The ODP Company ODP obtained a

The ODP Company ODP obtained a proposal from USR Dad or mum Inc. — the Sycamore-affiliated proprietor of Staples — to amass its shopper enterprise for $1 billion in money. Markedly, The ODP Company’s strikes to separate its enterprise haven’t dissuaded Staples from its pursuit to amass the corporate’s mentioned operations. We be aware that shares of the corporate have rallied 11.2% on Jun 4, following this growth.

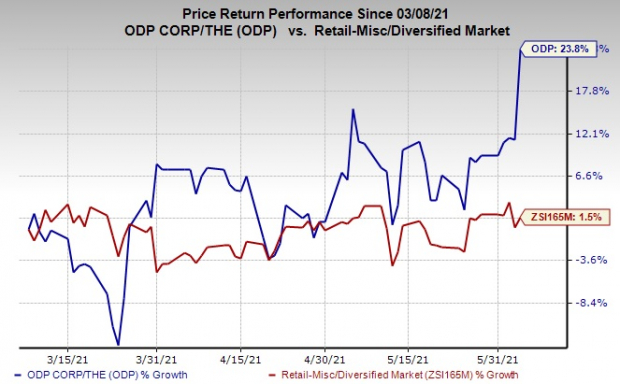

We be aware that shares of this Zacks Rank #2 (Purchase) firm have elevated 23.8% up to now three months in contrast with the business’s rise of 1.5%.

Coming to the buyout provide, in a letter dated Jun 4, 2021, Staples highlighted its curiosity to amass the corporate’s shopper enterprise that includes the Workplace Depot and OfficeMax retail shops enterprise in addition to the direct channel enterprise (officedepot.com). The proposal additionally contains the Workplace Depot and OfficeMax mental property and all model names. Markedly, the money provide, valued at almost $18.27 per share, represents about 43% of the 30-day common closing share worth as of June 2. In response to this, on Jun 5, The ODP Company acknowledged that its board in help with its monetary and authorized advisors is fastidiously reviewing the proposed transaction.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Moreover, Staples knowledgeable that it’s going to present the corporate with customary fairness and debt financing dedication letters to supply all required funding for the transaction. Furthermore, Staples acknowledged that its efforts to finish the transaction won’t be conditioned on the receipt of financing. Staples can be progressing nicely with the antitrust approvals required in relation with the buyout.

We be aware that Staples has been in pursuit of The ODP Company for fairly a while now. Its buyout proposal in 2016 was turned down resulting from antitrust scrutiny points. Earlier this yr, Staples had once more put forth its provide to amass numerous belongings of The ODP Company, which hit a roadblock. The ODP Company had turned down the provide in March by outlining causes akin to inadequate dialogue on the valuation of the belongings meant to amass in addition to lack of dedication to finish the deal. It’s left to be seen whether or not Staples’ proposal ends efficiently this time.

A month in the past, The ODP Company introduced plans to separate itself into two impartial publicly-traded firms. Markedly, the corporate might be spinning off its Enterprise Options Division contract unit, Grand & Toy, and impartial regional office-supply distribution operations. This tax-free spin-off will create the entity — “NewCo”. The entity may also personal the B2B digital platform know-how enterprise, together with BuyerQuest in addition to world sourcing workplace and different sourcing, provide chain and logistics belongings. The separation is anticipated to be accomplished throughout the first half of 2022.

Administration believes that the separation is probably going to enhance strategic focus and create long-term worth for shareholders. In accordance with the plans to separate operations, The ODP Company will retain its retail shopper in addition to small-business services and products. Other than this, the corporate is on monitor with the sale proceeds for CompuCom.

Clearly, The ODP Company has remained dedicated towards boosting its total enterprise prospects. The corporate can be on monitor with digital transformation of its enterprise, in order that it could actually effectively serve a rising neighborhood of patrons and suppliers within the on-line area. Moreover, The ODP Company’s core methods for development includes points akin to driving a low-cost mannequin, increasing worth proposition to prospects in addition to shifting into increased worth companies via new development engines. We be aware that The ODP Company has additionally made notable progress on its B2B pivot. On this context, it has remodeled B2B sourcing, buying, and provide chain operations for suppliers and patrons. The corporate’s B2B enterprise serves almost 10 million enterprise prospects, greater than 200,000 massive enterprises and almost half of the Fortune 500 firms.

Three Sizzling Retail Shares to Contemplate

Goal Company TGT, flaunting a Zacks Rank #1 (Sturdy Purchase), has a long-term earnings development charge of 13.3%. You’ll be able to see the whole listing of at the moment’s Zacks #1 Rank shares right here.

Tapestry, Inc. TPR has a long-term earnings development charge of 10% and presently carries a Zacks Rank #2 (Purchase).

Tractor Provide Firm TSCO, additionally a Zacks Rank #2 inventory, has a long-term earnings development charge of 9%.

Breakout Biotech Shares with Triple-Digit Revenue Potential

The biotech sector is projected to surge past $775 billion by 2024 as scientists develop therapies for hundreds of illnesses. They’re additionally discovering methods to edit the human genome to actually erase our vulnerability to those illnesses.

Zacks has simply launched Century of Biology: 7 Biotech Shares to Purchase Proper Now to assist traders revenue from 7 shares poised for outperformance. Our latest biotech suggestions have produced features of +50%, +83% and +164% in as little as 2 months. The shares on this report might carry out even higher.

See these 7 breakthrough shares now>>

Click on to get this free report

Goal Company (TGT): Free Inventory Evaluation Report

The ODP Company (ODP): Free Inventory Evaluation Report

Tractor Provide Firm (TSCO): Free Inventory Evaluation Report

Tapestry, Inc. (TPR): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.