The coronavirus pandemic, which

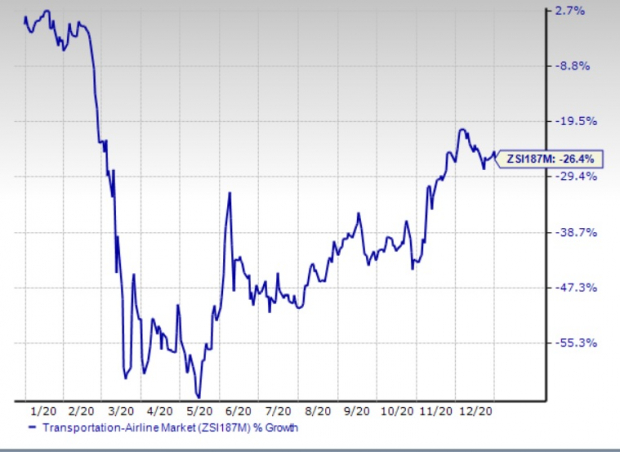

The coronavirus pandemic, which was aptly described in April 2020 because the “the worst monetary disaster in aviation historical past” by United Airways’ UAL former CEO Oscar Munoz, brought on an untold distress to airways final 12 months. With air-travel demand touching a nadir, most airline firms incurred losses in every of the 4 quarters of 2020. Reflecting the hardships, the Zacks Airline trade declined 26.4% final 12 months.

Picture Supply: Zacks Funding Analysis

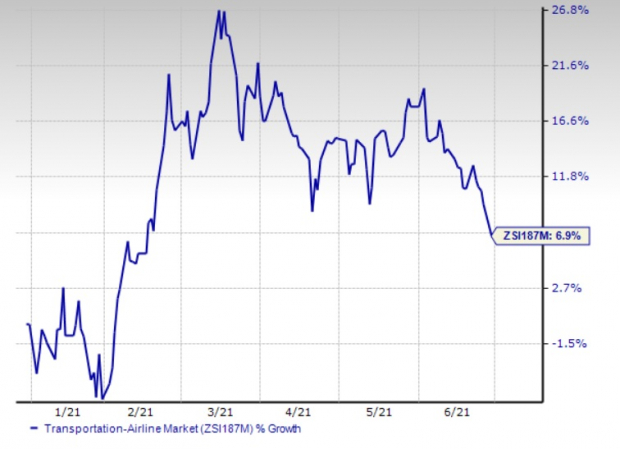

Nevertheless, the trade members’ fortunes modified with the arrival of 2021. Vast-spread vaccinations instilled confidence in folks to fly as soon as once more with out the concern of contracting the an infection from a fellow-traveler. Because of the uptick in air-travel demand (significantly for leisure), carriers together with Delta Air Strains DAL, Spirit Airways SAVE and JetBlue Airways JBLU introduced plans so as to add/resume operations on a number of routes to fulfill the demand surge. Additionally, European provider Ryanair Holdings RYAAY is seeing a swell in passenger depend regardless of the coronavirus-led journey restrictions, per a Reuters report.

Furthermore, in the US, the Transportation Safety Administration screened greater than two million folks in not lower than 10 days throughout June (contemplating the information till Jun 29). In truth, TSA screened 2,167,380 folks final Sunday i.e. Jun 27, 2021. This was the best studying taken since Mar 5, 2020. Betterment of the state of affairs is well-reflected within the Zacks Airline trade’s progress of 6.9% 12 months so far.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Air Visitors Prone to Proceed Northward Motion in 2H

Whereas the weak point pertaining to enterprise journey is unlikely to vanish quickly, general air-travel demand is prone to proceed enhancing within the second half of 2021, pushed by leisure journey. The truth that the expectation of a restoration will not be solely restricted to the US is evident from the very fact the European provider Ryanair’s current addition of 200,000 seats on flights from the UK to Malta and the Balearics (Ibiza and Palma) for July, August and September.

This follows the U.Ok. authorities’s resolution to incorporate these islands on the inexperienced listing for journey that permits flyers to go to these websites with out having to quarantine (offered they’re declared COVID destructive) themselves on their return. The comfort is efficient at this time.

Even in Latin America, air-travel demand is northbound on the again of ramped-up vaccination packages. That is evident from the truth that consolidated site visitors at Azul AZUL improved 12.4% in Could from the April tally. At one other Latin American provider Gol Linhas GOL, Could site visitors surged 65% month over month.

