Victory Capital Holdings VCTR reported assets under management (AUM) by its subsidiaries of $162.6 billion for October 2021. The results reflect a 1.7% rise from the $159.9 billion reported on Sep 30, 2021.

At the end of October, Victory Capital’s U.S. Mid Cap Equity AUM inched up marginally from the September-end figure to $30.1 billion while the U.S. Large Cap Equity AUM rose 5.6%, sequentially, to $15.6 billion. Moreover, the Global/Non-U.S. Equity AUM climbed 3% from the September-end level to $16 billion in October while the U.S. Small Cap Equity AUM of $20.1 billion increased 4%.

Victory Capital recorded $41.3 billion in Solutions for October 2021, up 5% from $39.4 billion recorded in September. Other assets increased 6.5% to $443 million on a sequential basis. Fixed Income AUM came in at $35.3 billion, down 4.3% from the prior-month level.

The sound positioning of Victory Capital’s integrated multi-boutique business model in a rapidly-evolving industry and effectiveness of the distribution platform will likely keep supporting its performance in the days to come.

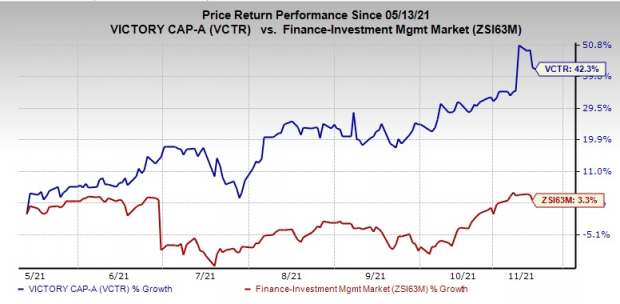

Shares of this currently Zacks Rank #3 (Hold) Victory Capital have gained 42.3% over the past six months, outperforming the industry’s 3.3% rally. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Performance of Other Asset Managers

T. Rowe Price Group, Inc. TROW reported a preliminary AUM of $1.67 trillion as of Oct 31, 2021. This reflects a 3.7% increase from the prior month’s $1.61 trillion.

T. Rowe Price’s AUM result was mainly driven by a solid market appreciation.

Lazard Ltd. LAZ recorded a 2.6% rise in the preliminary AUM as of Oct 31, 2021 from the previous-month level. The total AUM balance aggregated $279.7 billion, marking an increase from the prior month’s $272.6 billion.

Growth in Lazard’s AUM balance was supported by a market appreciation of $7.2 billion and a favorable foreign-exchange impact of $0.5 billion, partially offset by net outflows of $0.6 billion.

Franklin Resources BEN reported a preliminary AUM balance of $1,561.7 billion for October. This highlighted a 2.1% rise from $1,530.1 billion recorded as of Sep 30, 2021. The reported month’s AUM reflected changes in the reported asset class of certain products as part of the company’s integration efforts following acquisitions.

The rise in Franklin’s AUM balance was primarily driven by the positive impacts of markets, partly offset by modest long-term net outflows.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Click to get this free report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

Lazard Ltd (LAZ): Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com