaboration with GlaxoSmithKline GSK for Blenrep and to a lesser extent, from Polivy’s sales under its collaboration with Roche RHHBY.

Research and development (R&D) expenses of $459.1 million increased significantly year over year, primarily owing to the upfront payment due under the RemeGen collaboration.

Selling, general and administrative (SG&A) expenses shot up 41.3% year over year to $180.3 million, mainly on account of higher costs related to the recent launch of Tukysa in Europe as well as the commercial launch of Tivdak in the United States.

2021 Guidance

Seagen increased its financial guidance for the current year. This might have resulted in the company’s stock to go up in pre-market trading of Friday.

The company now expects Adcetris’ full-year net sales in the range of $700-$710 million compared with the earlier projection of $675-$700. Padcev’s full-year net sales are expected in the range of $330-$335 million compared with the earlier expectation of $310-$325 million. Tukysa’s sales are anticipated in the band of $315-$325 million compared with $300-$315 million expected earlier.

The company expects collaboration and license revenues in the band of $25-$30 million compared with the earlier expectation of less than $20 million. Royalty revenues are now anticipated within $140-$150 million compared with the earlier projection of $125-$135 million.

Recent Updates

In September 2021, the FDA granted accelerated approval to Seagen’s investigational antibody drug conjugate (“ADC”), Tivdak (tisotumab vedotin-tftv), for the treatment of recurrent/metastatic cervical cancer in adult patients whose disease progressed on or after chemotherapy. Seagen is developing Tivdak in collaboration with Denmark’s Genmab A/S.

Also, in September 2021, completed patient enrollment in the phase II MOUNTAINEER study evaluating Tukysa in combination with Roche’s Herceptin (trastuzumab) and as a single agent for treating patients with HER2-positive metastatic colorectal cancer (mCRC) who were previously treated with first- and second-line standard-of-care therapies.

In July 2021, the FDA approved two supplemental biologics license applications (sBLA) that sought a label expansion for Padcev.

Seagen Inc. Price, Consensus and EPS Surprise

Seagen Inc. price-consensus-eps-surprise-chart | Seagen Inc. Quote

Zacks Rank

Seagen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Tech IPOs With Massive Profit Potential: Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Click to get this free report

GlaxoSmithKline plc (GSK): Free Stock Analysis Report

Roche Holding AG (RHHBY): Free Stock Analysis Report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Seagen Inc. (SGEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com