Using on such an improved state of affairs, Gol’s outlook for the second half of 2021 appears rosy. The provider, at the moment carrying a Zacks Rank #3 (Maintain), expects internet working revenues for the latter half to be roughly R$6 billion, a lot increased than the second-quarter estimate of roughly R$1 billion.

You’ll be able to see the whole listing of at this time’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Furthermore, alike the primary half of the 12 months, the give attention to the cargo section ought to proceed to serve airways properly within the latter half of the 12 months too.

The above write-up clearly means that issues are on the mend so far as airways are involved and the second half of the 12 months ought to see this momentum to proceed on the again of enhancements witnessed in first half of the 12 months. We subsequently highlighted three airline shares, every presently carrying a Zacks Rank of three, that buyers ought to maintain tabs on.

Our Decisions

United Airways: In response to a greater air-travel demand, United Airways plans so as to add in extra of 400 each day flights to its July schedule. The airline expects to function 80% of its pre-pandemic U.S. schedule within the month as summer time journey bookings soar 214% from the 2020 ranges. The corporate’s cost-control initiatives are supporting its backside line. Owing to an improved air-travel demand state of affairs, the Zacks Consensus Estimate for 2021 is at the moment pegged at a lack of $14.15 per share, narrower than the lack of $14.26 estimated for the inventory 60 days in the past.

Southwest Airways LUV: Restoration of leisure-travel demand is a big plus for this Dallas-based provider. To fulfill the anticipated demand upturn within the latter half of the 12 months, Southwest Airways not too long ago introduced a pay hike for its hourly staff. The approaching increment, which will probably be efficient Aug 1, is aimed toward retaining its present staff in addition to attracting new personnel.

Owing to bloated bookings, aided by an upswing in air-travel demand, the Zacks Consensus Estimate for 2021 is at the moment pegged at a lack of $1.29 per share, narrower than the lack of $1.47 estimated for the inventory 60 days in the past.

Alaska Air Group ALK: With air-travel demand rising, Alaska Airways is continually trying so as to add routes and widen its community to fulfill the anticipated demand swell. This upbeat state of affairs led to a wholesome money stream from the corporate’s operations.

Boosted by increased bookings, attributable to a spike in air-travel demand, the Zacks Consensus Estimate for 2021 at the moment stands at a lack of $2.50 per share, narrower than the lack of $2.86 anticipated for the inventory up to now 60 days.

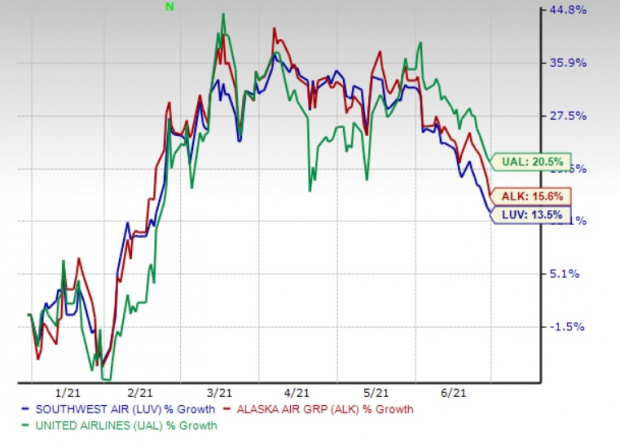

Notably, shares of United Airways, Southwest Airways and Alaska Air have rallied 20.5%, 13.5% and 15.6%, respectively, up to now this 12 months. Have a look —

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Bitcoin, Just like the Web Itself, Might Change Every part

Blockchain and cryptocurrency has sparked probably the most thrilling dialogue matters of a era. Some name it the “Web of Cash” and predict it may change the best way cash works perpetually. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early levels of this know-how, and because it grows, it’s going to create a number of investing alternatives.

Zacks’ has simply revealed Three firms that may assist buyers capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them immediately.

See Three crypto-related shares now >>

Click on to get this free report

Ryanair Holdings PLC (RYAAY): Free Inventory Evaluation Report

Delta Air Strains, Inc. (DAL): Free Inventory Evaluation Report

United Airways Holdings Inc (UAL): Free Inventory Evaluation Report

Southwest Airways Co. (LUV): Free Inventory Evaluation Report

JetBlue Airways Company (JBLU): Free Inventory Evaluation Report

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Inventory Evaluation Report

Alaska Air Group, Inc. (ALK): Free Inventory Evaluation Report

Spirit Airways, Inc. (SAVE): Free Inventory Evaluation Report

AZUL SA (AZUL): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.