Watsco, Inc. WSO has been benef

Watsco, Inc. WSO has been benefiting from robust gross sales progress, a greater gross sales mixture of high-efficiency methods, improved promoting margins and working efficiencies. Additionally, the corporate’s e-commerce enterprise is gaining power amid the pandemic

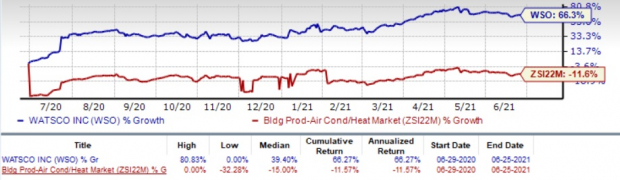

Notably, shares of Watsco have gained 66.3% over the previous 12 months in opposition to the Constructing Merchandise – Air Conditioner and Heating trade’s 11.6% fall. Aside from the above-mentioned tailwinds, the worth efficiency was backed by a stable earnings shock historical past. Watsco’s earnings surpassed the Zacks Consensus Estimate in 4 of the trailing 5 quarters. Earnings estimates for 2021 have moved up 4.5% previously 60 days. This optimistic development signifies bullish analyst sentiments and justifies the corporate’s Zacks Rank #2 (Purchase), indicating sturdy fundamentals and expectation of outperformance within the close to time period. You may see the whole record of as we speak’s Zacks #1 Rank (Robust Purchase) shares right here.

Main Development Drivers

Deal with Expertise

Watsco is persistently targeted on investing in trendy applied sciences to reinforce buyer expertise. With the progress of the digital period, the necessity of pace, productiveness and effectivity will enhance. Consequently, the corporate is investing to enhance buyer expertise by e-commerce. Watsco is deploying expertise that improves order fill charges with pace and accuracy. It has the trade’s largest database of digitized product data, with greater than 875,000 SKUs in 2020, displaying a rise of 20% over 2019 ranges. Pushed by varied expertise platforms, the present run fee of e-commerce gross sales stands at 18% in first-quarter 2021 versus the year-ago interval. E-commerce transactions within the quarter grew 30% from a 12 months in the past.

To serve clients and workers with higher applied sciences, Watsco is repeatedly leveraging its expertise platforms. The corporate launched “contactless” gross sales and servicing capabilities amid the present surroundings. Notably, common weekly customers of its cellular apps surged 11% from a 12 months in the past within the first quarter.

Watsco’s digital gross sales platform for HVAC/R contractors — OnCall Air — generated $105 million in gross merchandise worth for purchasers within the first quarter, reflecting an 111% year-over-year enhance. Additionally, its companion financing platform — CreditForComfort — processed greater than 1000 financing purposes, up 31% from final 12 months.

Accretive Acquisitions

Watsco — which shares area with AAON, Inc. AAON, Consolation Programs USA, Inc. FIX and The AZEK Firm Inc. AZEK — relies upon largely on acquisition of belongings and companies for solidifying its product portfolio and leveraging new enterprise alternatives in a bid to extend buyer base and profitability. On Mar 16, 2021, Watsco and Service World Company fashioned a three way partnership to accumulate the biggest Service distributor within the Midwest — Temperature Gear Company (TEC). Nonetheless, the phrases of the transaction have been stored below wraps. With this buyout, Watsco will foray into the U.S. Midwest market.

Since 1989, Watsco has taken over 63 companies, as of 2020. The corporate focuses on partnering with nice companies targeted on the HVAC/R trade. Watsco’s revenues in HVAC/R distribution grew to $5.1 billion in 2020 from $64.1 million in 1989, primarily buoyed by strategic acquisition of firms with established market positions.

Rewarding Shareholder

Watsco considerably rewards shareholders on a well timed foundation by share repurchases and dividends. The corporate has been paying money dividends for 47 consecutive years. It has elevated dividends in 19 out of the final 20 years. In February 2021, the board of administrators raised annual dividend by 10% to $7.80 per share. This method has helped the corporate achieve buyers’ belief.

Superior ROE

Watsco’s superior return on fairness (ROE) can also be indicative of its progress potential. The corporate’s ROE at present stands at 16.1%. This compares favorably with ROE of 13.4% for the trade it belongs to. This means effectivity in utilizing its shareholders’ funds and Watsco’s potential to generate revenue with minimal capital utilization.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Bitcoin, Just like the Web Itself, May Change All the things

Blockchain and cryptocurrency has sparked one of the crucial thrilling dialogue matters of a era. Some name it the “Web of Cash” and predict it may change the best way cash works endlessly. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early phases of this expertise, and because it grows, it would create a number of investing alternatives.

Zacks’ has simply revealed Three firms that may assist buyers capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them immediately.

See Three crypto-related shares now >>

Click on to get this free report

Watsco, Inc. (WSO): Free Inventory Evaluation Report

AAON, Inc. (AAON): Free Inventory Evaluation Report

Consolation Programs USA, Inc. (FIX): Free Inventory Evaluation Report

The AZEK Firm Inc. (AZEK): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.