Wall Avenue has maintained its spectacular northbound journey thus far this 12 months after finishing an astonishing bull run within the coronavirus-ridden 2020. Nonetheless, the U.S. inventory market’s driver has modified.

In 2020, it was the know-how sector that drove Wall Avenue to do away with the pandemic-led traditionally shortest bear market and fashioned a brand new bull market. In 2021, the cyclical sectors like financials, industrials, vitality, supplies and shopper discretionary took the middle stage.

The explanation for this sectoral shift is primarily resulting from three causes. First, on account of its hovering efficiency, the know-how sector turned overvalued because the starting of 2021 and traders have been involved {that a} main correction is within the offing.

Second, because of speedy deployment of nationwide COVID-19 vaccinations and a faster-than-expected reopening of the economic system, the cyclical sectors, that suffered the blow of the pandemic turned profitable.

Third, a spike generally worth stage and rising issues a couple of sustainable inflation compelled a big part of market individuals to ponder that Fed will shift from the ultra-dovish financial insurance policies that it applied to sort out the pandemic. This may end in an increase out there’s risk-free returns, which can be detrimental to progress sectors like know-how.

Know-how Sector Regains Tempo

But, a detailed look into Wall Avenue’s efficiency of the know-how sector is in actual fact flourishing in most components of 2021 thus far. Prior to now six months, the market’s benchmark – the S&P 500 Index – gained 18.7% whereas the Know-how Choose Sector SPDR (XLK), one of many 11 broad sectors of the benchmark, jumped 23.1%, second solely to the Actual Property Choose Sector SPDR (XLRE), which soared 32.8%.

The know-how sector’s efficiency has been even higher previously three months. The S&P 500 Index was up 8.2% whereas know-how surged 16%, almost double of the benchmark itself and have become the very best performer throughout the S&P 500 secure.

Furthermore, 12 months to this point, the broad-market S&P 500 Index has rallied 20.8%. The tech-heavy Nasdaq Composite is shortly catching up with a acquire of 19.2% regardless of a gradual begin this 12 months. However, the blue-chip Index – the Dow – which inclines extra towards cyclical shares – is up simply 15.6%.

Know-how is the Greatest Guess within the Lengthy Time period

The logic that the know-how sector will underperform the opposite cyclical sectors could also be true for a brief time frame however in the long run, know-how shares will stay the very best bets. We should not neglect that the rising demand for hi-tech superior merchandise has been a catalyst for the sector in an in any other case powerful atmosphere.

A collection of breakthroughs within the 5G wi-fi community, cloud computing, predictive evaluation, AI, self-driving autos, digital private assistants and IoT, has given a lift to the general house.

The main rising markets of Asia, Latin America, Africa and a few European international locations are nonetheless approach behind in utilizing digital know-how in contrast with the developed world. The outbreak of coronavirus shortly modified the life-style and lookout of individuals over there.

They’re now turning to digital platforms for workplace work (make money working from home), meals ordering and different each day wants, together with transferring cash and making funds. Furthermore, on-line education, video conferencing and digital networking have now develop into important.

Find out how to Make investments

At this stage, a number of know-how shares that look enticing can be found for future progress. Nonetheless, selecting them on the next 5 standards will make the duty simple. First, choose know-how bigwigs (market cap > $100 billion) as these corporations have a globally established enterprise mannequin and internationally acclaimed model worth.

Second, these shares witnessed stable earnings estimate revisions for 2021 throughout the final 60 days. Third, these shares have robust upside left mirrored by a long-term (3-5 years) progress charge of greater than 10%. Fourth, these corporations are common dividend payers that may act as an revenue stream in a market’s downturn.

Lastly, every of those shares carries a Zacks Rank #2 (Purchase). You possibly can see the whole checklist of at this time’s Zacks #1 Rank (Robust Purchase) shares right here.

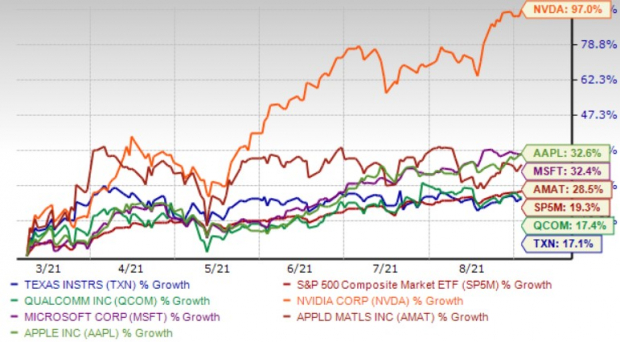

Six shares have fulfilled our choice standards. These are: Apple Inc. AAPL, Microsoft Corp. MSFT, Utilized Supplies Inc. AMAT, NVIDIA Corp. NVDA, QUALCOMM Inc. QCOM and Texas Devices Inc. TXN.

The chart under exhibits the worth efficiency of above-mentioned six shares previously six months.

Picture Supply: Zacks Funding Analysis

5 Shares Set to Double

Every was handpicked by a Zacks skilled because the #1 favourite inventory to realize +100% or extra in 2021. Earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying beneath Wall Avenue radar, which offers an important alternative to get in on the bottom flooring.

In the present day, See These 5 Potential House Runs >>

Click on to get this free report

QUALCOMM Integrated (QCOM): Free Inventory Evaluation Report

Texas Devices Integrated (TXN): Free Inventory Evaluation Report

Apple Inc. (AAPL): Free Inventory Evaluation Report

Microsoft Company (MSFT): Free Inventory Evaluation Report

NVIDIA Company (NVDA): Free Inventory Evaluation Report

Utilized Supplies, Inc. (AMAT): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com