Our total tackle the Q2 earnings season, which is now in its last section, has persistently been very constructive. The notable positives within the earnings story embody broad-based progress, materials momentum on the income aspect and continued constructive revisions to estimates for the present interval (2021 Q3).

Please be aware that once we are discussing company earnings within the combination, we’re utilizing the S&P 500 index SPY because the helpful proxy. The considering behind this assumption is that the breadth and variety of this large-cap index permits us to seize all enterprise tendencies throughout all industries and sectors.

This can be a truthful assumption, however we should always understand that there are elements of smaller and youthful corporations which might be completely different from bigger and extra mature corporations.

We offer loads of protection for what’s taking place with the large-cap earnings image, the most recent being this week’s Earnings Tendencies report >>>> Robust Retail Sector Earnings

This be aware takes a have a look at the 2021 Q2 earnings season and the evolving earnings image for the present and coming quarters for the small-cap S&P 600 SPSM index to see if the aforementioned view is smart.

Q2 Earnings Season Scorecard

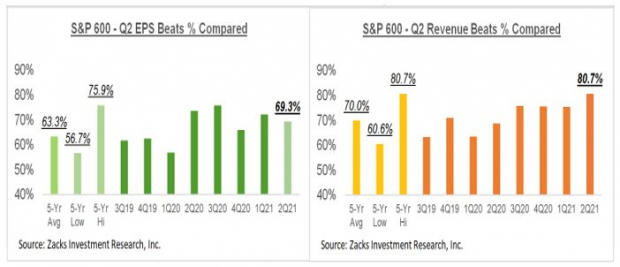

For the S&P 600 index, we now have Q2 outcomes from 561 corporations or 93.3% of the index’s complete membership. Whole earnings for these corporations are up +205.5% from the identical interval final yr on +35.2% greater revenues, with 69.3% beating EPS estimates and 80.7% beating income estimates. The proportion of those 561 S&P 600 members which have crushed each EPS and income estimates is 61.3%.

The comparability charts under put the Q2 efficiency in a historic context. For reference, we’ve additionally offered the corresponding comparisons for the large-cap S&P 500 index.

The EPS and income beats percentages for the S&P 600 (SPSM) index.

Picture Supply: Zacks Funding Analysis

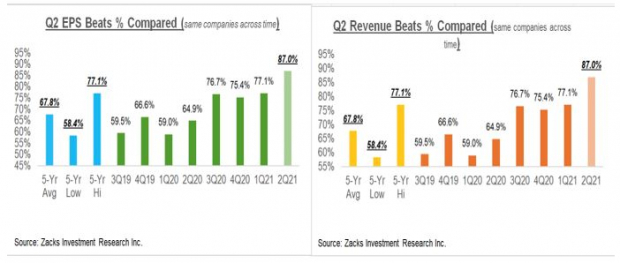

Beats % for the S&P 500 index.

Picture Supply: Zacks Funding Analysis

What we see from this comparability is that the majority small-cap corporations beat estimates as nicely, however the percentages for the large-cap index are successfully in document territory, whereas the small-cap index figures are merely good.

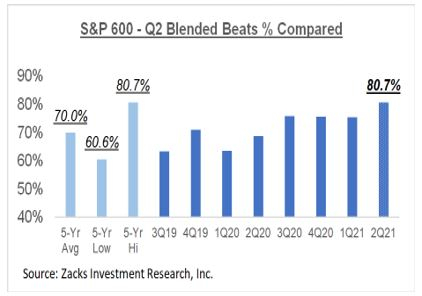

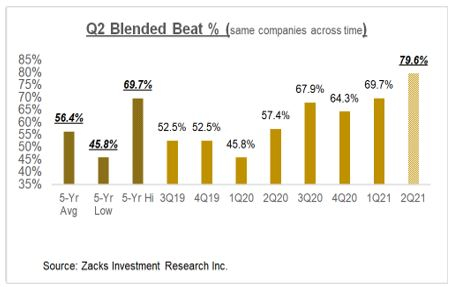

This variance is even clearer once we examine the Q2 blended beats percentages, the proportion of those corporations beating each EPS and income estimates, to different current intervals

Blended Beats % for S&P 600.

Picture Supply: Zacks Funding Analysis

Blended Beats % for S&P 500.

Picture Supply: Zacks Funding Analysis

Q2 as an entire for the small-cap index, combining the precise outcomes which have come out with estimates for the still-to-come corporations, complete S&P 600 earnings are on observe to be up +250.5% on +32.8% greater revenues.

Picture Supply: Zacks Funding Analysis

The chart under reveals the year-over-year earnings progress charges for the small-cap index on a trailing 4 quarter foundation.

Picture Supply: Zacks Funding Analysis

The chart under reveals the small-index’s earnings image on an annual foundation.

Picture Supply: Zacks Funding Analysis

A giant a part of this yr’s progress is a results of simple comparisons to final yr’s Covid impacted outcomes. However as you’ll be able to see within the chart under, 2021 earnings are on observe to be up +29% from the pre-Covid 2019 degree.

Picture Supply: Zacks Funding Analysis

For extra particulars in regards to the Q2 earnings season and the evolving image for 2021 Q3 and past, please take a look at our weekly Earnings Tendencies report >>>Robust Retail Sector Earnings

Bitcoin, Just like the Web Itself, May Change Every part

Blockchain and cryptocurrency has sparked one of the vital thrilling dialogue matters of a technology. Some name it the “Web of Cash” and predict it may change the way in which cash works perpetually. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early phases of this expertise, and because it grows, it’s going to create a number of investing alternatives.

Zacks’ has simply revealed Three corporations that may assist buyers capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them immediately.

See Three crypto-related shares now >>

Click on to get this free report

SPDR S&P 500 ETF (SPY): ETF Analysis Experiences

SPDR Portfolio S&P 600 Small Cap ETF (SPSM): ETF Analysis Experiences

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.