The well-known econ

The well-known economist typically acts contradictory and has denounced Bitcoin regardless of examples of earlier understanding.

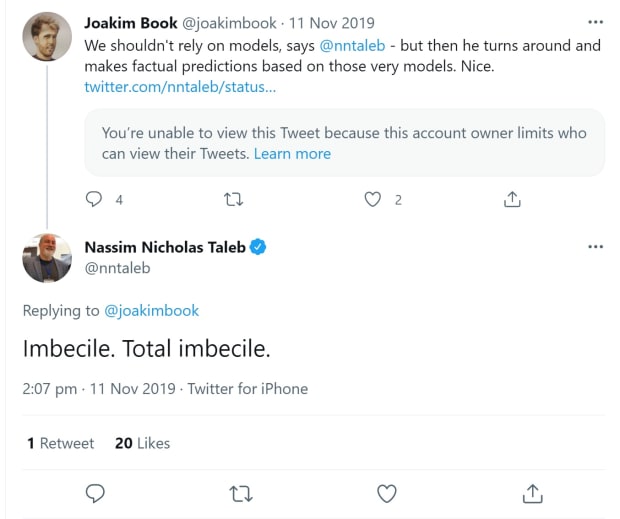

I joined Nassim Nicholas Taleb’s very intensive block checklist about two years in the past. It’s not a really unique crowd and plenty of extra erudite individuals than me have obtained the patented “Imbecile” tweet that indicators an imminent Taleb block. My crime? I had quoted “Antifragile” again at him in an argument over one thing I can not bear in mind. (I proudly cherish the screenshot of the final tweet I ever noticed of his).

For his Bitcoin nonsense launched in June 2021 — the paper ‘Bitcoin, Currencies, and Fragility’ (an earlier model used “Bubbles” within the title as an alternative of “Fragility”) — we’d repeat the train of quoting his personal phrases again at him.

Mr. Taleb, inclined to creating extravagant claims and denouncing everybody from journalists and politicians to economists and overseas coverage specialists, now appears to have joined the ranks of different well-known Bitcoin skeptics: Robert Shiller, Paul Krugman, Nouriel Roubini, and — considerably puzzlingly — the world’s foremost professional on hyperinflations, Steve Hanke. Worse is that Taleb is perhaps one of many first vocal supporters to unlearn what he as soon as knew, or maybe pretended to know; in 2018 Taleb wrote the preface to Saifedean Ammous’ “The Bitcoin Normal”.

Many individuals additional down the rabbit gap than Taleb took aside his impressive-sounding however surprisingly fragile paper (I can extremely advocate Louis Rossouw’s take or Sevexity’s piece). A quick abstract of the paper’s argument is:

- Bitcoin did not be a foreign money as a result of currencies want steady costs and value fixing.

- It’s a awful retailer of worth.

- It lacks the properties of an inflation hedge.

- And due to a non-zero likelihood of hitting the absorbing barrier of worthlessness, its current worth is subsequently zero.

These are, as Robert Solow as soon as stated in an Ely Lecture fifty years in the past: “phrases, all phrases.”

Which, by Taleb’s personal admissions, don’t matter. All that issues is what’s in any person’s portfolio, per his personal rule in his e-book, “Pores and skin within the Recreation”: “Do not inform me what you ‘suppose,’ simply inform me what’s in your portfolio” (p. 4). Or, “Those that discuss ought to do and solely those that do ought to discuss.” (p. 28).

One among a number of areas the place I believe Taleb’s concepts method Austrian economics is the “Motion Axiom” – that actions communicate louder than phrases; that discuss is reasonable and subsequently unreliable; and that valuation comes from doing, not saying. When was the final time Taleb transacted utilizing bitcoin, I ponder? Has he ever tried shopping for his macchiato utilizing the Lightning Community? Did he ever write code or construct one thing that makes use of Bitcoin?

Just a few chapters into this in any other case nice e-book (revealed across the identical time as his notorious preface to “The Bitcoin Normal”) we get a private anecdote. Taleb tells of as soon as having to touch upon shares in a TV roundtable dialogue:

“The subject of the day was Microsoft, an organization that was in existence on the time. Everybody, together with the anchor, chipped in. My flip got here: ‘I personal no Microsoft inventory, I’m brief on Microsoft inventory, therefore I am unable to discuss it.’ I repeated my dictum of Prologue 1: ’Do not inform me what you suppose, inform me what you could have in your portfolio.’” (p. 63)

So, will we belief the person’s twenty-odd years of writing and dwelling in line with the ethics and arguments explored in his books, “Fooled by Randomness,” “Antifragile,” or Pores and skin within the Recreation”? Or will we throw that seriously-contemplated and well-argued physique of labor overboard in favor of some transient Twitter anger and the mental acceptance of his fellow Bitcoin critics? Although maybe he’s staying true to his skin-in-the-game argument and is definitely brief quite a lot of BTC. However then, per his personal guidelines, he must say so publicly.

Within the preface to Saifedean’s e-book, Taleb wrote:

“Bitcoin will undergo hick-ups. It might fail; however then it will likely be simply reinvented as we now know the way it works. In its current state, it might not be handy for transactions, not adequate to purchase your decaffeinated espresso macchiato at your native virtue-signaling espresso chain. It might be too unstable to be a foreign money, for now. However it’s the first natural foreign money.”

He noticed then the exact same issues that he now echoes in his new paper to determine bitcoin’s long-term worth at zero. However in 2018 he didn’t suppose those self same issues had been issues. He didn’t see them as insurmountable challenges, however fairly technical points that might and can be overcome. Cue rising widespread adoption since then, 400% value enhance, a practical Lightning Community and a multisig revolution within the makings. However Taleb, the king of contrarians, does a one-eighty simply when the remainder of the world is catching on.

An Professional Known as Lindy

One other argument that pervades Taleb’s writing is that point is the final word take a look at of every little thing. Brief time period, you may idiot your accountant or your regulators. For a surprisingly very long time you may even idiot giant political audiences. However you can not idiot actuality. For those who plant fragilities, given sufficient time, they blow up. Actuality is the final word arbiter.

The one factor that issues, Taleb repeatedly taught me, is time. Thus far, Bitcoin has survived every little thing thrown at it and the trade surrounding it’s thriving.

Twelve years from inception to a $1 trillion market cap is ludicrously quick. We have used cash on and off for about 5,000 years, commodity cash with a layer-2 banking system for some 500, and floating fiat currencies run by megalomaniac central bankers for about 50. Taleb is at his most persuasive when he chants the Lindy impact – the tendency of issues which have already endured the take a look at of time to final even longer. Once more from “Pores and skin within the Recreation,” an awfully handy Taleb-busting e-book, we get “time is the professional” (p. 140) and “the one efficient decide of issues is time” (p. 142).

It appears odd, then, to denounce Bitcoin as untested and insufficiently confirmed in 2021, when in 2018 the exact same Lindy-wielding likelihood theorist wrote:

“Which is why Bitcoin is a wonderful thought. It fulfills the wants of the advanced system, not as a result of it’s a cryptocurrency, however exactly as a result of it has no proprietor, no authority that may resolve on its destiny. It’s owned by the group, its customers. And it has now a observe file of a number of years, sufficient for it to be an animal in its personal proper.”

You publicly denounced Bitcoin, Nassim, as is your prerogative. But it surely’s all okay. Your contributions are your nice books, not your poorly argued paper or the occasional pompous TV look. “Impeccable work,” writes Scott Raines, “doesn’t indicate private infallibility.”

For these achievements — and regardless of your human flaws — we, the Bitcoin group, thanks.

It is a visitor submit by Joakim Guide. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.